Recently, Rand and I released the results of the State of Digital Agencies survey for 2025. Our goal of this annual survey is simple – get a temperate check on the digital agency world and give folks a benchmark for how they’re performing compared to their peers.

If you’ve missed the launch post, you can catch up it here:

Note that some of the takeaways below may also be mentioned in the post above, but we’ve also included them here for completeness on the topic of sales and marketing.

For this post, we’re releasing all of the results from the sales and marketing section of the survey. We’ve pulled out a number of key trends and benchmarking data that we hope will be useful to agencies and consultants.

Overall, the results seem to follow a core theme of things getting slowly better for agencies, but still being challenging. Agency owners are optimistic about the future but also state that new business is likely to be their number one challenge over the next 12 months.

Let’s get into the data.

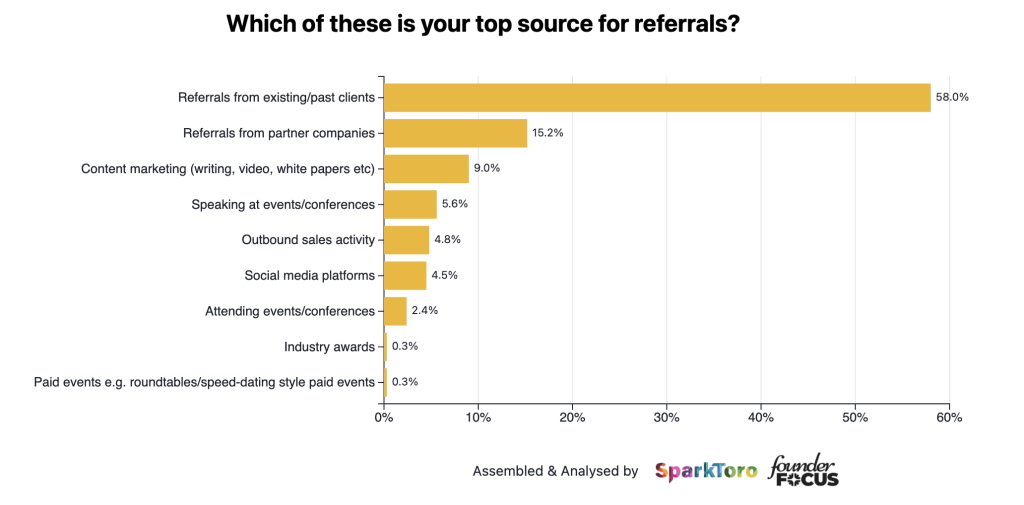

Referrals from existing and past clients are still by far the biggest driver of new business referrals

By far the biggest driver of new business remains referrals from existing and past clients. This is unchanged from 2024, as do the results overall, showing the general strength of quality work and its effect on driving new business.

Whilst referrals from existing and past clients was far and away the most popular answer, 15% of agencies did say that referrals from partner companies were the top driver of referrals for new business. Something that, in my experience, is an area of untapped potential for most agencies and freelancers.

Events and conferences finally making a comeback?

One notable change from 2024 is that speaking at events and conferences jumped up two places from 6th to 4th, overtaking outbound sales activity and social media platforms as a driver of referrals.

The improvement in performance for event and conference speaking holds true to my own experience speaking with agency folks. If you have good speakers who resonate with your target audience, it’s not unthinkable to pick up a handful of decent leads from each event.

Generally, speaking at events and conferences do seem to provide a better ROI for agencies compared with SaaS products, particularly lower price point / self-service products.

If an agency picks up just one client from an event (or even from 3 or 4 events) then this one client could be worth tens or hundreds of thousands of dollars per year to them.

Why do social media platforms perform so badly for agencies?

We were a little surprised to see social media platforms drop down the list and not appear to be a significant driver of new business for agencies. Given that social media channels are one of the key ways to distribute content and that so much of content marketing has actually become “consume said content in bite size chunks on social”.

And paid networking events and industry awards continue to struggle

Paid networking style events and industry awards remain stuck firmly at the bottom of the list, as they were in 2024. I personally find this quite interesting because I’ve seen both activities work well for agencies, but they do require quite a sizable amount of budget and time in order to stand a chance of working well. So from my own experience, I wouldn’t rule them out or write them off as marketing activities, but I am not surprised that they are not close to being the number one driver of referrals for agencies.

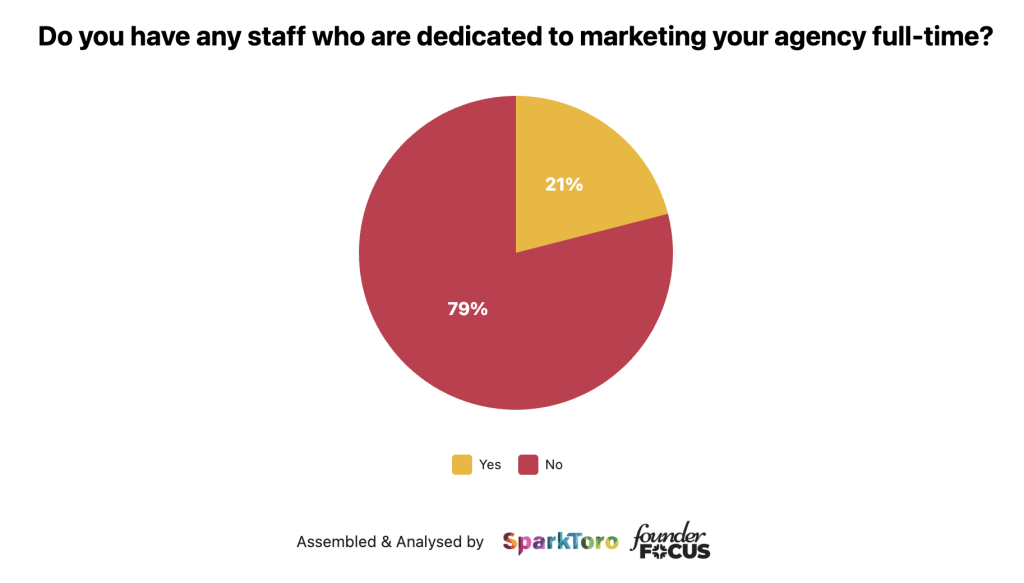

Most agencies don’t have dedicated marketing or sales teams to support their growth

79% of agencies do not have someone who is dedicated to their own marketing. In many cases, the job of marketing an agency falls to the founder(s) which on one hand is natural but on the other hand, somewhat ironic!

If we also remember that the top two drivers of new business for agencies in 2025 are referrals from clients and partners, it’s almost certainly the case that many agencies aren’t able to actually put as much time into their marketing as they’d like.

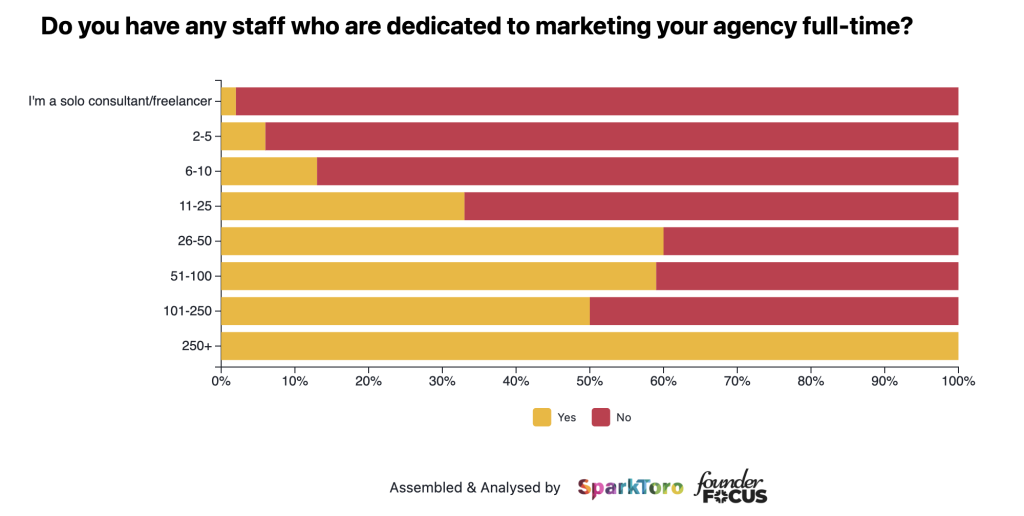

If we take a closer look at this trend and segment based on agency size, we can see that as agencies grow, they do tend to take on staff who focus on marketing full-time.

This almost certainly means that during the early days of an agency, responsibility for marketing falls on the shoulders of the founder(s).

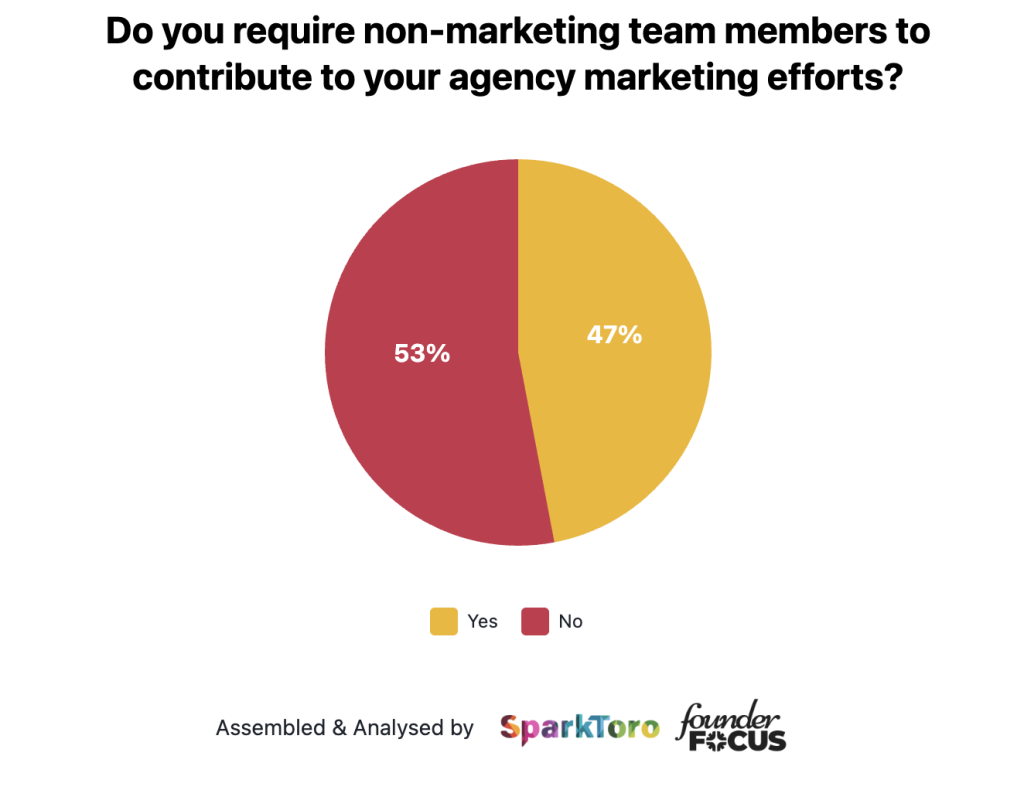

Having said that, we wanted to see if agencies without dedicated marketing resources instead asked their regular team members to help out.

So, for the 79% who said no, we asked whether they require their team to contribute to marketing efforts given that they don’t have dedicated resources.

It turns out that agencies are split almost 50/50 on whether, instead of a dedicated marketing resource, they ask other team members to dedicate their time towards marketing efforts.

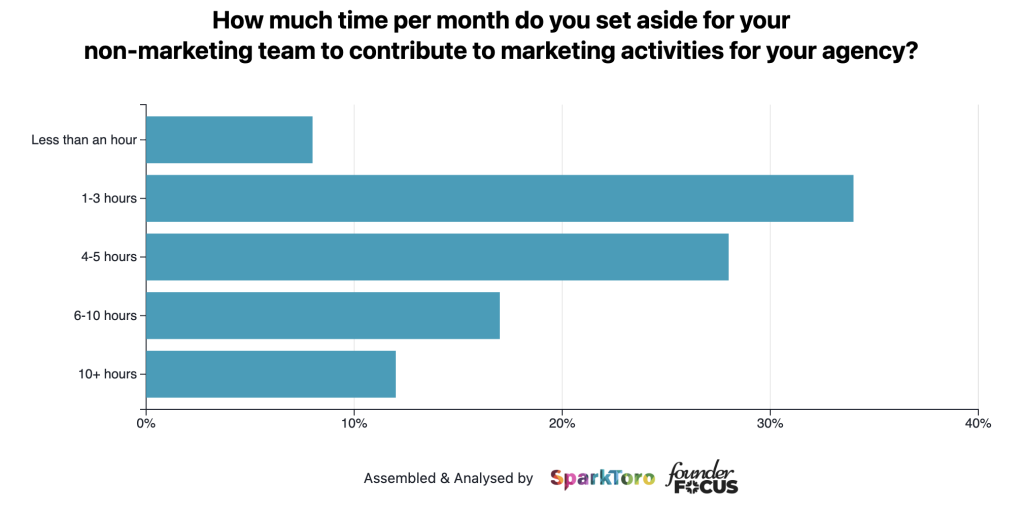

Leading on from this, those who do require non-marketing team members to contribute towards marketing efforts typically ask for between 1-5 hours per month for these efforts:

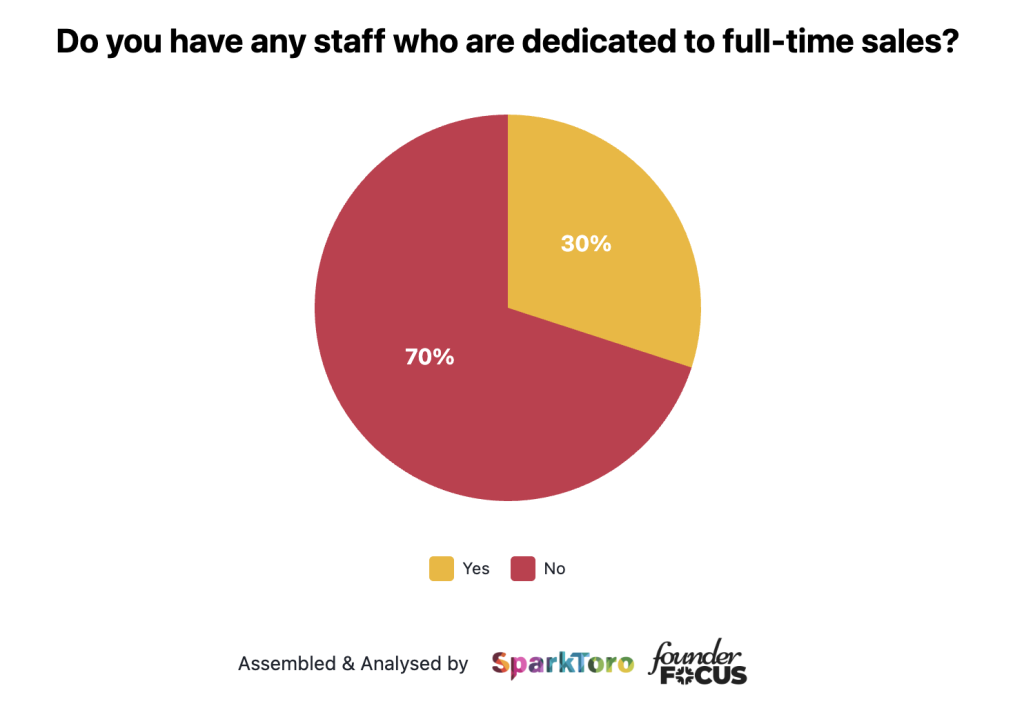

On a similar front, 70% of agencies do not have any staff who are dedicated to sales full-time. This, combined with the fact that only 21% of agencies have people dedicated to marketing, means that agencies rely on skills (and time!) from their existing team members to fill this gap.

Given that content marketing and speaking at events are within the top five sources of referrals for agencies, one can assume that team members have to fit this work into their regular schedules alongside client work.

Lots of agencies have tried outbound sales activities but only a few describe the results as very effective

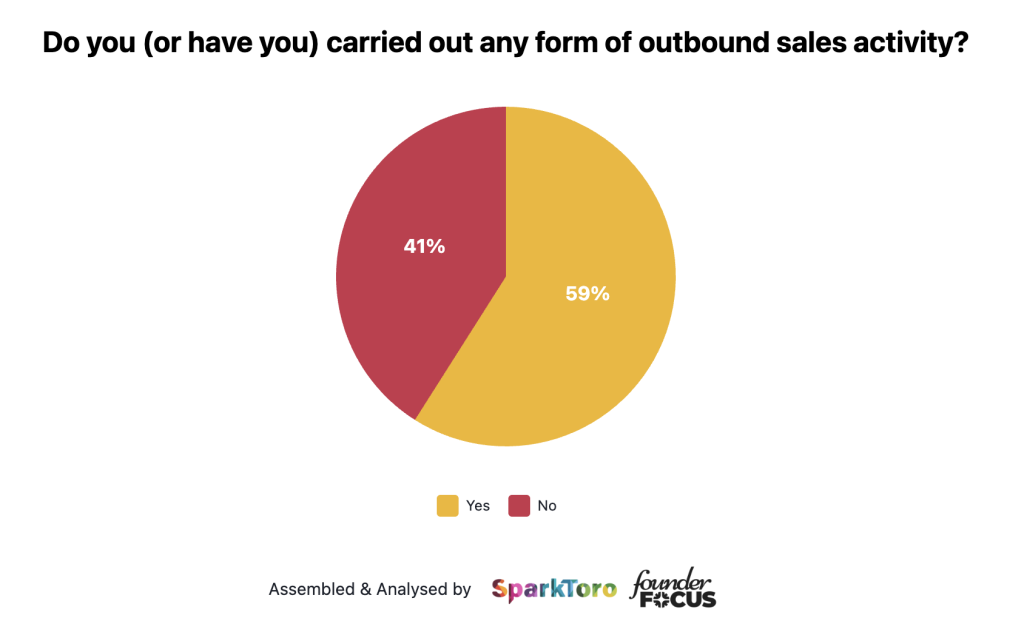

59% of agencies have tried outbound sales as a way to drive new business and sales leads. This has seen minimal change compared to 2024 where we saw an almost identical response.

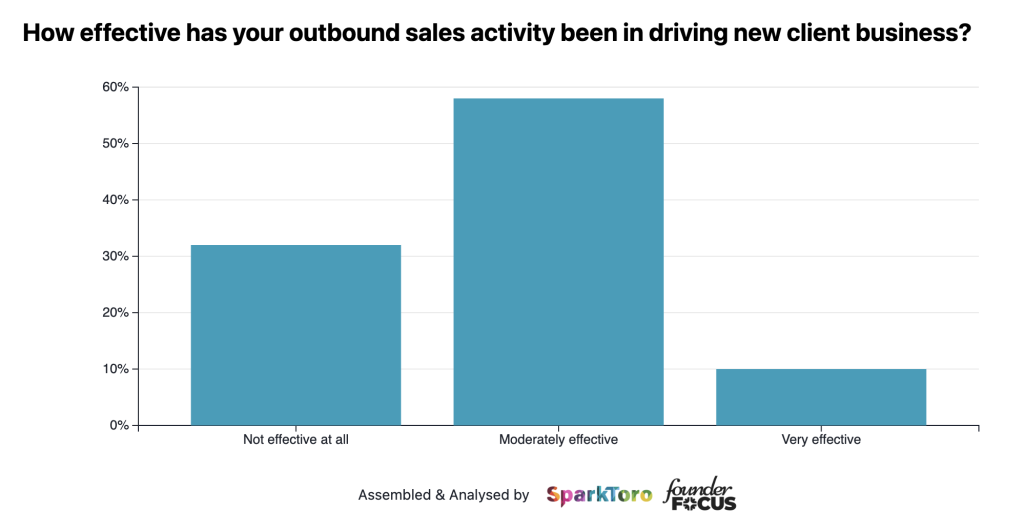

Results from this activity appear to be quite mixed. Only 9% described results as very effective, whilst 58% described it as moderately effective. The remaining 33% reported that their outbound sales efforts were not effective at all.

There was marginal change compared with 2024 with the only notable difference being that 10% of respondents said that this tactic was effective, compared to 9% this year.

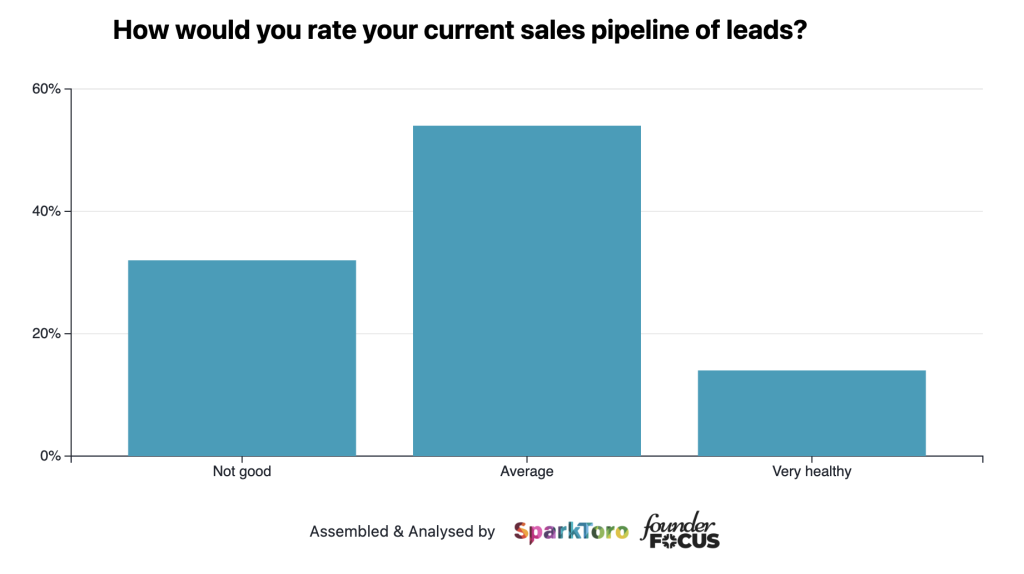

Only 14% of agencies describe their sales pipeline as healthy right now (but things have gotten better)

We wanted to understand the current status of sales pipelines for agencies and freelancers and we found that only 14% feel that their current pipeline is healthy. Over 50% describe it as average and the remaining 32% say that it’s not very good.

This finding was fairly consistent across all regions where our respondents were located.

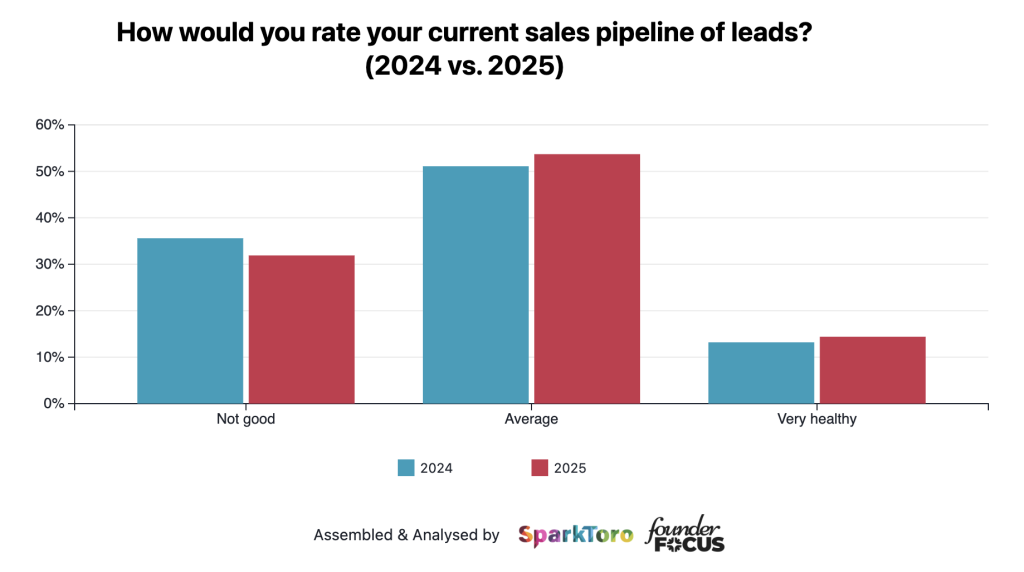

We’re seeing a (very) small improvement in sales pipeline for most agencies

In terms of how things have changed compared to 2024, it’s probably best summarized as “still hard but slowly getting better”.

In 2024, 13% of agencies described their sales pipeline as very healthy. In 2025, this increased very slightly to 14%. Not enough to make us confirm a significant change, but we did also see a slight improvement elsewhere…

In 2024, 36% described their sales pipeline as not good. Whereas in 2025, this decreased to 32%. Again, not as big of an improvement as any of us would like, but combined with the previous numbers too, there are slight improvements.

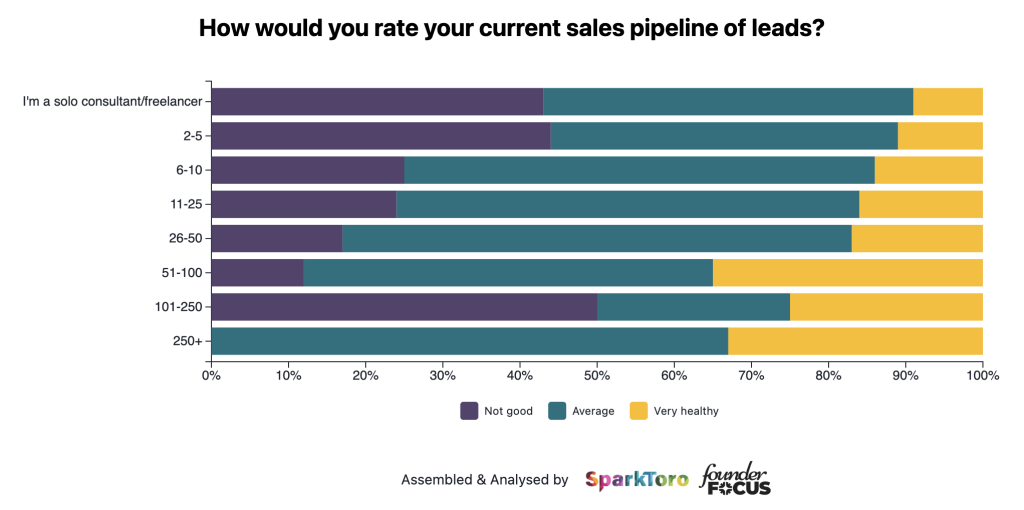

Larger agencies are faring better than smaller agencies in terms of their sales pipeline

Despite location not appearing to be a big factor when it comes to the health of sales pipelines, there is an interesting trend that seems to indicate that larger agencies are doing better than smaller agencies at the moment.

We can also see that agencies that are 51+ people in size are reporting their pipelines to be very healthy at a much higher rate than smaller agencies.

We should mention that the same size of larger agencies is naturally smaller, but the trend does appear to be genuine.

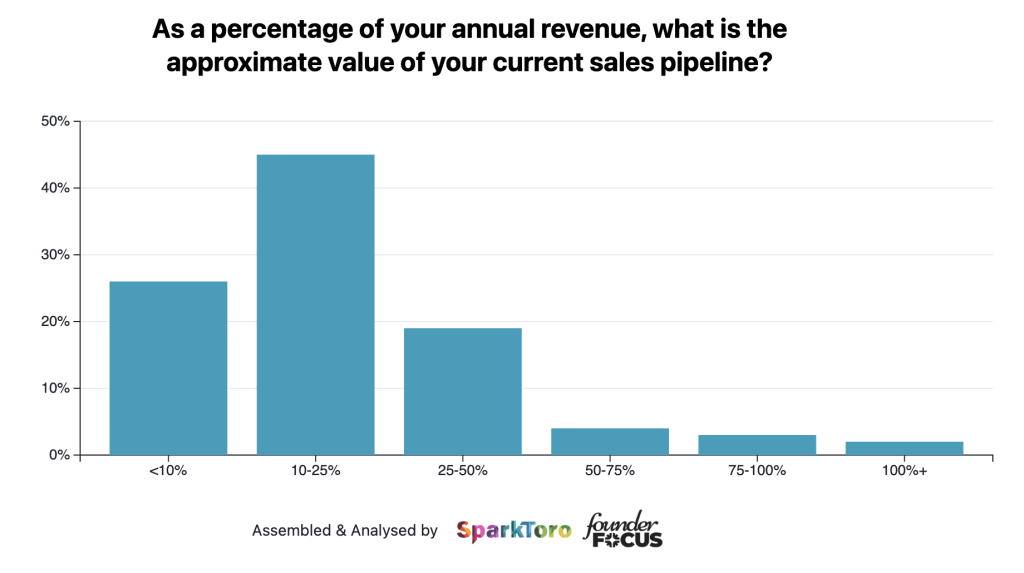

A lot is hanging in the balance when it comes to the new business pipeline

We asked our respondents to estimate the current value of their sales pipeline and nearly half (45%) reported it to be between 10-25% of their current revenue. 19% estimated the value of current leads to be between 26-50%.

This shows that things can change very quickly and just a few wins with new business could have a significant impact on the performance of an agency.

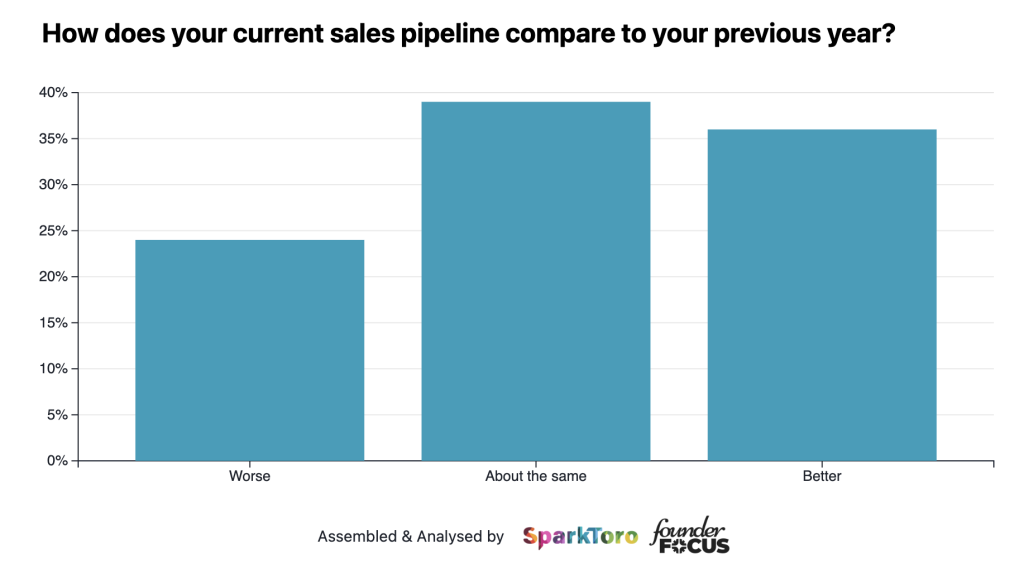

A quarter of agencies say that their sales pipeline has gotten worse over the last year (but things are marginally better than two years ago)

At first glance, it is concerning to see that one in four agencies reported that their sales pipeline has gotten worse over the last year.

Whilst 36% of agencies reported that their pipeline has gotten better and the remainder (39%) said that it was about the same as a year ago.

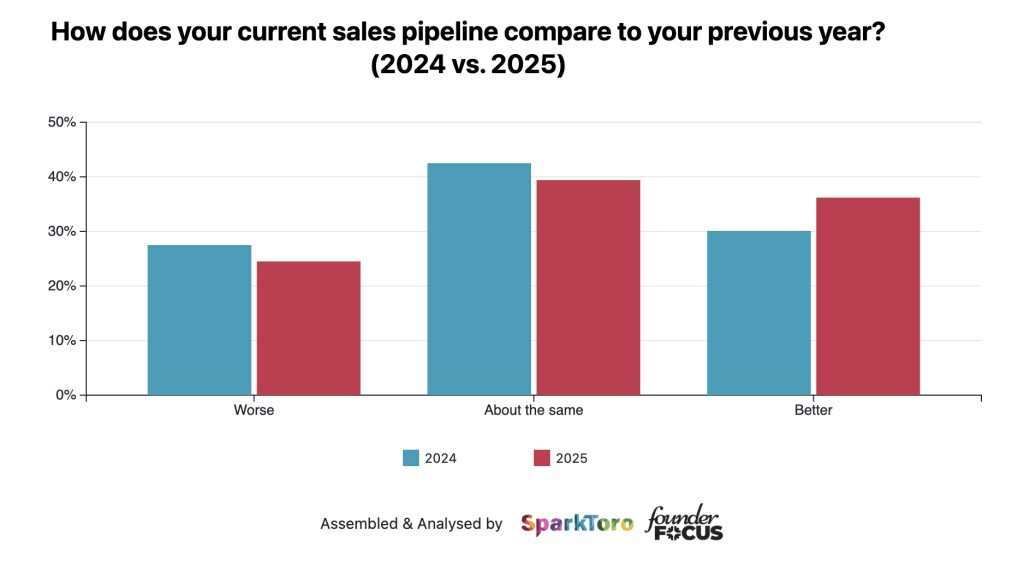

We can get a better idea of how things look if we zoom right out and take into account our results from 2024 as well.

In summary, things appear to be trending in the right direction, albeit very, very slowly. This further adds to the sentiment of this section of our report – yes, sales and new business does appear to be getting slowly better, but things are far from easy.

The improvements that we see are very small shifts.

Looking at the data, we can see that when we asked the same question in 2024, more agencies (27% vs 24%) reported that their pipeline had gotten worse compared to 2025.

In 2024, 30% of agencies reported that their pipeline was better than a year ago, whilst this increased to 36% in 2025.

Whilst relatively small shifts, these are encouraging signs for an industry that has had a generally difficult few years. Fewer agencies are reporting pipeline getting worse and more are reporting it getting better.

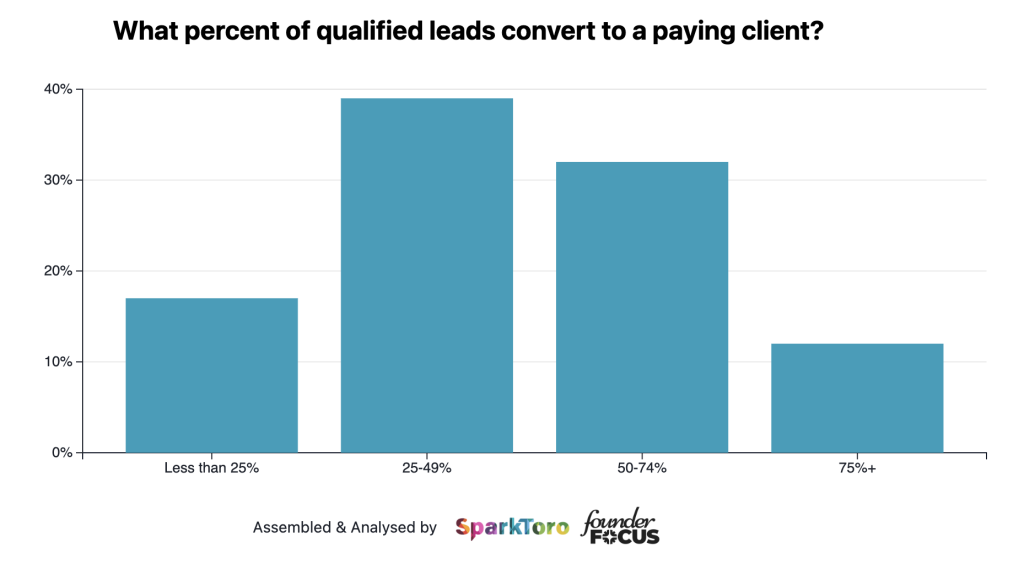

A sales conversion rate of between 25-49% is most common amongst agencies

A new question for 2025, we decided to ask agencies about their sales conversion rates, focusing specifically on the conversion rate from a qualified lead through to becoming a client.

The majority (39%) reported that they convert at a rate of between 25-49%.

From my own agency experience and having worked with a number of agencies over the last year, this range is about average right now but has been higher in the past.

This was closely followed by a third (32%) who convert between 50-74% of qualified leads, whilst 17% convert less than 25% of their qualified leads. The remainder, just 12% reported that they close over 75% of their qualified leads.

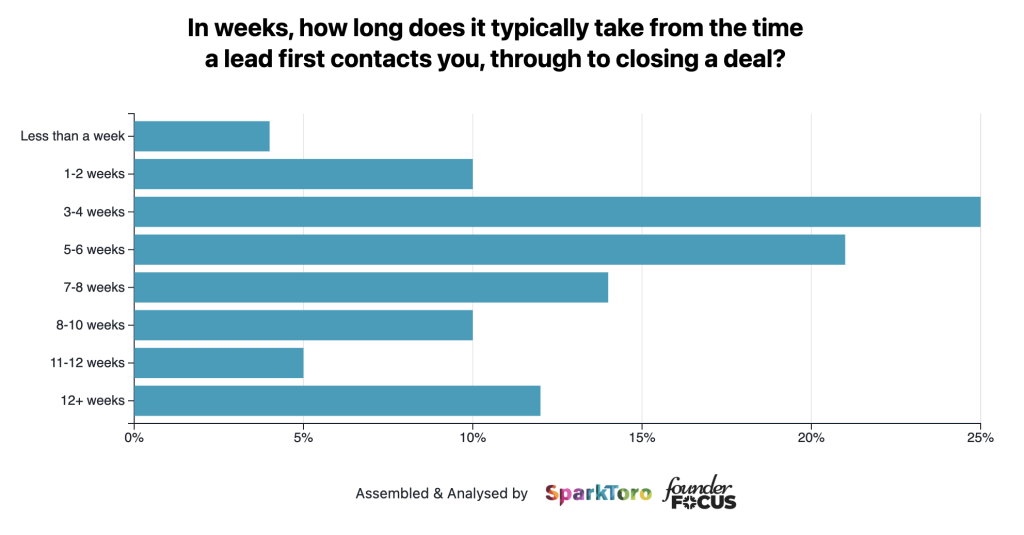

Sales leads are taking longer to close compared to a year ago

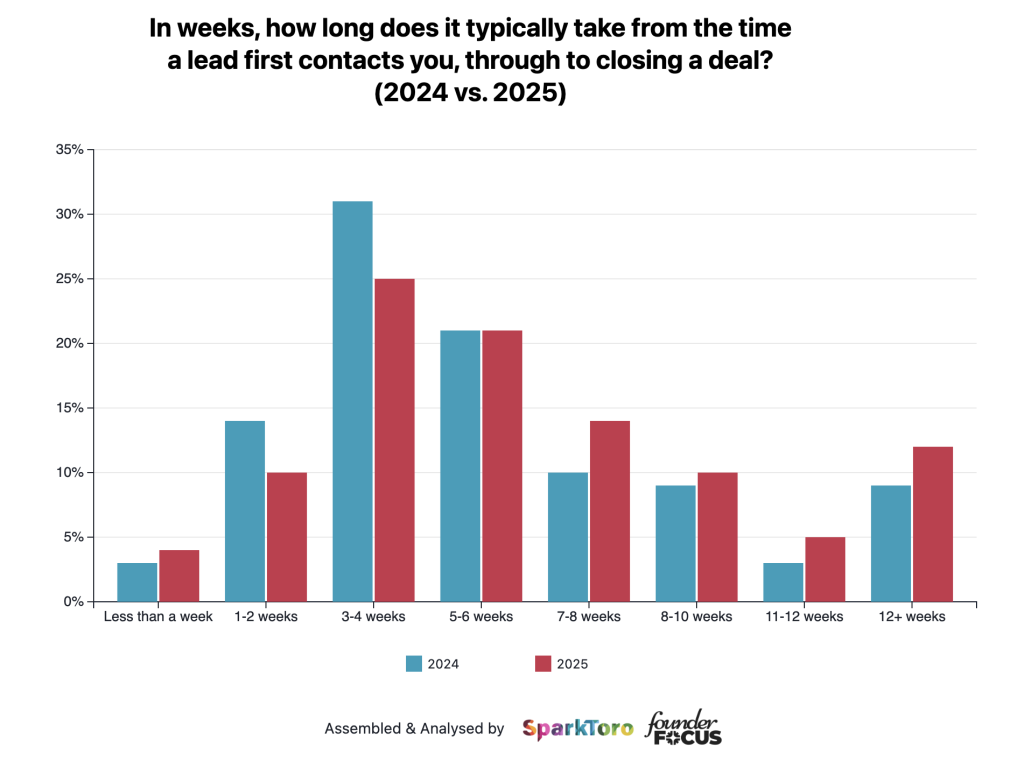

Around 55% of agencies said that it can take between 1-6 weeks for a lead to go through the sales process and convert into a client. 10% said it can take 1-2 weeks, 25% said it takes 3-4 whilst 21% said it can take 5-6.

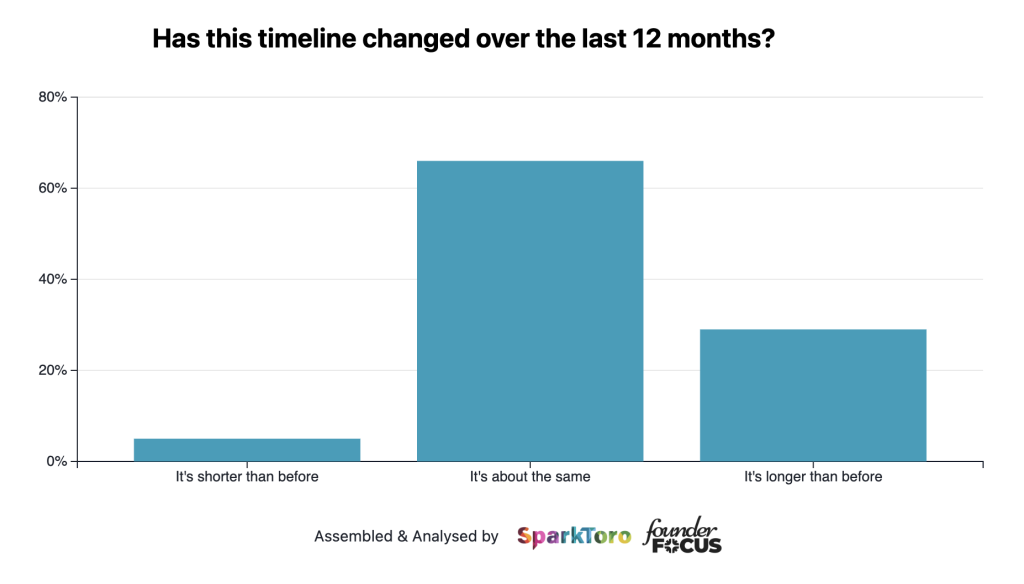

Leading on from this, we asked whether this timeline had changed over the last 12 months, to try to see if clients are typically taking longer or shorter to commit to contracts.

29% said that it is indeed taking longer for this process to be completed compared to the previous year.

The majority (66%) said that the timeline has remained the same and only 5% said that the timeline has shortened compared to the previous year.

To make this change more concrete, we can take a look at the same question on our 2024 survey and we see that the timeline does indeed appear to have extended.

This appears to show that more agencies are reporting timelines in the 7-12+ week ranges when compared with 2024. The biggest increases are in the 7-8 week and 12+ weeks ranges.

The only exception to this is the less than a week range which is also being reported more frequently than last year. Perhaps showing that clients are either committing very quickly, or taking their time to make a decision.

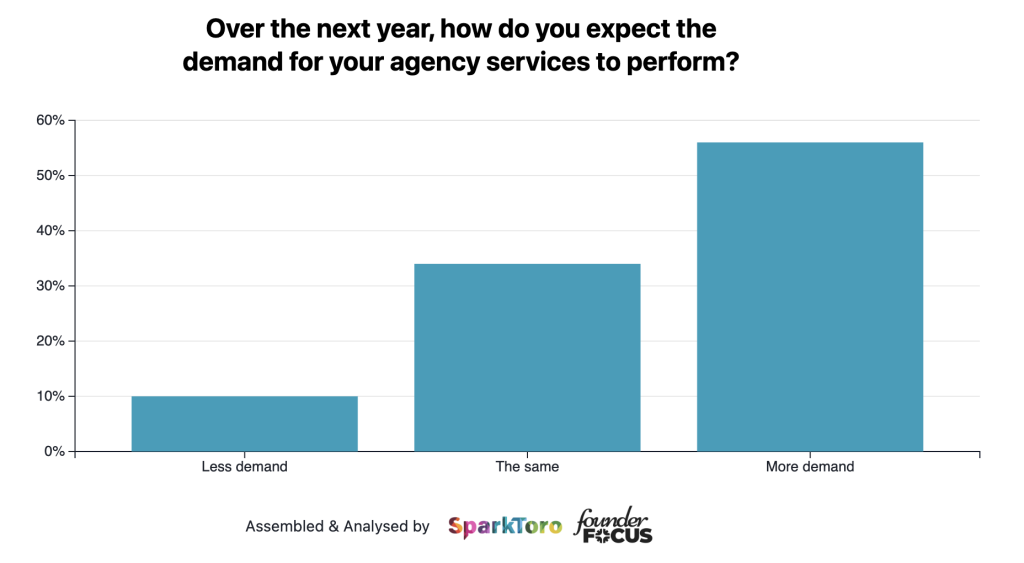

Agencies remain optimistic about demand for their services – over half expect an increase

Like last year, most agencies (56%) expect there to be more demand for their services over the next year.

This was followed by about a third (34%) who said that they expect demand to remain the same. Only 10% expect less demand over the next year.

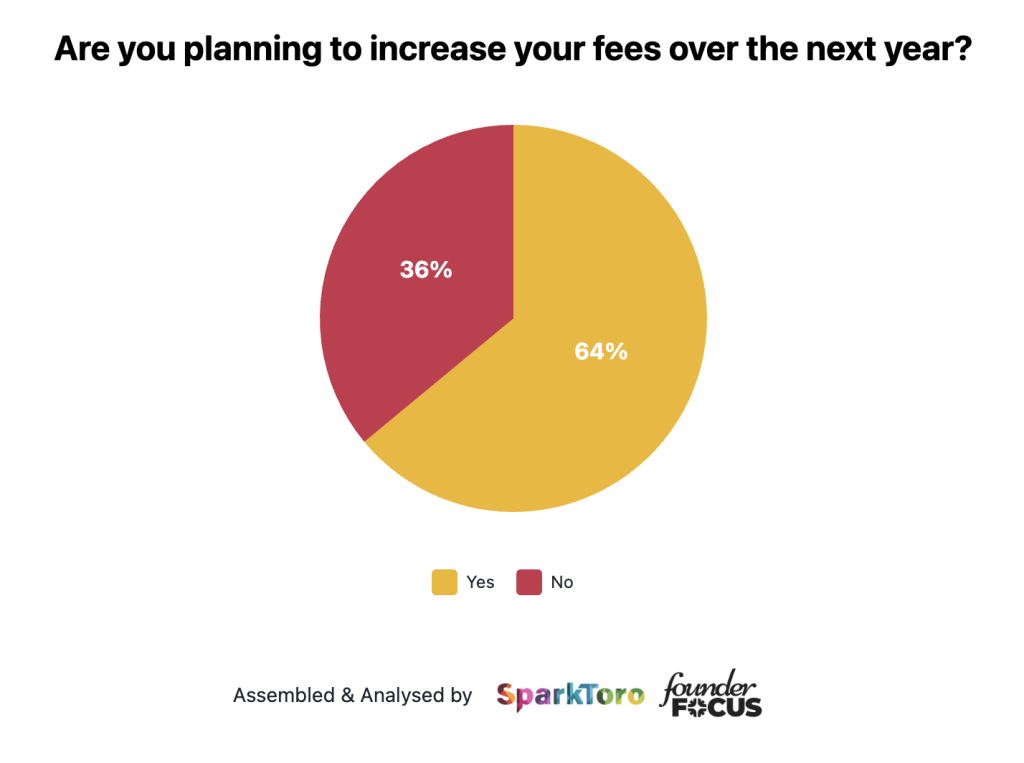

Nearly two out of three agencies plan to increase their fees over the next year (but most don’t increase them for existing clients)

One to watch for if you work in-house – 64% of agencies plan to increase their fees over the next year.

This shouldn’t come as a surprise given that general operating costs for running businesses are increasing, but it remains to be seen whether agencies will actually feel comfortable enough to increase prices.

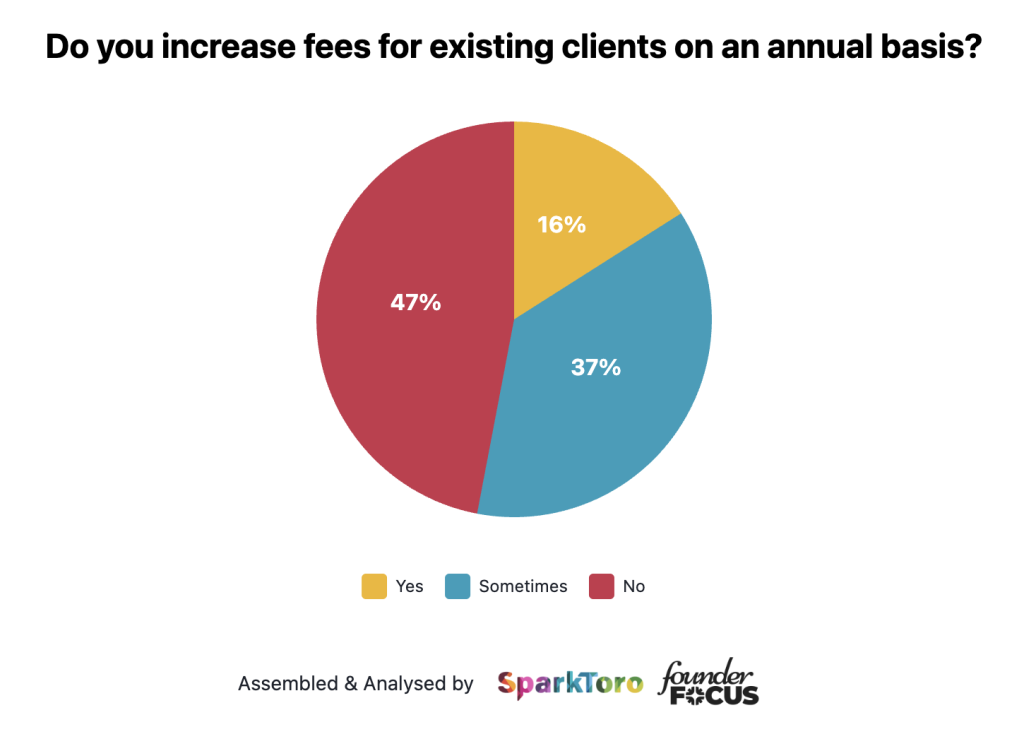

A signal as to whether they will do this lies in the next question where we asked agencies whether they typically increase their fees for existing clients.

Whilst it should be understandable that any business will need to increase their fees regularly to reflect increased operational costs, only 16% of agencies typically increase their fees on an annual basis for existing clients.

To be fair, over a third responded to this question with “Sometimes” which may indicate that they make a judgement call on whether an increase will be possible or if it may jeopardize their relationship with a client.

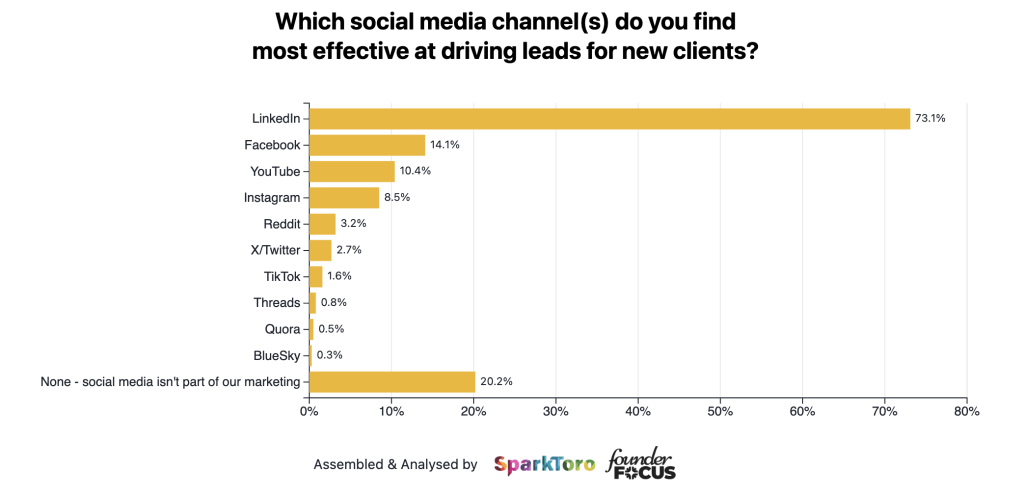

Over half of agencies say that LinkedIn is the most effective social media channel for new business

We asked respondents about their social media activity and which social media platforms (if any) drove new business for them.

LinkedIn was by far the most effective social media channel with 73% saying it was the one that worked best for them.

Interestingly, the next most popular answer was that social media isn’t part of marketing for the agency – 20% stated that this was the case.