What the #$%* is going on with the digital advertising ecosystem?

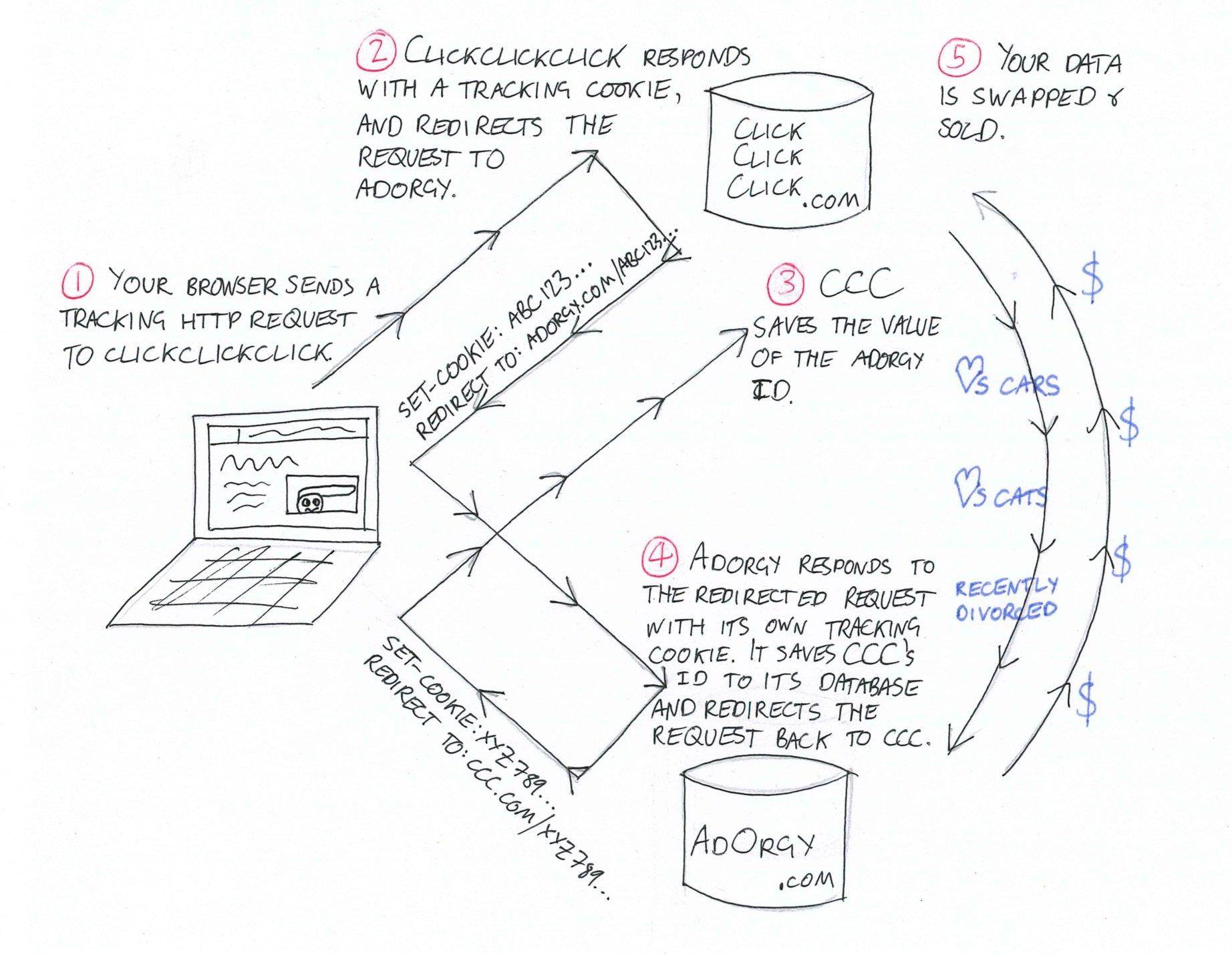

Where to even begin… Should we start with the upcoming loss of third-party cookies? The bizarre Google & Facebook duopoly teamup against anti-trust action? The rise of online ads as a money laundering & terrorist-funding tactic? Or maybe we should talk about brands’ ever-shrinking ability to attribute ad clicks. Hundreds of millions in provable ad fraud. Disturbing privacy issues that remain unaffected by GDPR or other government efforts.

No wonder a lot of savvy people believe adtech and the entire online advertising industry are due for a subprime-mortgage-style reckoning.

Sure, Ads Suck, But How Else Are You Gonna Get Customers?

If you need to market your products or sell your services, you could turn to earned and owned channels, but statistically speaking, you won’t. You’ll do what 95%+ of businesses do: throw money at Google and Facebook (and maybe Amazon if you’re in consumer e-commerce).

Why do the overwhelming majority of brands invest 10-100X as many dollars, people, and effort into paid advertising > organic marketing?

It’s a question that’s stymied me for eighteen years. In 2012, I convinced myself that the long-standing equation: 90%+ of Internet attention/clicks going to organic, but <10% of marketing spend was a paradigm that could not survive. SEO, content, social were all becoming more standardized and less stigmatized, so surely they’d soon become bigger pieces of the pie.

I was dead wrong.

In 2010, the IAB estimated ~$25 billion was spent in digital advertising. A decade later, it’s risen to ~$325 billion.

Content, social media, organic search, email, PR and every other non-paid channel combine for ~10% of that number. The fundamental equation remains. Display ads earn <1% CTR. Social ads average <3%. On mobile, close to half of all ad clicks are accidental or fraudulent. Search ads, the best performing bunch of the group, average <6%. That’s not to mention the somewhere between 11%–27% of web users employing ad blockers.

There’s only one thing that’s really changed. Today, I can answer the question about why organic gets all the clicks, yet ads get all the investment: incentives.

Let’s Talk Advertiser Incentives

Whenever I see anti-advertising discussions (like this recent, relatively high-quality deep dive from Freakonomics), inevitably there’s a slick, ad professional playing the boogeyman part. Sometimes they’re from an agency, other times it’s an in-house CMO or head of advertising. But, the implication is clear: the ad pros are the ones pulling the wool over well-meaning CEOs or business owners who would spend more wisely if only they weren’t so bamboozled by the Don Drapers of digital.

Bollocks.

The reason CEOs, board of directors, owners, and investors are perfectly fine overspending on advertising is because nearly all of them value growth over profitability. That’s been how potential acquirers, public market investors, venture capitalists, and private equity firms have all valued companies for the last twenty(ish) years.

Want a personal example? My old company, Moz, was valued at $120M when it had $22M in revenue and was growing at 100%/year. A few years later, the company passed $50M in revenue, but the growth rate had slipped to ~8%/year. The valuation then? $90M. From the shareholder perspective, throwing $10M/year at advertising to get an incredibly unprofitable $5M more in revenue would technically make sense.

Via NYTimes, 2017

If your CEO says “we need to grow at all costs,” you’re gonna get a lot of wasted dollars thrown at advertising. Because, as shoddy as ad attribution has gotten, CEOs and investors still trust the numbers from your Google and Facebook Ad accounts. If you can show them that by spending $X million more dollars next year, you can grow by 2X, you’ve got ’em salivating.

Put that same effort into organic efforts (SEO, PR, email, content marketing, etc) and the story gets a little riskier. Sure, you put a shockingly reasonable $250K into SEO with an agency this year and saw 4X organic growth, but can you prove that by spending $500K with that agency next year, you can do it again? Doubtful.

An extreme, but highly relevant example played out in the recent Georgia Senate runoff elections, where $450M was spent on advertising to change the minds of perhaps 20-50,000 “persuadable” voters.

The New York Times quoted Dr. Ken Goldstein, professor of politics:

“The stakes are so high and the margins are so tight that even a really inefficient strategy makes sense for people who are trying to control the United States Senate.”

The world of customer acquisition isn’t much different, especially in high competition, high-investment spaces. Companies (especially investor-backed ones) are willing to pay a premium for growth, even if it means being hugely unprofitable, because growth is what the markets value. Those same dollars would be unacceptable as a fixed cost for employees or product investments. But when the $ signs appear in the cost of acquisition (CAC) column, no one complains.

Via Elea Feit, 2020

That’s the beauty of ads. Investors, potential acquirers, and execs feel like they can take CAC numbers to the bank. It’s not slick ad men and women conning innocent brands out of their hard-earned marketing budgets. It’s valuation-focused CEOs and owners who know where their bread is buttered, and don’t much care if 88% of their advertised-to audience would have bought the product anyway.

Now Let’s Talk Ad Platform Incentives

Facebook, Google, and Amazon (who collectively own ~65% of the digital ad market) have intense, high pressure incentives to show that buying ads on their platform works. And, they have a similarly strong incentive to hide any data suggesting that organic investments pay off. Hence, when you buy ads, the numbers look really good. And when you earn organic traffic, attribution hovers between incredibly-difficult-to-prove and wholly impossible.

The ad platforms’ incentives are so misaligned with reality that hiding abuse and ineffectiveness isn’t just easy, it’s par for the course. Yes, even from the “trusted” platforms like Google and Facebook. When you get into the long tail of ad providers and platforms, it gets even worse.

Brands of all sizes are making the low-friction, low-ROI decision to throw money at these ad platforms, because they don’t feel they have much choice. They need growth, aren’t penalized for high CAC, and so they spend. The macro-level results are inevitable.

After decades of dominance, growth, and easy money, adtech’s metastasized into a fattened beast gorging on advertisers’ lack of options. Fraud runs rampant. ROI is shrinking. And the platforms that once provided high quality attribution are so dominant, they no longer need to bother proving themselves.

Something truly is rotten in the state of online ads. But, in the words of King Hamlet: the hour is almost come when advertising’s tormenting fraud must render itself up.

What Happens Next?

Are we due for a revolution in online advertising? Will brands really change their behaviors? Can adtech providers and ad platforms be pressured into real transparency?

My best guess: don’t expect an overnight revolution, but get ready for substantive, incremental change.

Movements like these build pressure for a long time before a release valve finally blows. I think we’ll see a torrent of journalism and stories about ineffective and fraudulent ads snowballing into broader awareness of the problem. Executives will, eventually, get the message. Investors will start asking if their portfolio companies can grow more efficiently. CMOs and heads of advertising will start to realize they can look good to their bosses by raising efficiency (not just by increasing raw acquisition).

You can only read so many stories about millions of wasted spend before you start to wonder if you’re one of the suckers.

A few years ago, there were inklings of this movement when stories about the world’s largest advertiser, P&G, cutting $200M of ad spend without losing any customer acquisition, came out.

Via Reuters, 2017

The recent $100M ad fraud case at Uber, uncovered by Check My Ads cofounder, Nandini Jammi, has “gone viral” over the past week, and will undoubtedly get some execs checking their own ads.

Via Tech.co, 2021

And let’s not forget the peculiar ad stalking case that dominated ad-world’s headlines over the 2020 holidays: the buttflap pajamas.

Thousands of social media users noticed the ads following them around the web, and took to their platforms to comment. When researchers dug into the why, how, and who behind it, things took a very strange turn.

In all likelihood, these buttflap pajamas are not the product. You and I are. Those ads are just a red herring for what’s really going on: astroturfing and device data collection by a network of Chinese and Taiwanese adtech firms who operate under very different kinds of privacy laws than those in the US and EU.

Shosana Wodinsky did a brilliant, revealing deep-dive into the dark ad ecosystems that collect and monetize this data (though it remains unclear if the overarching goal is primarily political, capitalist, or something else).

Viral pieces on advertising fraud like these can, eventually, penetrate the mainstream, but they’re not acting alone.

In my experience, it’s when stories don’t just come from big companies and mainstream media, but from people in our networks: friends, colleagues, industry publications, even social influencers, that behavior change accelerates.

Stories like Andrew’s:

Stories like Robert’s:

Stories like Headphones.com’s:

These anecdotes reinforce the big, “viral,” pieces and make the process of ad auditing and testing feel both accessible and necessary. That’s what’s needed to make incremental change.

What I don’t see happening anytime soon is change from the ad platforms themselves. Browsers blocking third party cookies will shut down some easy, abusive tactics, but browser fingerprinting and other tracking methods will undoubtedly take their place. Google and Facebook have no incentives to provide greater transparency because they face no real competition. Only government action could change their practices, and that feels unlikely given the priorities we’ve seen over the last decade.

What Should Advertisers Do?

Finally, an easy question!

Why is it easy? Because most advertisers pour money into the ad platforms’ default/suggested channels, haven’t audited their spend, and don’t grasp how relatively straightforward it is to hire an experienced agency or consultant who’ll fix this problem.

Your opportunity to find savings (and remove fraud/abuse) depends mostly on where you’re currently running ads. Below, I’ve created a rough, imperfect set of three buckets on the “hey, you might save a lot of money with an audit!” spectrum.

High Opportunity Ad Optimization Targets

- Re-targeting / re-marketing ads (on any platform)

- Display ads on platforms that aren’t Facebook or Google

- Programmatic ads that show large indirect conversion numbers (i.e. someone saw the ad, then later took action), but low direct conversion numbers (i.e. someone clicked the actual ad itself and converted on that same visit)

Mid Opportunity Ad Optimization Targets

- YouTube ads (of any kind)

- PPC/Search ads

- Ads on Facebook and Google’s display networks

- Conversion-focused ads on any social network (Twitter, Snapchat, Tik Tok, Instagram, Facebook, etc)

- Amazon search / DSP ads

Low(er) Opportunity Ad Optimization Targets

- Amazon affiliate ads

- Direct, 1:1, non-programmatic website ad buys

- Podcast, email newsletter, or video/stream sponsorships

- Non-programmatic, Influencer sponsorships

CAVEAT: I am not an online advertising auditor, and don’t do these audits myself, so your experience will likely vary, and it’s very possible an auditing pro would take issue with how I’ve labeled these. Listen to them.

If you want to read more of the nuts and bolts about how these audits work, and you could DIY, I recommend:

- SEER’s July 2020 deep dive on how to optimize your Google search ad spend (where tons of keywords you’re unwittingly opted-into buying are probably a waste).

- Check My Ads’ explanation of how brand safety companies and programmatic networks combine to cheat you out of high quality ad placements and funnel your dollars to dark corners of the web, rife with hate speech, abuse, and fraud.

- Wordstream’s basic, but comprehensive guide to auditing your Facebook ads, and their complimentary Facebook Ads Checklist.

- Jeff Sauer’s excellent 10-Minute Google Ads Account Audit

- Madison Feldhake’s post on Auditing Google Display Placement’s (not nearly as simple as it should be, but possible if you know what you’re doing).

- Webmechanix’s massive list of thousands of GDN sites to exclude (along with explanations of why). There are several good multi-thousand site lists like these, but this one provides the detail about *why* to exclude that I truly appreciated.

- CheckMyAds’ post on how sketchy ad platforms work, how they scam Google (or maybe, how Google lets themselves be scammed), and how advertisers can take action.

Be cognizant that great audits aren’t just about finding fraud, ad slurry, low quality sources, or useless keywords in your accounts. They also involve testing, which can mean lower ad penetration and fewer signups during a test period. You can’t know how effective ads are until/unless you shut them off (or, as Wistia did, throw up a Smokey-the-Bear PSA instead of your brand ad) and see what happens. If you’ve got a great, in-house ad buying team whose incentives aren’t tied to spend (i.e. you don’t compensate or fund their department more the larger the ad budget), they should be able to easily run some tests like these.

That said, I’d hire a specialist. This isn’t impossible work to do yourself, but an agency or consultant who’s seen how networks pull off their shady practices and how the big players hide the good clicks with the bad to create the inescapable “ad slurry,” is priceless. The firms and people above are a good start, and there are thousands more who’ve got the skills to save you huge bills. And there’s no substitute for hiring an agency incented to save you money, vs. spend your money.

I’m looking forward to continuing this series on the dark underbelly of the ad world in the weeks ahead, so stay tuned. Next up: an exploration of how to pivot your ad placements in a far less personalized, cookie-tracking world.

And please, if you’ve got feedback about this post, additional recommendations for brands attempting to pull back on their online ads, or resources for folks interested in the topic, please share ’em in the comments!