Introduction from Rand: I care deeply about the consulting world in digital marketing. These people are my friends, my colleagues, my fellow speakers, and my investors. Their fears, concerns, successes, and trends are bellwethers for our field as a whole. Is AI hurting or helping marketers? Is the Zero Click costing them clients or gaining them new ones? Are agencies’ revenue numbers going up or down? Well, buckle up, because Paddy Moogan (of Founder Focus – which helps agency founders level up, The New Leader – one of my fav newsletters, and Organic Video – who helped SparkToro make our promo videos) has answered all of these questions and dozens more thanks to the participation of hundreds of agency owners around the world. And since it’s our second year running this survey, we’ve got data trends across years this time, which I’m particularly excited to see. Without further ado, I turn you over to our friend and collaborator, Paddy Moogan…

A year ago, Rand and I set out to take a temperature check on the landscape for digital agencies, attempting to put some numbers and facts against our anecdotal experience – that things were harder than ever for digital agencies.

It turned out that this was true: hundreds of agencies and freelancers told us what we thought to be true – things were indeed hard. But there was also a healthy degree of hope for the future that things would improve and that the challenges would ease up a little.

So, did things actually improve? Was the optimism warranted? Or did 2025 bring more of the same for digital agencies?

In addition to the post below, you can also find more data here which focuses more on agency budgets, client services and operations:

Background on the survey

The goal of our survey is to get a temperature check on the state of the digital agency landscape, helping agency folks (and freelancers) to get a gauge on how their peers are feeling right now. We also wanted to establish some agency performance benchmarks and given that this is our second year running the survey, we are now able to do some year on year reporting of these benchmarks.

In terms of the topic areas that we asked about, we divided these into five core areas:

- Revenue and growth

- Client services and operations

- Sales and marketing

- Culture and ways of working

- What the future holds for agencies and consultants

We’ll be publishing the results of the 2025 Digital Agency survey over a series of posts, starting today with the top takeaway for agencies and consultants across all of these areas.

Who took the survey?

Let’s take a brief look at some top line demographics of those who responded to this year’s survey.

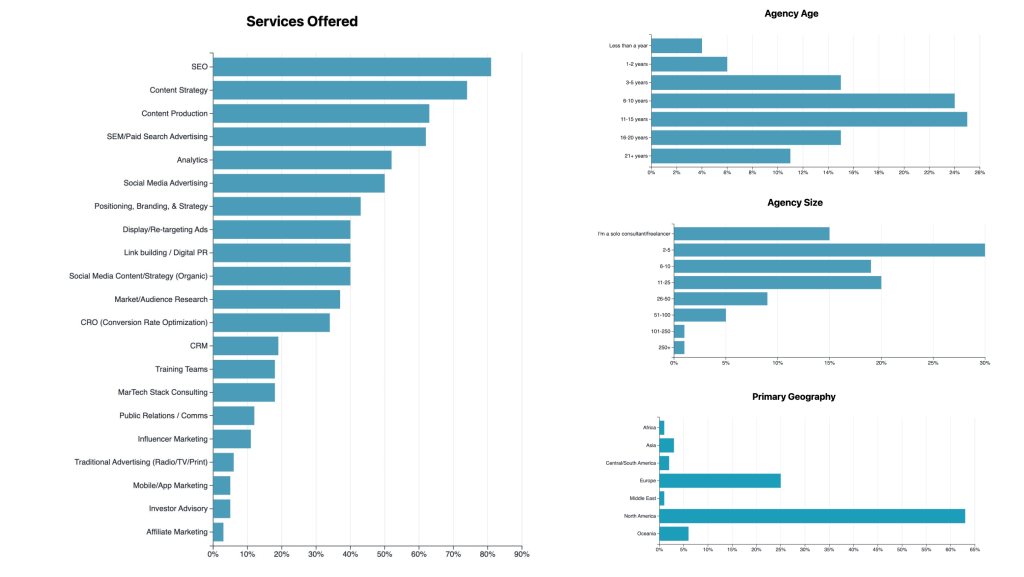

The survey includes agencies from a wide range of sizes, geographies, and services offered, but there’s definitely concentration in small to medium sized (1-50 person agencies), North America and Europe, $100K-$5M revenue businesses, and SEO, SEM, Content, and Analytics. In the sections below, we’ll break out responses from specific slices of these groups to illustrate key differentiators and illuminate useful patterns.

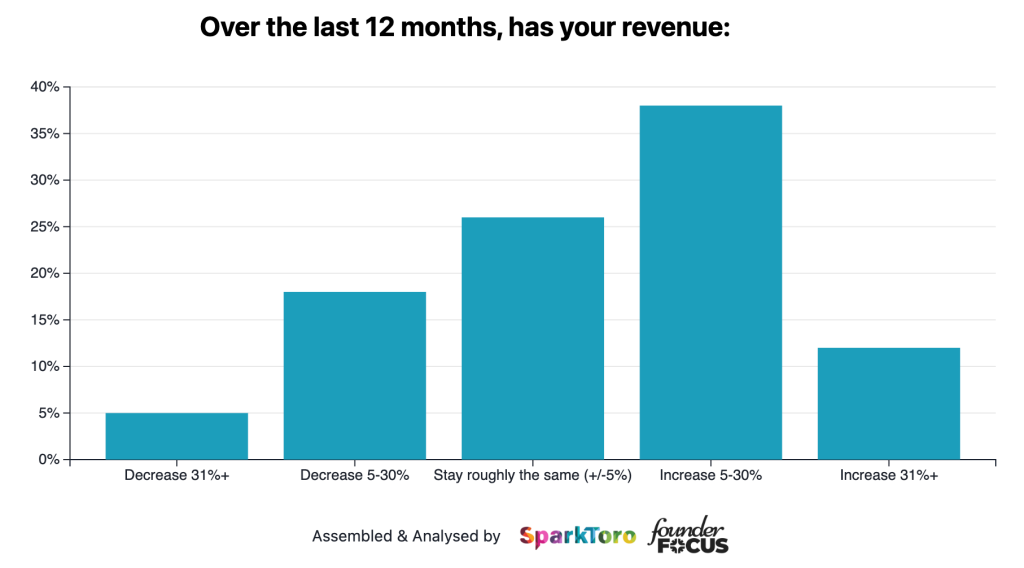

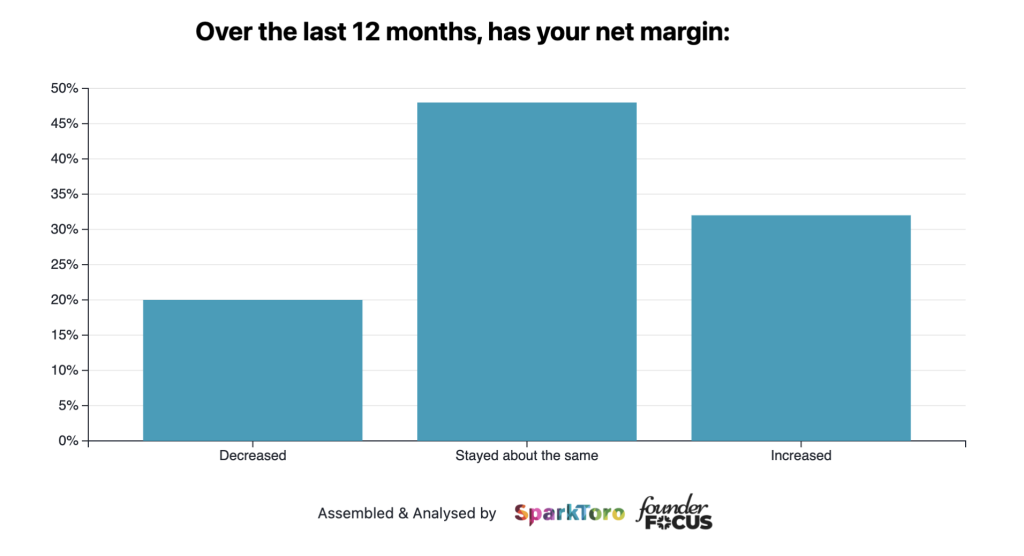

Half of agencies have seen revenue growth over the last 12 months whilst a third have seen net margin increase

Fortunately, whilst 23% of agencies saw a revenue decrease over the last 12 months, 50% of agencies reported an increase. 12% are doing particularly well and reported an increase of over 30%.

This year, we asked about net margin and 32% of agencies told us that their net margin had increased over the last 12 months. 48% reported that net margin had remained about the same and 20% said that it had decreased.

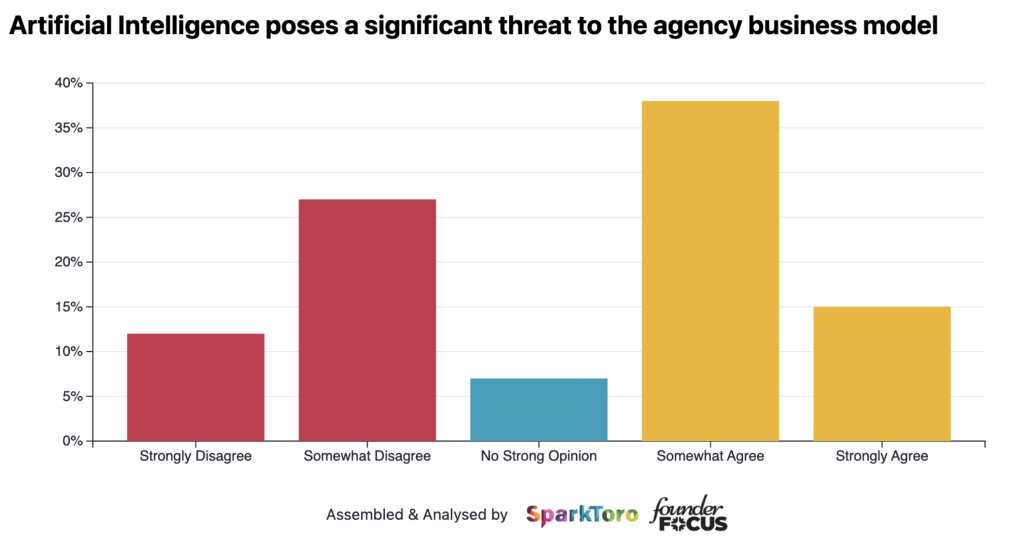

Agencies are more worried about the threat of AI to their business model than a year ago

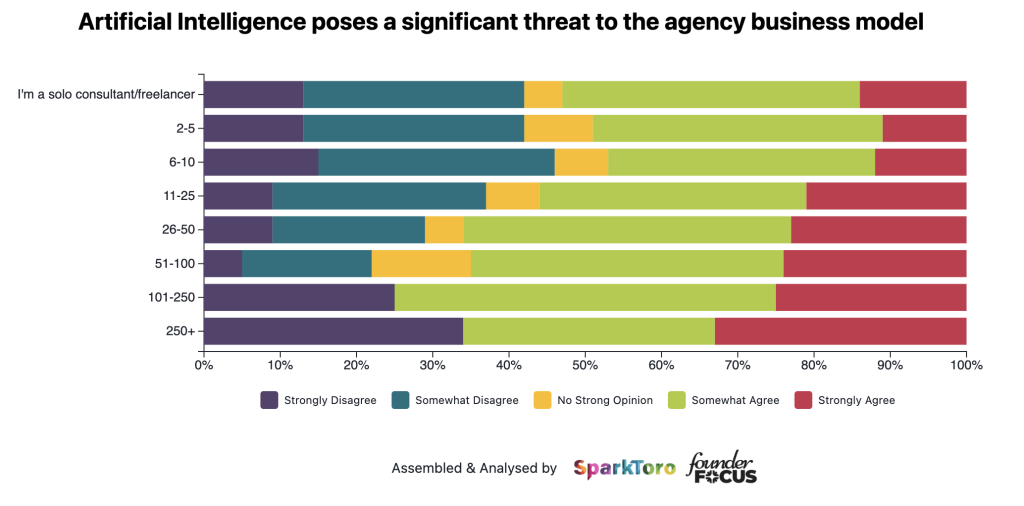

Like last year, we asked agencies for their thoughts on whether AI poses a significant threat to the agency business model. Some of you may remember that opinion was split pretty much exactly down the middle.

In 2024, 44% of agency folks agreed with this statement, whilst this year, this has increased to just over half at 53%.

Interestingly, the worries seem to correlate slightly with the size of the agency, with mid-size agencies seeming a little more worried about the threat of AI compared with smaller ones:

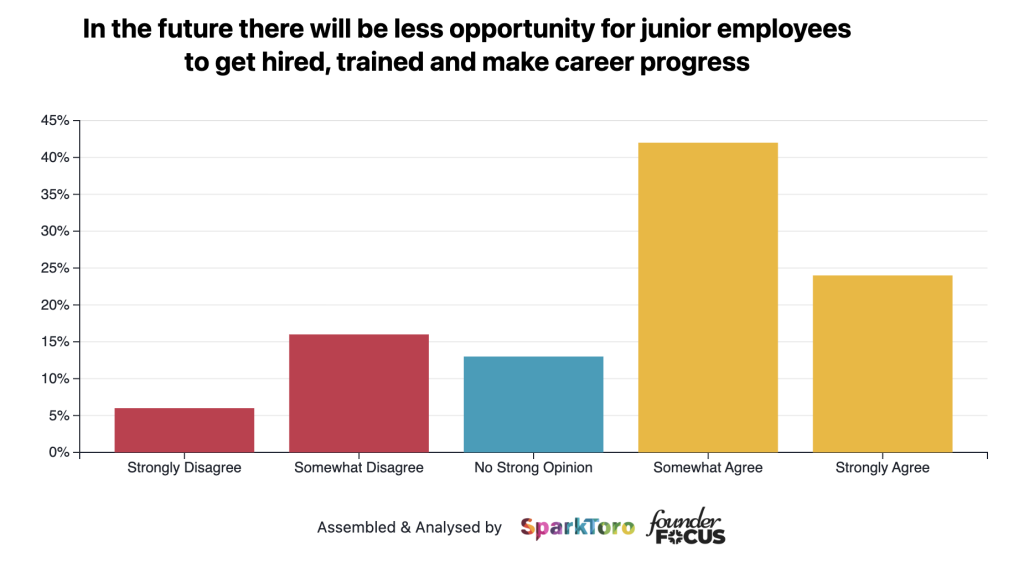

Two thirds of agencies are worried about career opportunities for junior level staff

One of the potential areas that AI can impact agency work is repetitive tasks where AI tools and agents can be trained to do the same job. Typically, such tasks are handled by junior team members who are learning their craft.

So we wanted to ask agencies about whether there could be a long-term impact on the opportunities afforded to junior agency folks.

Unfortunately, the worries seem to be shared by most agency owners, with 66% agreeing with the statement that junior team members may have less career opportunities in the future.

Only 22% disagreed with this statement and 13% had no strong opinion either way.

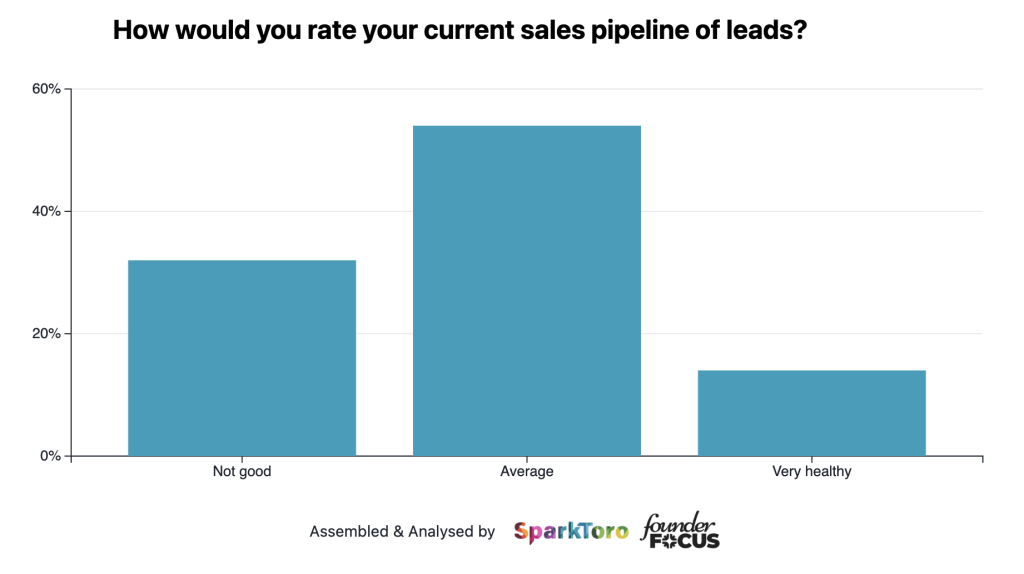

Only 14% of agencies describe their sales pipeline as healthy right now (but things have gotten better)

We wanted to understand the current status of sales pipelines for agencies and freelancers and we found that only 14% feel that their current pipeline is healthy. Over 50% describe it as average and the remaining 32% say that it’s not very good.

This finding was fairly consistent across all regions where our respondents were located.

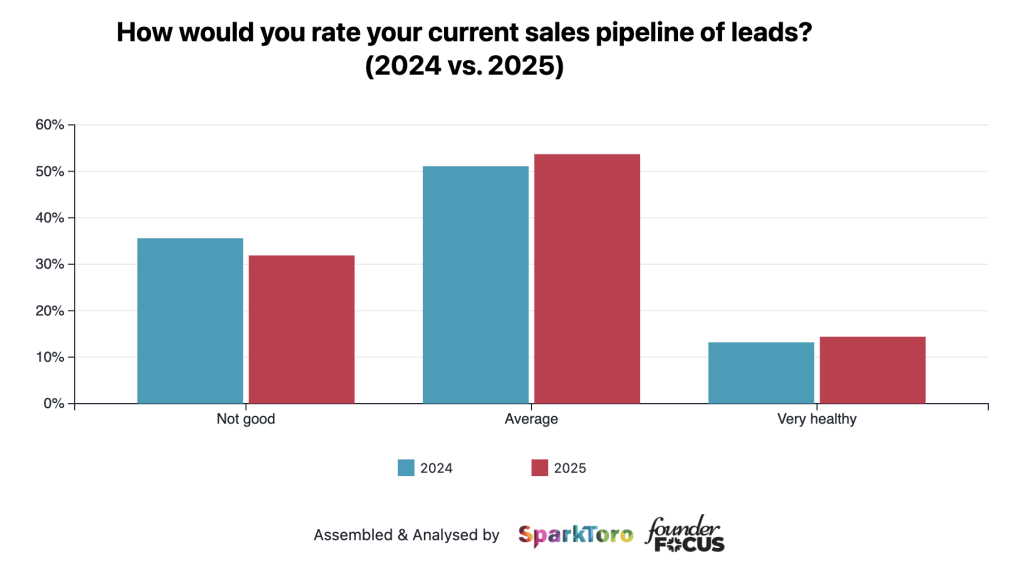

We’re seeing a (very) small improvement in sales pipeline for most agencies

In terms of how things have changed compared to 2024, it’s probably best summarized as “still hard but slowly getting better”.

In 2024, 13% of agencies described their sales pipeline as very healthy. In 2025, this increased very slightly to 14%. Not enough to make us confirm a significant change, but we did also see a slight improvement elsewhere…

In 2024, 36% described their sales pipeline as not good. Whereas in 2025, this decreased to 32%. Again, not as big of an improvement as any of us would like, but combined with the previous numbers too, there are slight improvements.

Larger agencies are faring better than smaller agencies in terms of their sales pipeline

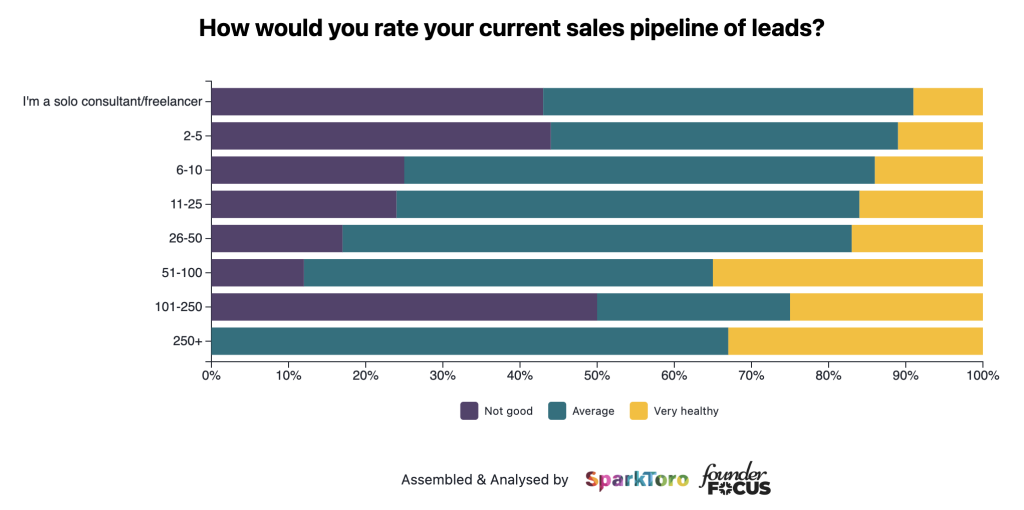

Despite location not appearing to be a big factor when it comes to the health of sales pipelines, there is an interesting trend that seems to indicate that larger agencies are doing better than smaller agencies at the moment.

We can also see that agencies that are 51+ people in size are reporting their pipelines to be very healthy at a much higher rate than smaller agencies.

We should mention that the same size of larger agencies is naturally smaller, but the trend does appear to be genuine.

Sales leads are taking longer to close compared to a year ago

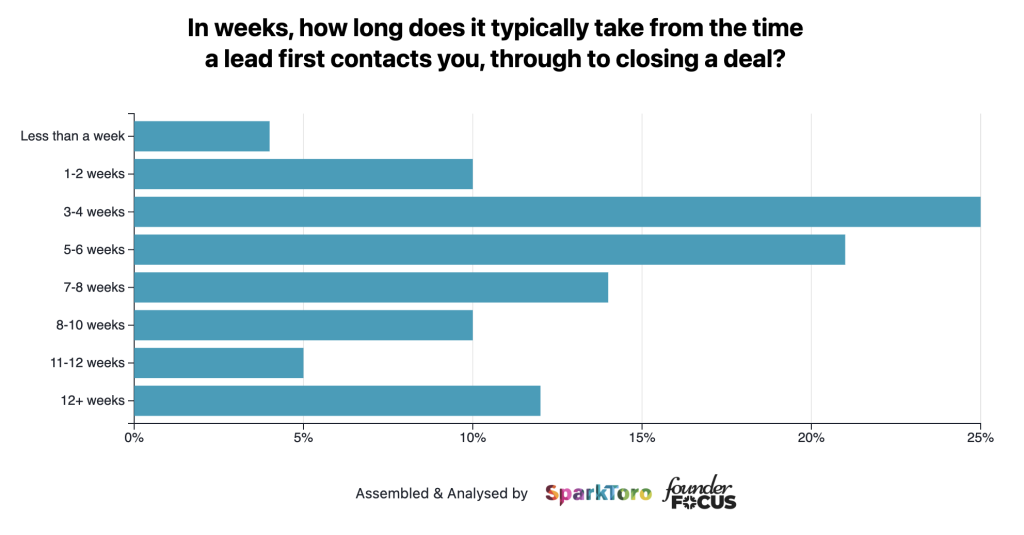

Around 55% of agencies said that it can take between 1-6 weeks for a lead to go through the sales process and convert into a client. 10% said it can take 1-2 weeks, 25% said it takes 3-4 whilst 21% said it can take 5-6.

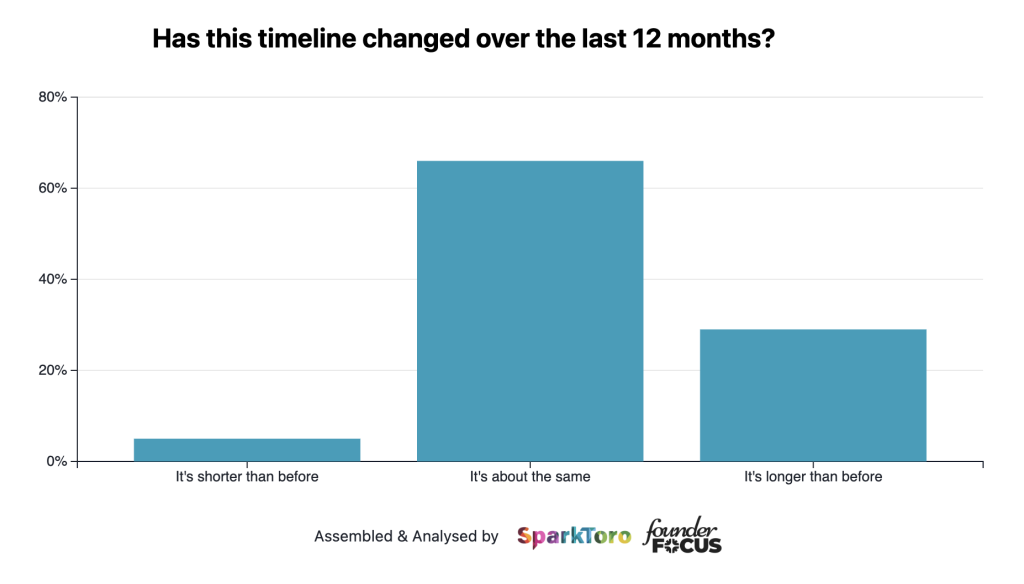

Leading on from this, we asked whether this timeline had changed over the last 12 months, to try to see if clients are typically taking longer or shorter to commit to contracts.

29% said that it is indeed taking longer for this process to be completed compared to the previous year.

The majority (66%) said that the timeline has remained the same and only 5% said that the timeline has shortened compared to the previous year.

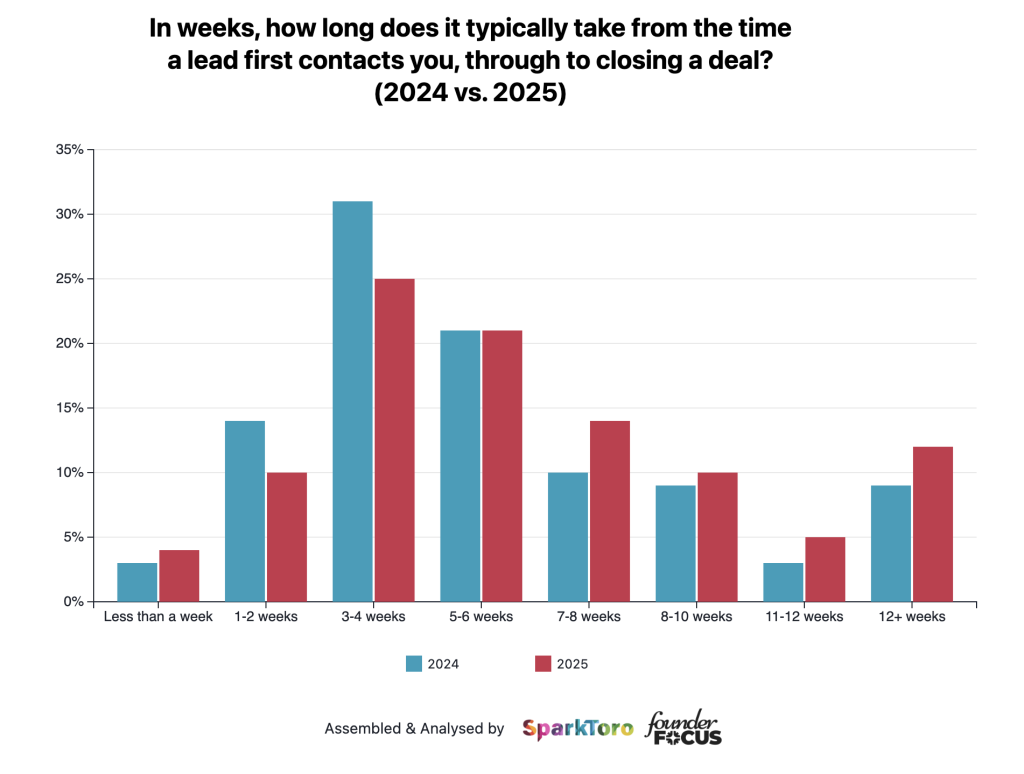

To make this change more concrete, we can take a look at the same question on our 2024 survey and we see that the timeline does indeed appear to have extended.

This appears to show that more agencies are reporting timelines in the 7-12+ week ranges when compared with 2024. The biggest increases are in the 7-8 week and 12+ weeks ranges.

The only exception to this is the less than a week range which is also being reported more frequently than last year. Perhaps showing that clients are either committing very quickly, or taking their time to make a decision.

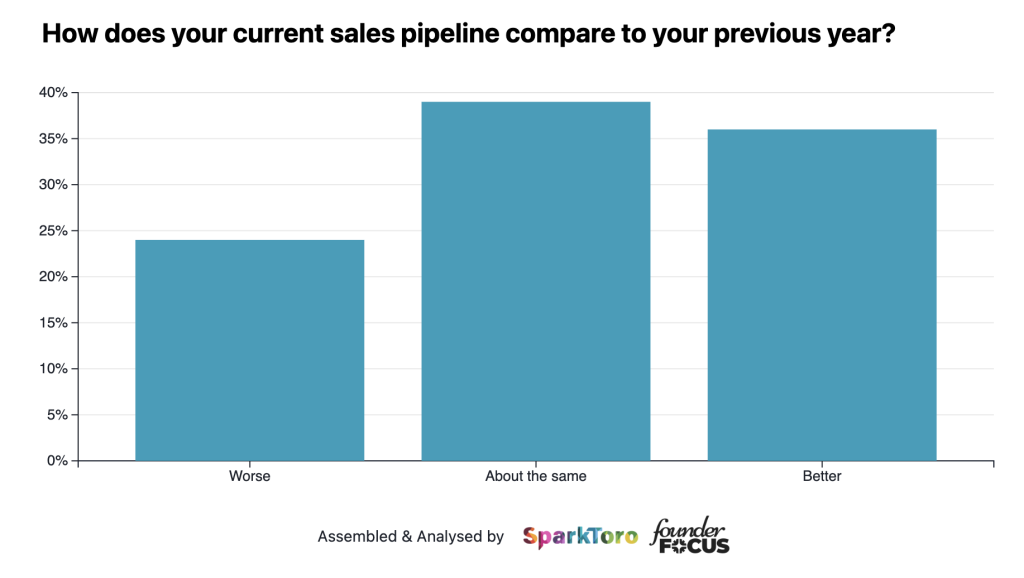

A quarter of agencies say that their sales pipeline has gotten worse over the last year (but things are marginally better than two years ago)

At first glance, it is concerning to see that one in four agencies reported that their sales pipeline has gotten worse over the last year.

Whilst 36% of agencies reported that their pipeline has gotten better and the remainder (39%) said that it was about the same as a year ago.

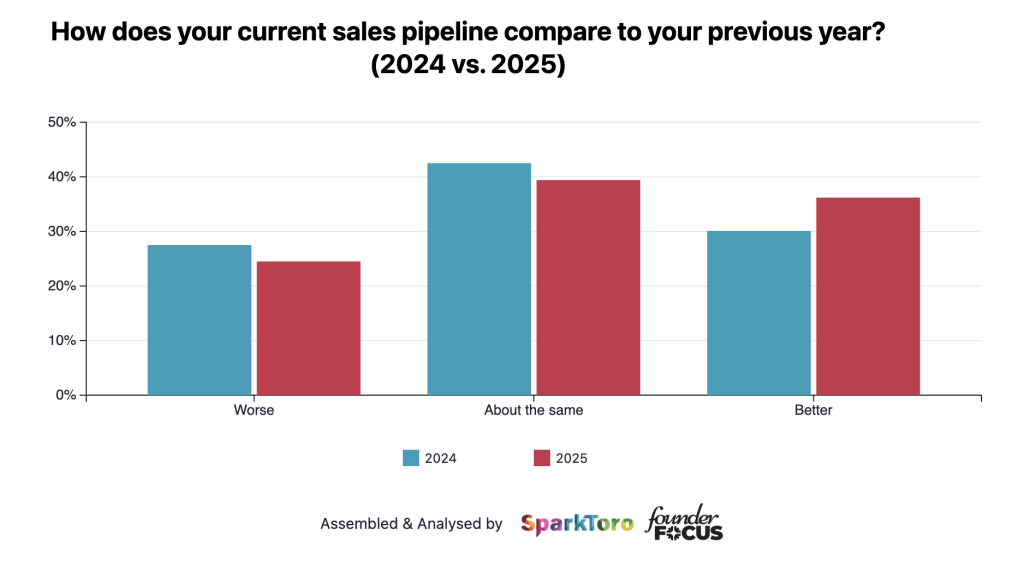

We can get a better idea of how things look if we zoom right out and take into account our results from 2024 as well.

In summary, things appear to be trending in the right direction, albeit very, very slowly. This further adds to the sentiment of this section of our report – yes, sales and new business does appear to be getting slowly better, but things are far from easy.

The improvements that we see are very small shifts.

Looking at the data, we can see that when we asked the same question in 2024, more agencies (27% vs 24%) reported that their pipeline had gotten worse compared to 2025.

In 2024, 30% of agencies reported that their pipeline was better than a year ago, whilst this increased to 36% in 2025.

Whilst relatively small shifts, these are encouraging signs for an industry that has had a generally difficult few years. Fewer agencies are reporting pipeline getting worse and more are reporting it getting better.

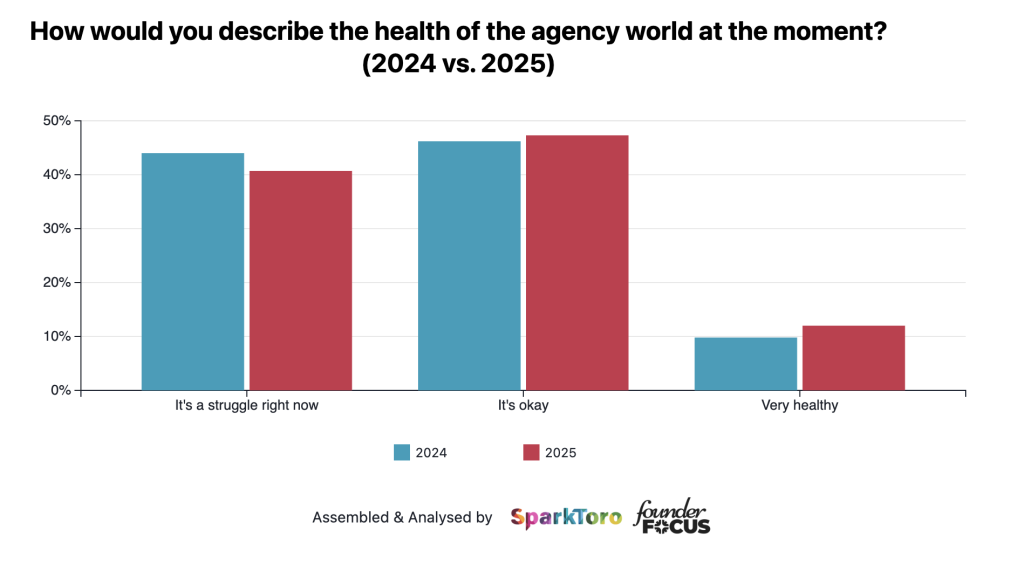

Very few agencies say that things feel very healthy in the agency world right now

We started by asking for a general temperature check on the health of the agency world right now. 12% of agencies reported it as feeling very healthy right now, whilst 47% said that it felt okay and the remaining 41% said that it’s a struggle right now.

There does seem to have been a very slight shift in comparison to 2024. Whereas this year, 12% of agencies reported that the agency world feels very healthy right now, it was lower last year at 9% – representing an improvement for some agencies.

At the same time, in 2024, 44% of agencies said that things felt like a struggle right now, compared to 41% this year.

If we drill into the numbers a bit more, we can see that it’s the small to medium sized folks that seem to be happier right now. Whilst the larger agencies aren’t reporting a positive sentiment for the agency world at the moment.

To further segment by location, it appears that the regions that are reporting struggles the most are Asia, South America and the Middle East.

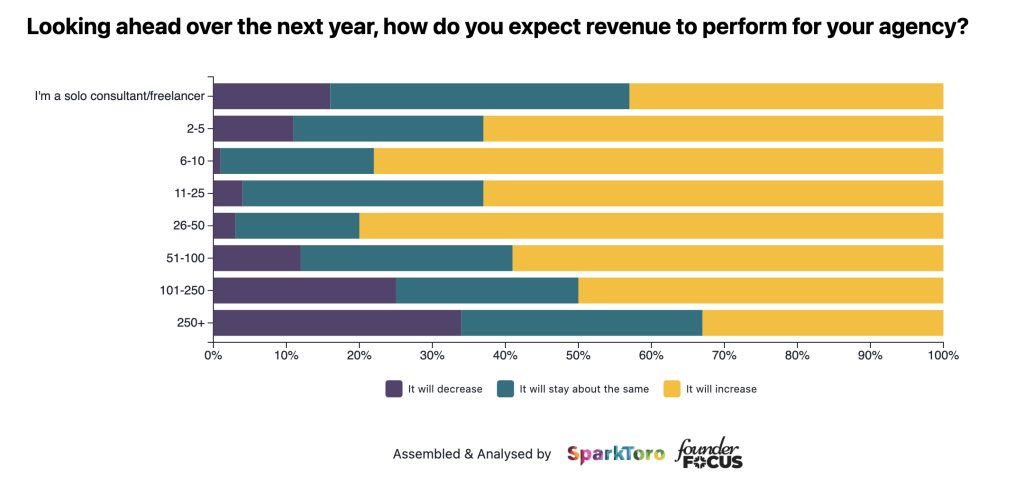

Despite the current sentiment, optimism for the future is very high

Even though so many agencies are reporting that things are a struggle or just okay right now, there is a high degree of optimism for the future, with the vast majority (64%) saying that they believe revenue will increase over the next 12 months.

Optimism also seems to have increased from 2024. Last year, we asked the same question and 60% of agencies said that they expected revenue to increase, slightly lower than this year at 64%.

Last year, 11% expected revenue to decrease which is higher than the 8% reported this year.

Generally, this seems to show a renewed optimism for the future of the agency revenue.

If we break things down by agency size, it appears that the larger agencies aren’t feeling as optimistic about future revenue growth. The largest number of agencies saying that revenue will decrease are the segments of 101-250 people and 250+ people.

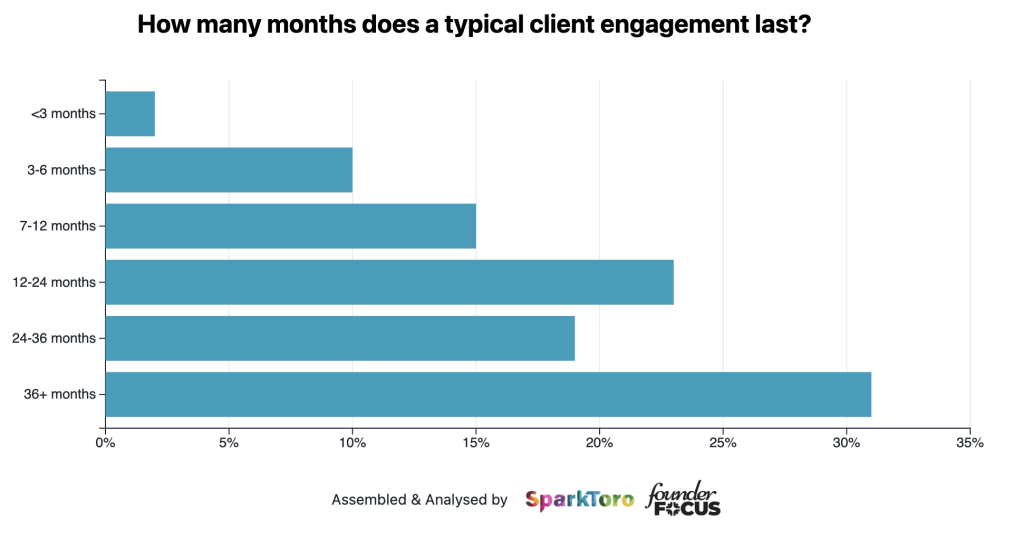

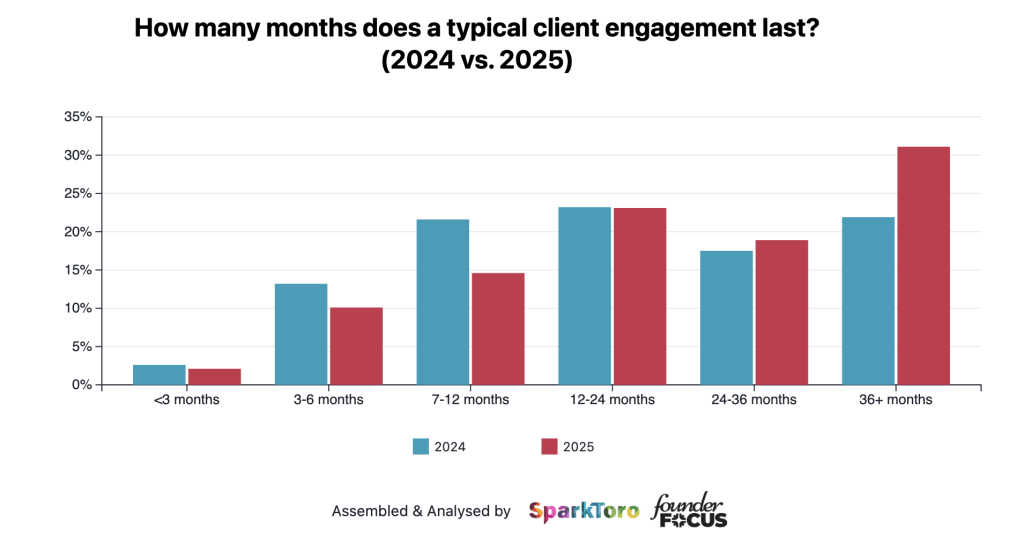

Agencies are retaining clients for longer and tend to work with clients for at least two years

We asked respondents how long they typically worked with clients, with around a third (31%) saying they worked with clients for over three years, whilst a fifth (19%) said that they worked with clients for between 2-3 years.

This appears to have improved compared with a year ago, with more agencies reporting that 36+ months is a typical client engagement length.

Generally this seems like a fairly healthy length of time that agencies are able to retain and work with their clients.

Having said that, a decent chunk (25%) will work with clients for less than 12 months.

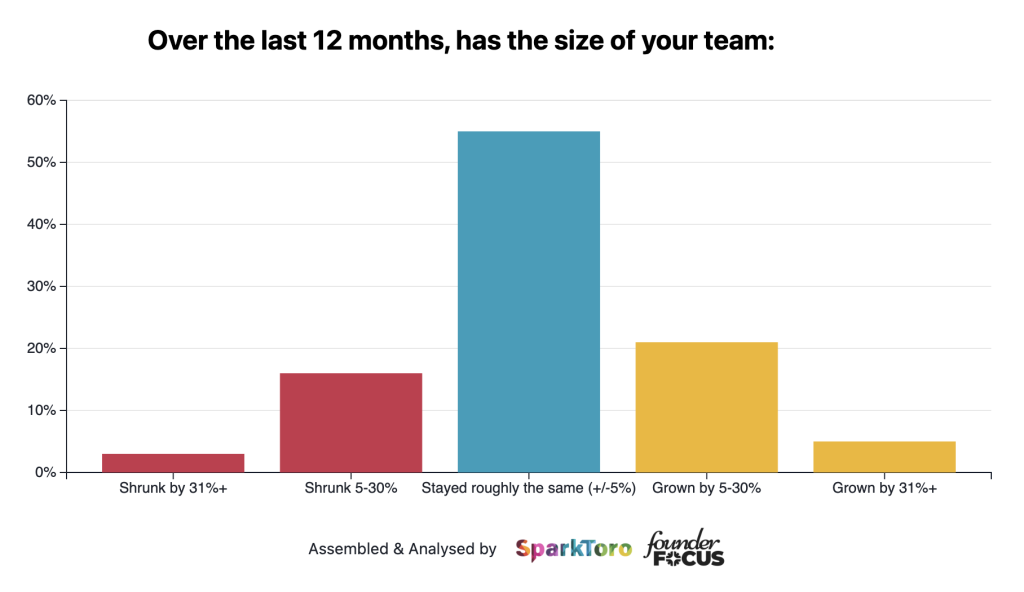

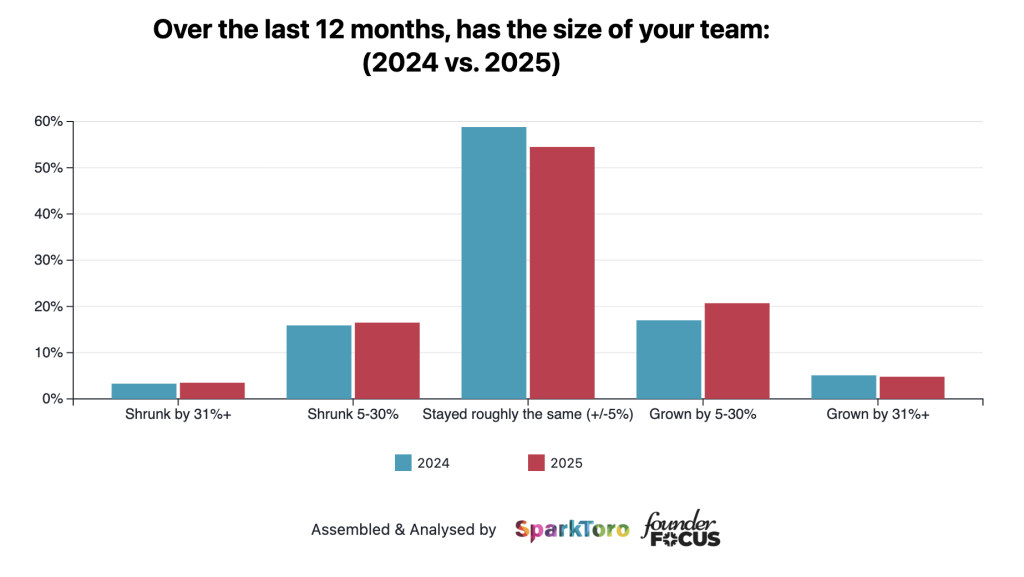

Over half of agencies said that the size of their team has remained the same as a year ago (but things are getting slowly better compared to 2024)

When it comes to headcount, 55% of agencies said that team headcount had stayed roughly the same.

21% said they’d grown by up to 30%, whilst 16% said they’d shrunk by up to 30%.

Only a small number reported sizable headcount changes overall.

This does appear to be another area where things have gotten slightly better for agencies compared to what they reported in 2024.

Last year, 22% of agencies reported that headcount had grown. Whilst this year, we saw a very slight increase with 26% saying that headcount had grown.

Methodology and demographics

In total, 376 individuals responded to our survey which was run using Typeform between 5th September 2025 and 31st October 2025.

Respondents were shown all questions and the vast majority were compulsory to answer. Logic and branching was used for some questions, meaning that a few questions were not shown to everyone. A handful of questions were optional e.g. where we asked about specific revenue numbers and potential for staff layoffs.

The data was analyzed by Rand Fishkin and Paddy Moogan, with the most interesting questions being visualized in the charts above and subsequent posts.

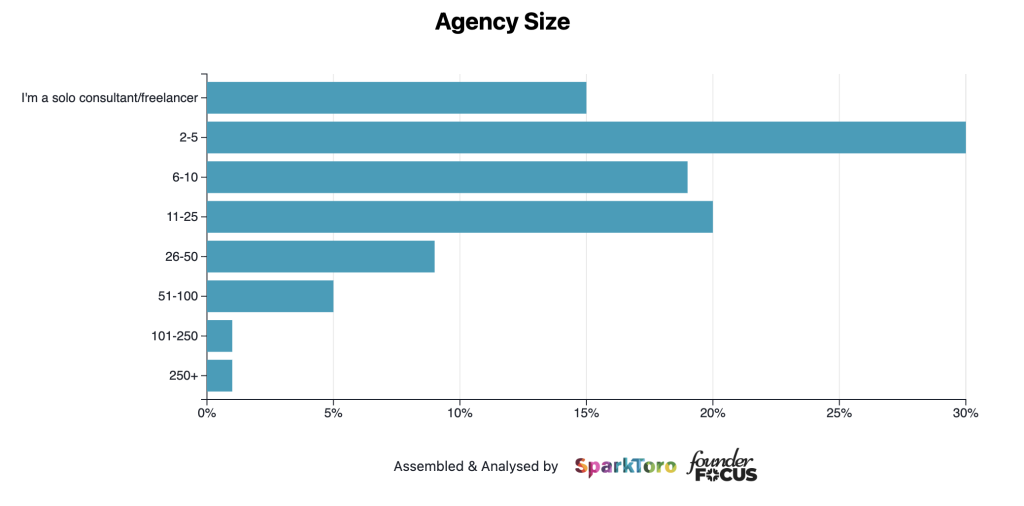

Agency size

The majority of our respondents represented a mix of solo consultants and agencies up to 25 people in size, totalling just over 84%. The remainder were mostly in the 26-100 range, with the smallest representation (1%) coming from agencies who are more than 250 people in size.

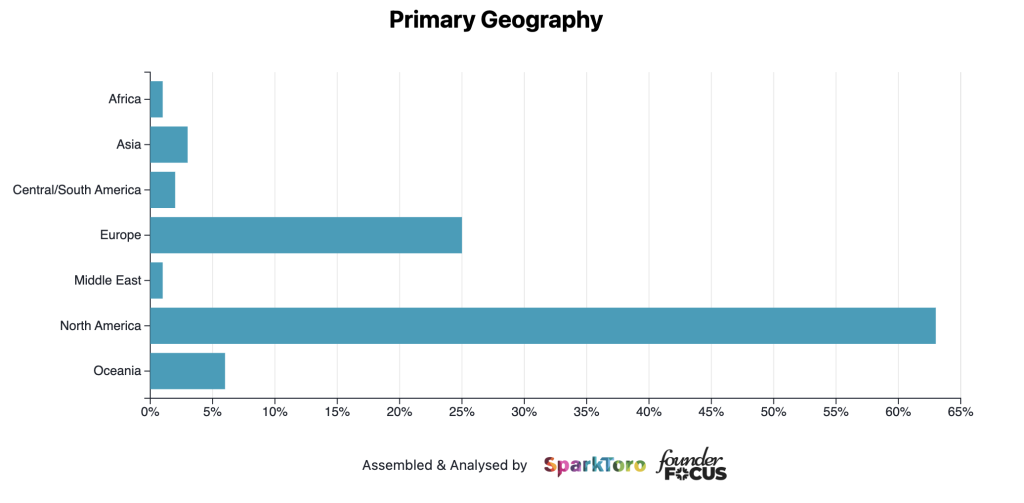

Location

We asked respondents to state where their agency was headquartered and where their clients were primarily based.

By far the biggest location where respondents are based was North America, with 63% stating that they served clients here. Next was Europe at 25%, followed by Oceania and Asia with 6% and 3% respectively. Central/South America came in at 2%, the Middle East and Africa were both just under 1%.

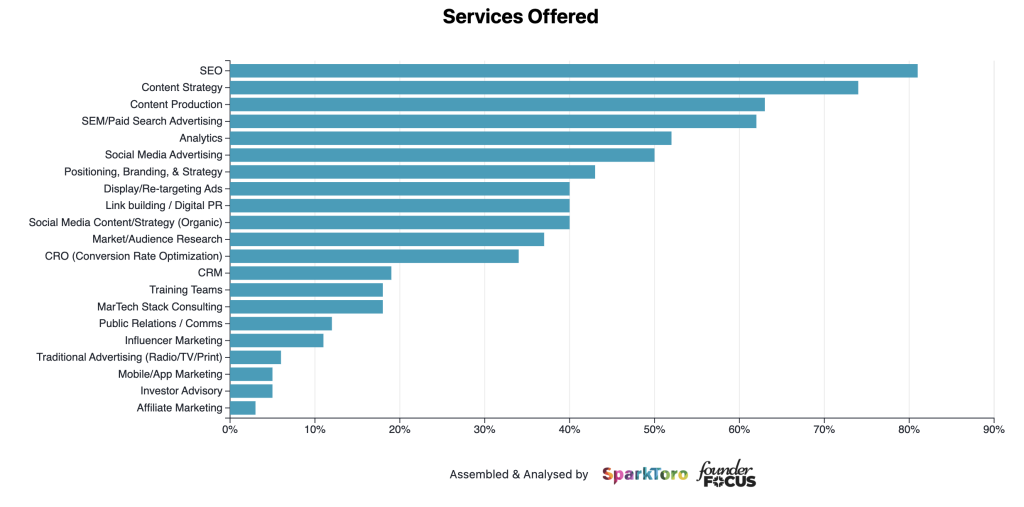

Services offered

We also asked respondents about their range of services. The options here were extensive and the responses were also very wide ranging, representing a big set of digital services. The most popular services were somewhat as we’d expected with SEO being the most popular at 81%. Next up was content strategy at 74% and SEM/Paid search being offered by 62% of respondents. Analytics and social media made up the top five most popular services and the rest were a varied mix.

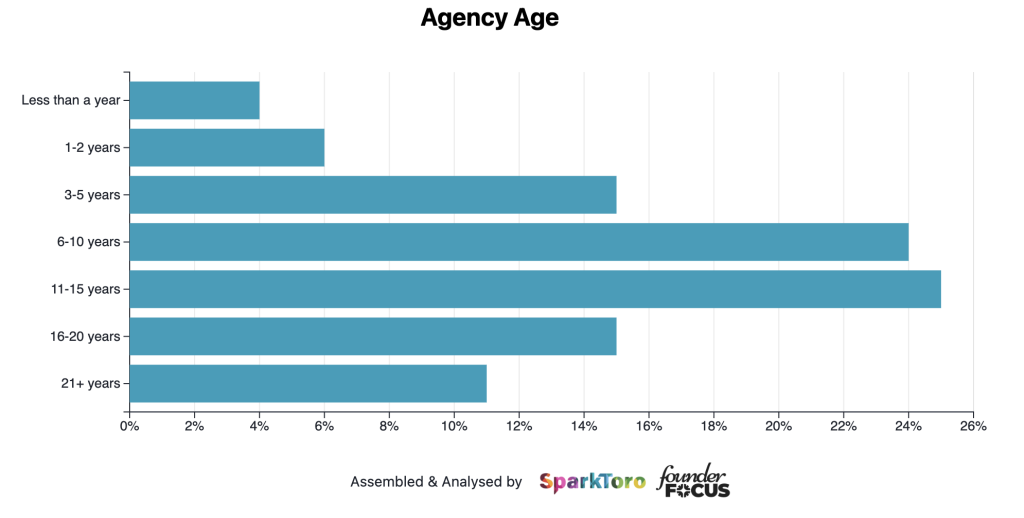

Agency age

Finally, we asked respondents about the age of their agency or consultancy. The biggest segment at 25% was agencies and consultancies aged 11-15 years old. This was followed by 6-10 years old with 24%. Around 10% of respondents reported that their agency or consultancy was less than two years old.

Coming Up Next…

Stay tuned for more data from this report in early January, 2026, when we’ll be publishing additional trend and opinion data from the hundreds of agency owners who completed this survey (including a few of Rand’s favorite takeaways from the dataset).