I like the marketing funnel. It’s a great analogy, and has served me well for years. I *STILL* think it works reasonably well as a way to describe how businesses experience the various points at which they engage/interact with users before they become customers. But, we cannot bury our heads in the sand and pretend it’s a reasonable way to describe real customer journeys.

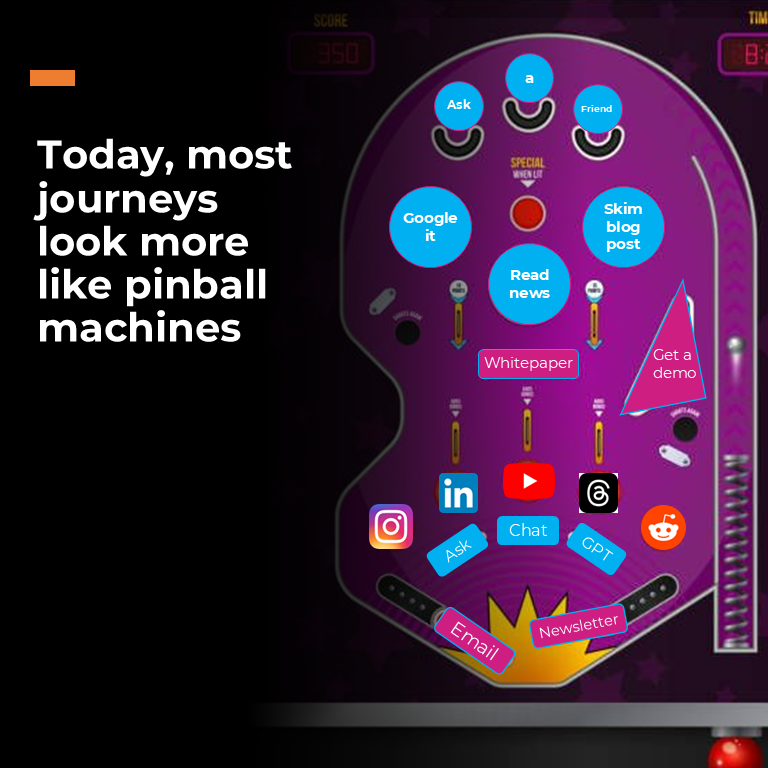

Today, people using the web and the real world to discover and solve problems don’t cleanly move as groups from a few channels at the top of the funnel to a few different channels in the middle to your website, a phone call, or storefront at the bottom. Nope. They look like… well, pinball machines.

The person might start their journey in a WhatsApp group conversation, a Substack newsletter, a browse of Instagram’s Discover page, a scroll through their personalized Google News feed, LinkedIn feed, Reddit feed, YouTube homepage, or a dozen others. Then they move to searching Google, asking ChatGPT, pinging friends, scouring Reddit, DM’ing experts they follow on LinkedIn or Threads. And even at the bottom of the funnel, they’re bouncing back to these same places prior to the final conversion event to double-check what your website or salesperson is telling them (sometimes in real time on their phone in the store checkout aisle).

That’s not a process any funnel-based analogy captures well.

It’s one that pinball machines nail perfectly. If you want to extend the analogy, imagine the size of those flippers at the bottom getting bigger the more effort you put into your product, brand, and messaging on various channels (or shrinking as you ignore them).

This week’s 5-Minute Whiteboard goes deeper on how modern customer journeys work using an example from the world of consumer banking choices. I think you’ll see your own behavior, and that of your peers, friends, kids, that dude on the subway you watched buy a giant golden rhino head for his living room — all of ’em — in this process.

Transcript:

I know you all are familiar with a marketing funnel, and it’s not entirely wrong. That’s not what I’m saying. But I do think the analogy doesn’t hold up like it used to. It used to be that at this top awareness stage, maybe people were searching, they were browsing, then they got to the interest stage and they were doing deeper research and visiting your website and asking questions. Then the consideration they’re comparing against competitors and then they have their evaluation and purchase process.

And today I think it works more like this. I think it’s a pinball machine. I think basically what happens is that people, first they’re like, hey, I’m thinking about this thing. I’m gonna ask a friend and then I’ll skim some blog posts and read some news and Google it and check out a white paper.

Maybe I’ll get a demo that, you know, if it’s enterprise whatever, that I’ll check out my Instagram and LinkedIn and YouTube and threads and Reddit. And I’ll ask chat GPT or other AI tools. And maybe I’ll subscribe to a newsletter or check out the newsletters I do subscribe to. Maybe the newsletter was the thing that tipped me off to in the first place.

And so this whole concept of a funnel is just busted. Let me show you show you what I mean.

Let’s say I’m looking for a new bank. Right? I’m I’m, moving to Philadelphia. Maybe I already live there.

And so I’m checking out checking out banks. And I’m like, okay, you know, I subscribed to this asset column, Substack and they’ve got a bunch of recommendations around things I should look for. FDIC insured, APY, tools, mobile checking deposit, sure of course, fraud protection. Alright, this is it’s a little basic but it gets me there.

So then since I did the sleep out personally in Philadelphia recently at the Citizens Bank Park, which is like where the Philadelphia Phillies baseball team plays. I’m gonna check them out. So I go and check out Citizens Bank interest rate. Right?

There’s another bounce. I’m like, okay, well, their private client money market has three percent and three point five percent. You know, I don’t know whether that’s good or not. I’m gonna ask around on Reddit or see what somebody else asked and there’s some recommendations in here.

And then you know what? Someone suggested Bankrate. I’ll go to Bankrate and I’ll bounce around and see what they offer. Wow.

Four percent. That sounds way higher. Maybe I should be checking those guys out. So then I’m gonna ask my buddy Will.

I was like, yo. Hey, Will. Oops. Hey, Will. Any Philly banks you recommend? I’m not actually gonna him that message.

And then I’m like, oh, you know, I should check if they actually have one in the neighborhood I’m moving to. So I’m gonna check near my, you know, zip code one nine one two two. Gosh, the ratings are super low. What are the reviews about?

The lines are long and the debit machines don’t work. Okay. This doesn’t tell me much about the APY. That’s kind of the thing that I care about.

So then I’m gonna go and check out Citizens Money Market accounts on their website, and then I’m gonna do you see what’s happening? Do you see what’s happening? Right? Like, I I am bouncing and bouncing and bouncing, and the process is wild.

The process is absolutely crazy. Understanding this this concept that human beings do not behave in the clean funnel sense that you want and that you can’t just choose a couple of channels. You you need to be in the places that your audience pays attention. Right?

And so, I mean, this is what SparkToro focuses on. So I look for, like, Philadelphia area, high rate bank deposit seekers. And then I’m like, okay, who are they and which platforms are they on? Funny enough, like, oh, yeah, Substack.

I guess that makes good sense because, hey, I I also started my journey with Substack. That was the thing that kinda nudged me there.

And so this this entire process makes me think of this meme, which was originally shared I think by Adam Singer, is like, oh, no. We need an econometrics model to evaluate which inputs contributed to which sales and this whole process. But you can’t measure this stuff. You’re never gonna measure an appearance on a podcast.

You’re never gonna be able to properly measure the value of, you know, Citizens Bank, having their branding on the Philadelphia Phillies stadium, right, which was the thing that inspired me to look them up. You gotta reach the right people in the right places with the right message. If your bank is trying to compete on locations and friendliness or tellers in short lines and debit machines, well then you should be worried about those Google Maps reviews I showed you. And if instead you’re like, no, I’m I’m targeting these high interest seekers, well then you should be in these places like Substack and potentially Twitter and probably on YouTube and in Reddit.

And you should make sure that in personal finance subreddit, which it suggests is a is a high affinity one that that you’re present in that place, and you should be pushing that same message over and over again, which is not, you know, whatever short lines and debit card machines, but is instead high, yield savings accounts, high yield money market accounts. And those messages in the places that your audience actually pays attention is the new way to do this old funnel methodology. Like, this this system has transformed into this system, this pinball methodology. And marketers, I think we have to catch up by putting the right message in the right place for the right audience.