Recently, Rand and I released the results of the State of Digital Agencies survey for 2025. Our goal of this annual survey is simple – get a temperate check on the digital agency world and give folks a benchmark for how they’re performing compared to their peers.

If you missed the launch post, you can catch up on it here:

Note that some of the charts and takeaways below may overlap with those in the post above. We’ve included them here for completeness and to include all results related to client services and operations in one place.

Below, we’re focusing on all of the results from the client services and operations section of the survey.

Generally, sentiment on this topic appears to be positive compared to 2024. Agencies are reporting that headcount has grown a little and that they plan to hire more folks over the next 12 months. Agencies are also reporting that they are generally working with clients for longer, which is a positive sign.

At the end of the post, you can also find information on the demographics of those who took the survey.

Let’s get into the data.

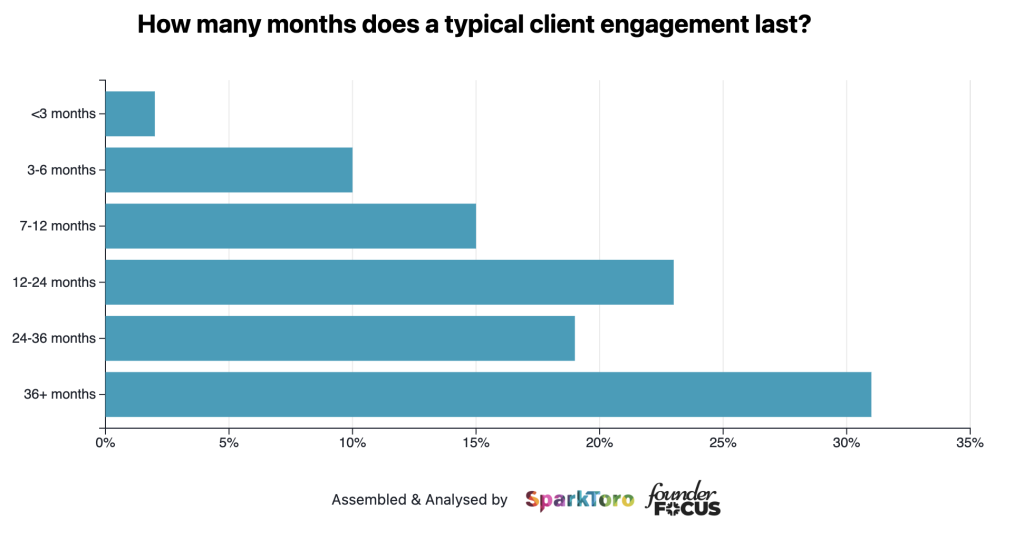

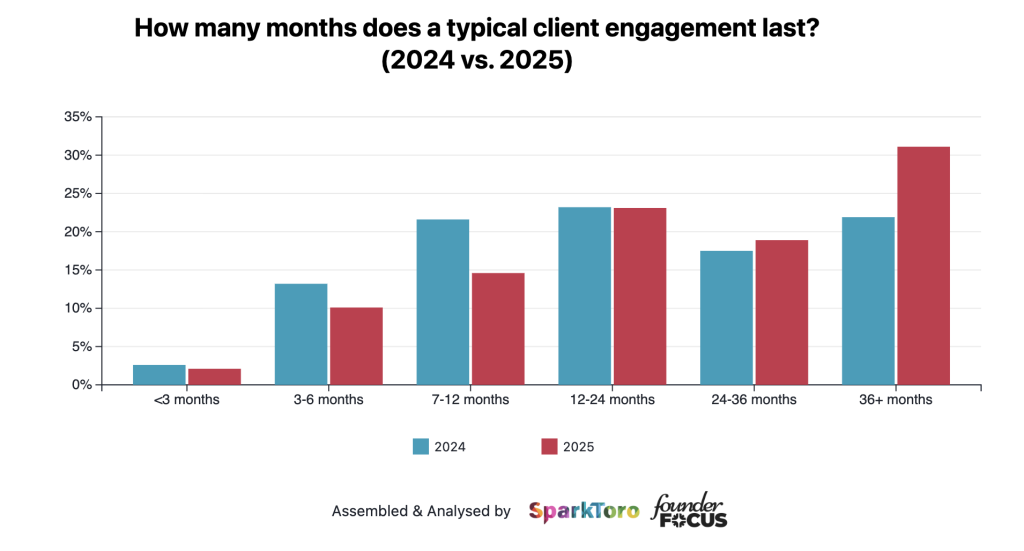

Agencies are retaining clients for longer and tend to work with clients for at least two years

We asked respondents how long they typically worked with clients, with around a third (31%) saying they worked with clients for over three years, whilst a fifth (19%) said that they worked with clients for between 2-3 years.

This appears to have improved compared with a year ago, with more agencies reporting that 36+ months is a typical client engagement length.

Generally this seems like a fairly healthy length of time that agencies are able to retain and work with their clients.

Having said that, a decent chunk (25%) will work with clients for less than 12 months.

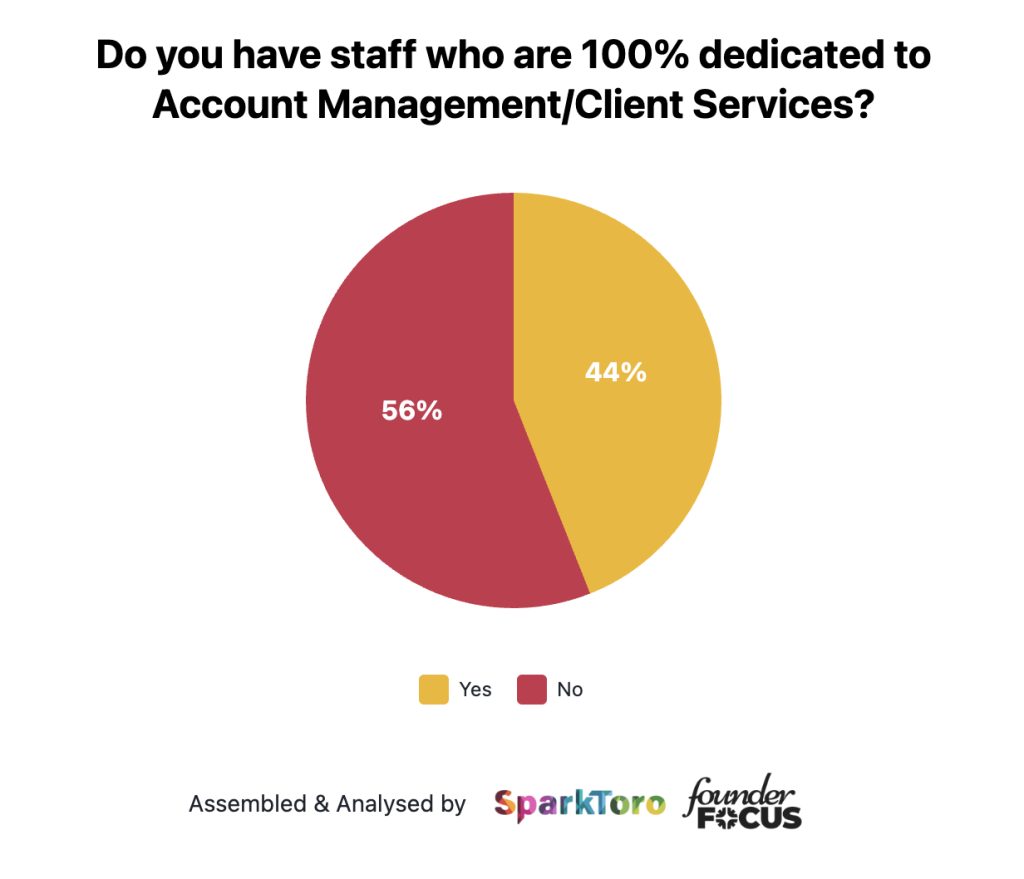

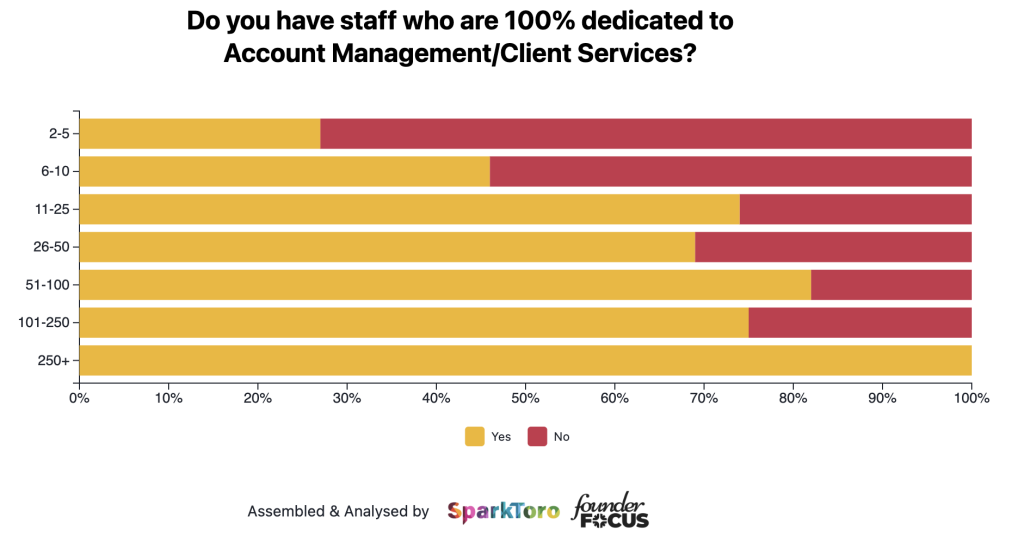

Dedicated account managers are most common at larger agencies

An ongoing question that many agency owners ask themselves is whether they should have dedicated account managers or not. The results were almost split down the middle, but tilted towards agencies not having account managers:

This does appear to change if we segment by agency size, with larger agencies leaning much more heavily towards needing account managers:

As we can see, agencies that are bigger than 50 people are consistently saying that they have dedicated account managers. This isn’t overly surprising given that as an agency grows, layers of management are often added. There is also more chance of larger agencies being multi-service, necessitating the need for someone to sit at the heart of these services and ensure effective delivery.

To time track or not to time track – that is the question

Another perennial question for agencies is whether to enforce time tracking / timesheets with their team. Some agencies proudly tell the world “we don’t track time” whilst others aim to record every minute of their team’s time.

But which approach is most used?

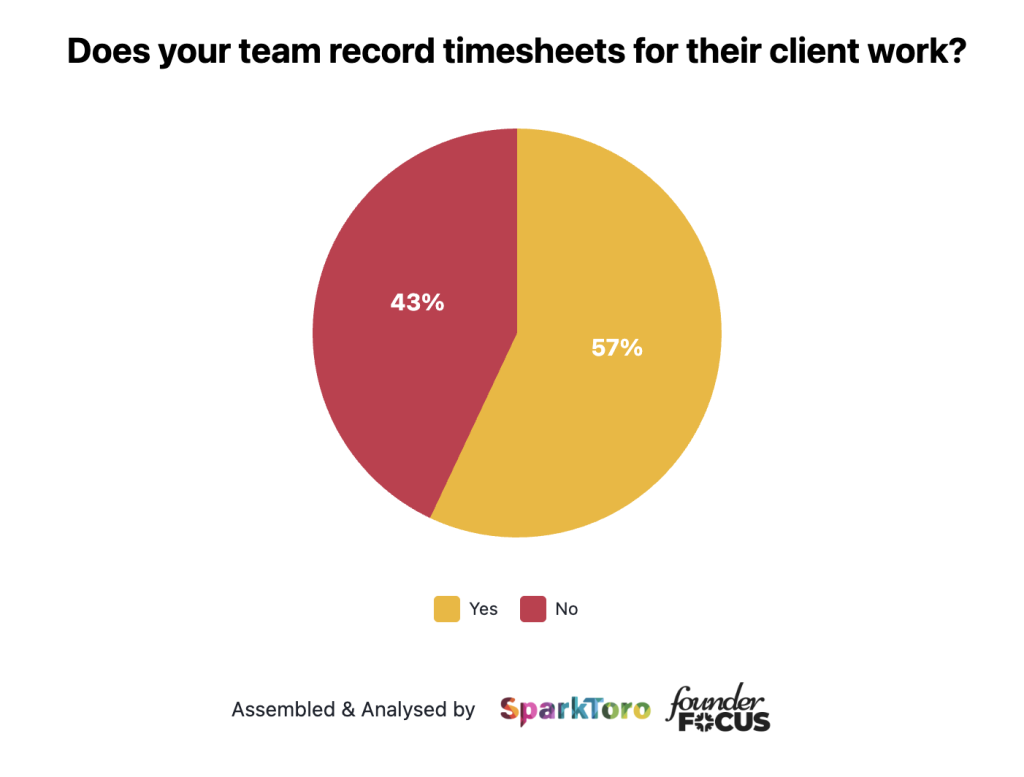

It turns out that once again, agencies are fairly evenly split:

There is a slight tilt toward using timesheets, with 57% saying that their team does indeed record them.

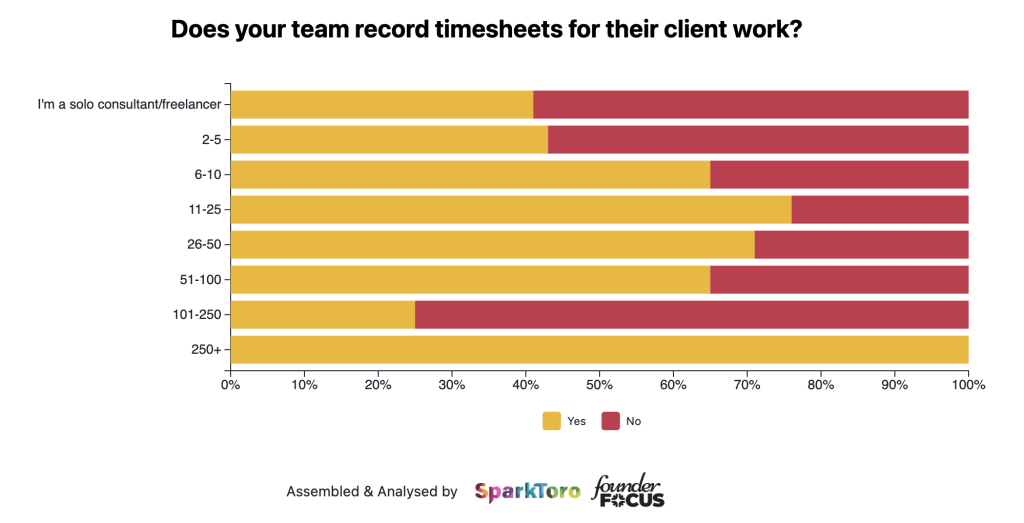

If we segment by agency size, we do see a slow, but clear trend that with team size increasing, the higher likelihood that timesheets will be used.

This is a fairly common trend, with smaller agencies not seeing the need for timesheets but as headcount increases, this attitude changes and the agency can take a more numbers driven approach to operations and capacity planning.

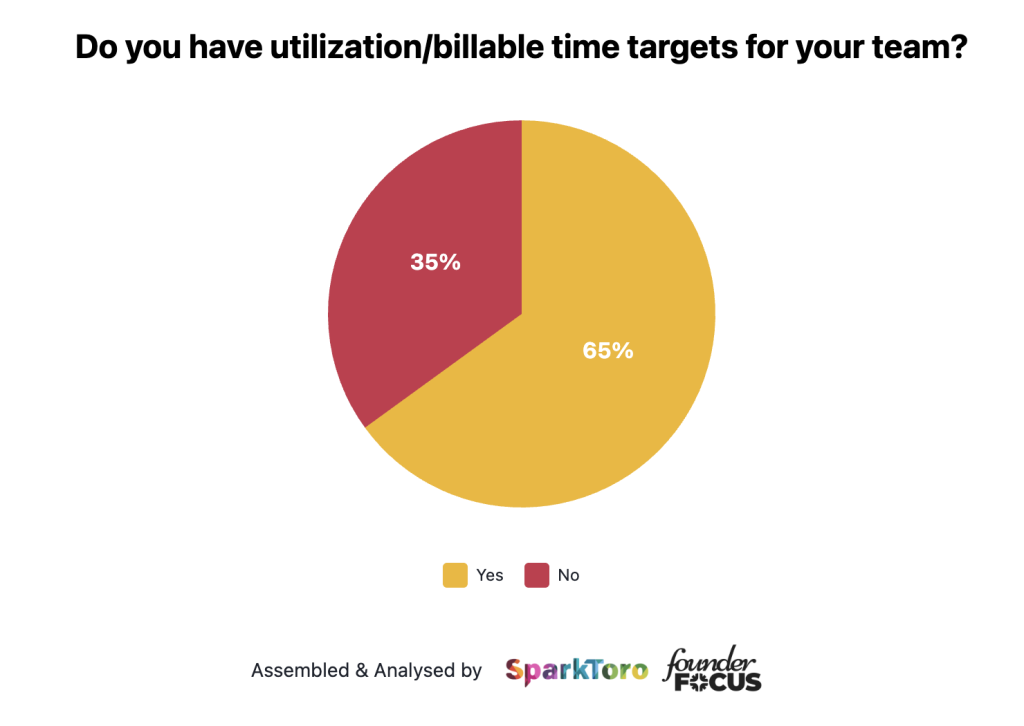

For those agencies that do use time sheets, the majority (65%) also set utilization targets for their team.

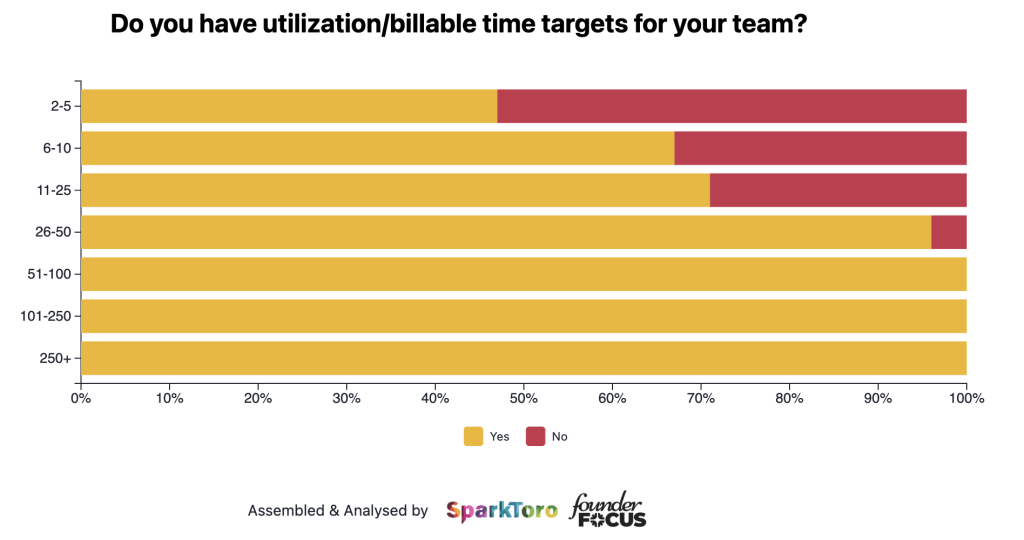

Once again, we see this trend become even stronger as agency size increases. The bigger the agency, the more likely it is that utilization targets will be set.

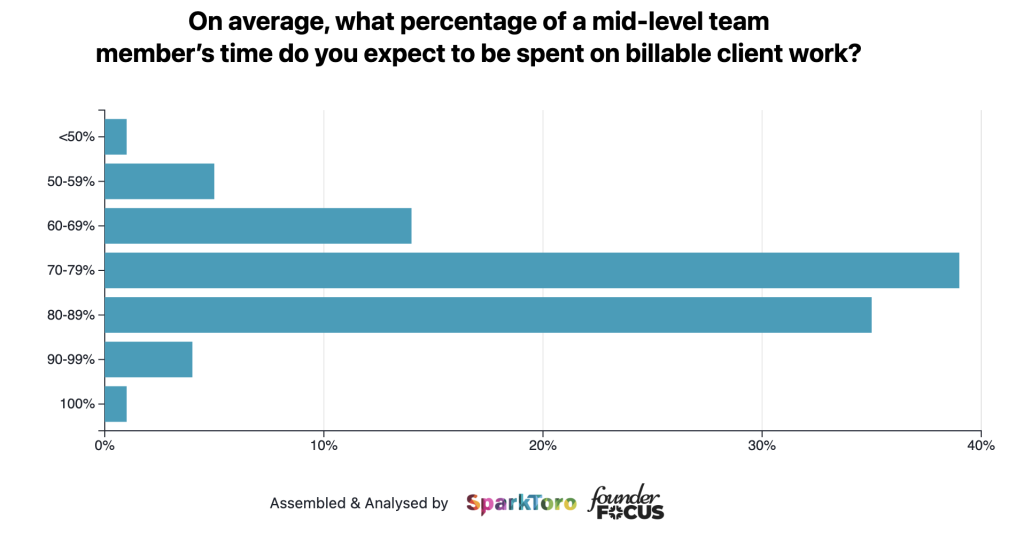

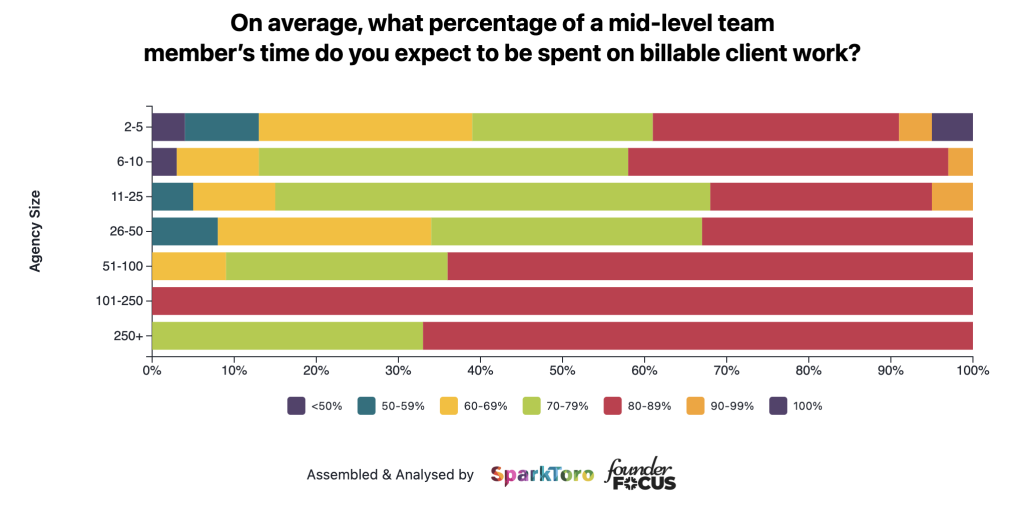

The next logical place to go from here is to look at exactly what those utilization targets are – so we asked.

The most popular utilization targets are 70-79% with 39% of agencies setting this as a target for a typical mid-level team member. This was followed by 35% of agencies setting a slightly higher target of 80-89% utilization of time.

Again, this did seem to correlate with the size of the agency, with utilization targets typically increasing alongside the number of people they employed.

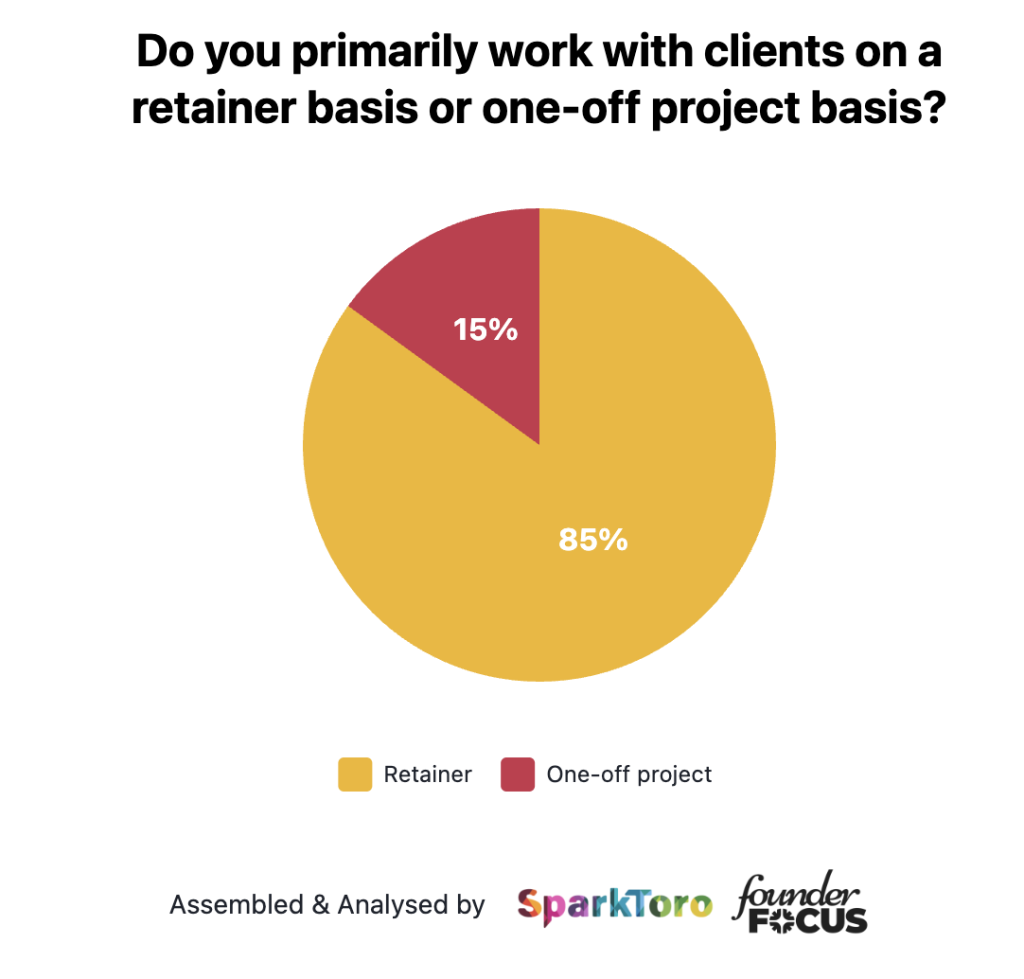

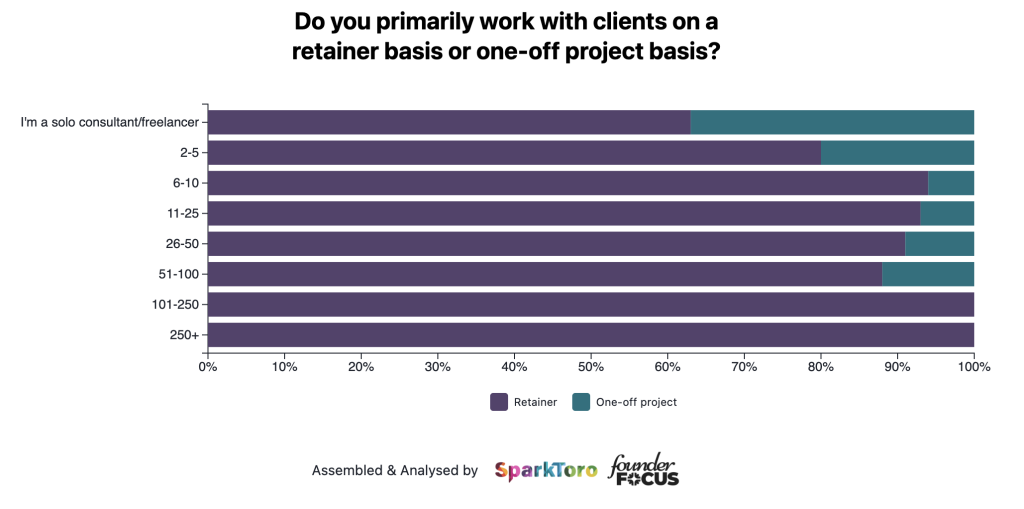

The vast majority of agencies prefer to work on a retainer model

Our survey confirmed what many of us would guess instinctively – 85% of agencies prefer to work with clients on a retainer basis.

Interestingly, this is a slight increase compared to 2024 where 81% of agencies said that they primarily work on a retainer basis – perhaps a sign that agencies are looking for more consistent, reliable revenue.

This is generally true amongst most agencies, regardless of size. However it is worth noting that solo consultants and freelancers are much more likely to work on a one-off project basis.

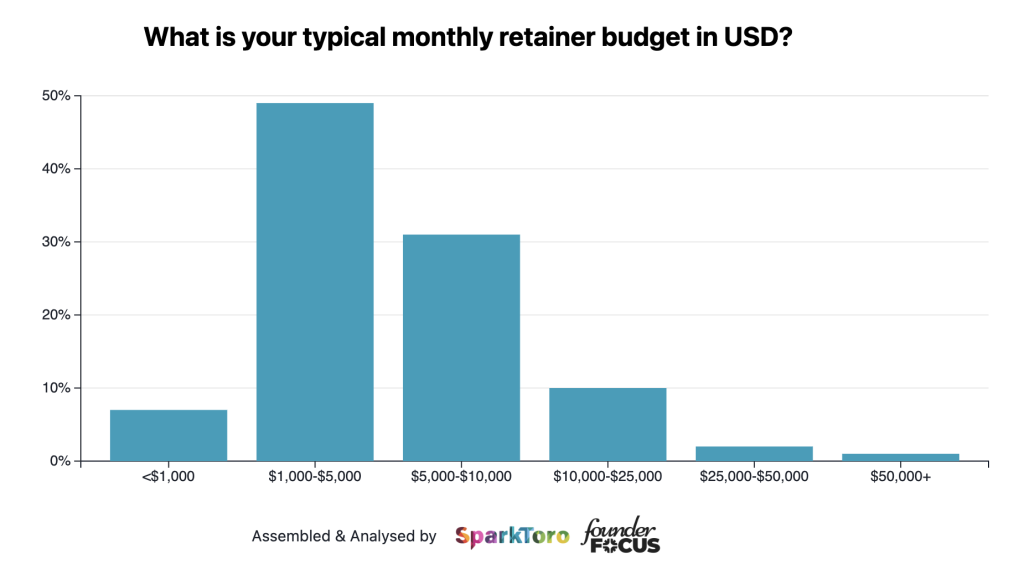

The vast majority of agency monthly retainer budgets are $10k or less

86% of agencies reported that their average monthly retainer is up to $10k. To break this down further, Nearly half (49%) said that their average monthly retainer is between $1,000-$5,000, whilst 31% report that it sits between $5,000-$10,000 per month.

The next biggest segment was $25,000-$50,000 per month where 10% of agencies said that this was their typical monthly retainer.

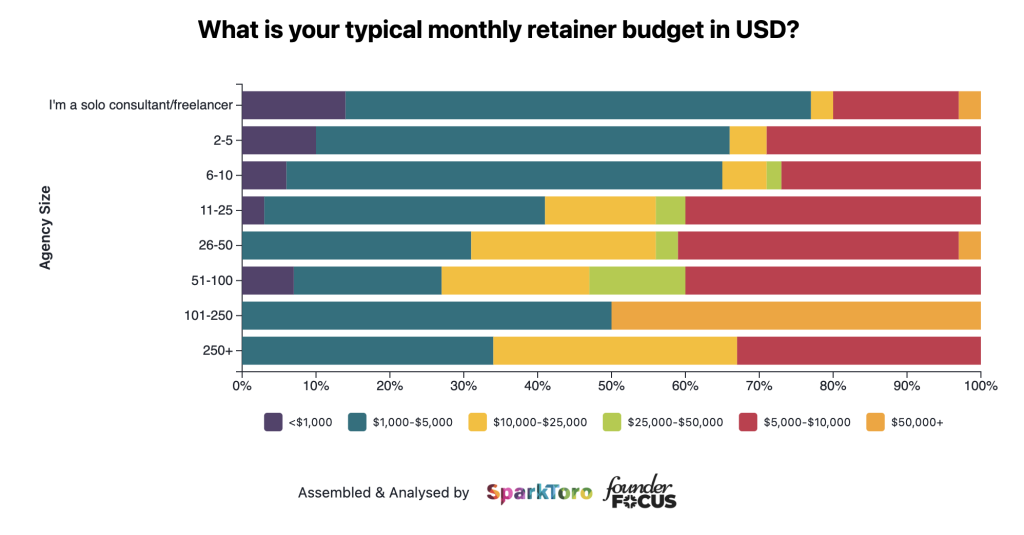

If we segment by agency size, we can see that typically, the $5,000-$10,000 per month budget range becomes more common as agencies grow towards 50 people.

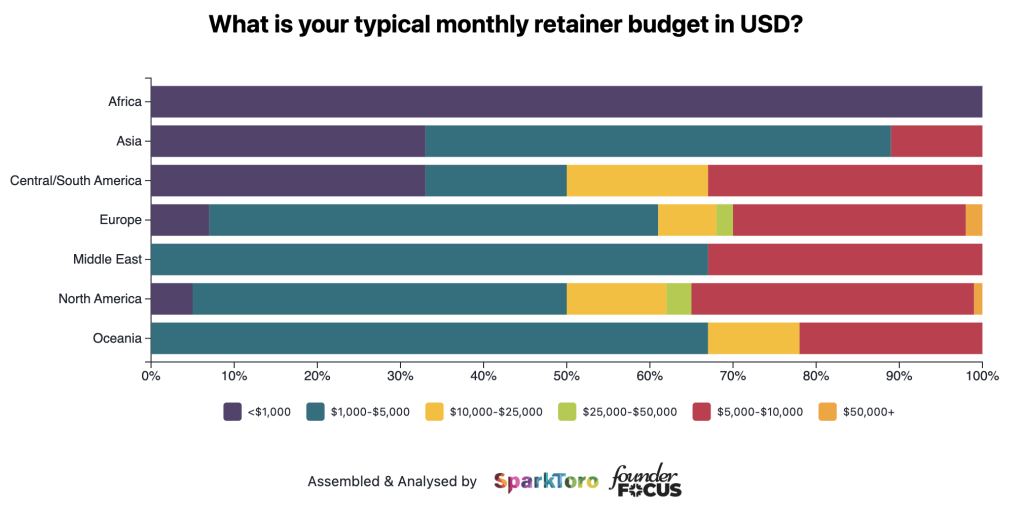

To further break the numbers down by location, typically the super large retainers of $25,000 per month upwards are only reported in North America and Europe. Whilst the majority of smaller retainers are reported by agencies who primarily work in Africa, Asia and Central/South America.

Over half of agencies charge between $1,000-$10,000 for one-off projects

In terms of agencies who typically work on a project basis, we can see that, similar to retainers, the budgets typically sit between $1,000-$10,000, with 54% of agencies sitting in this range.

It is worth remembering that according to our data above, only 15% of folks work on a project-basis.

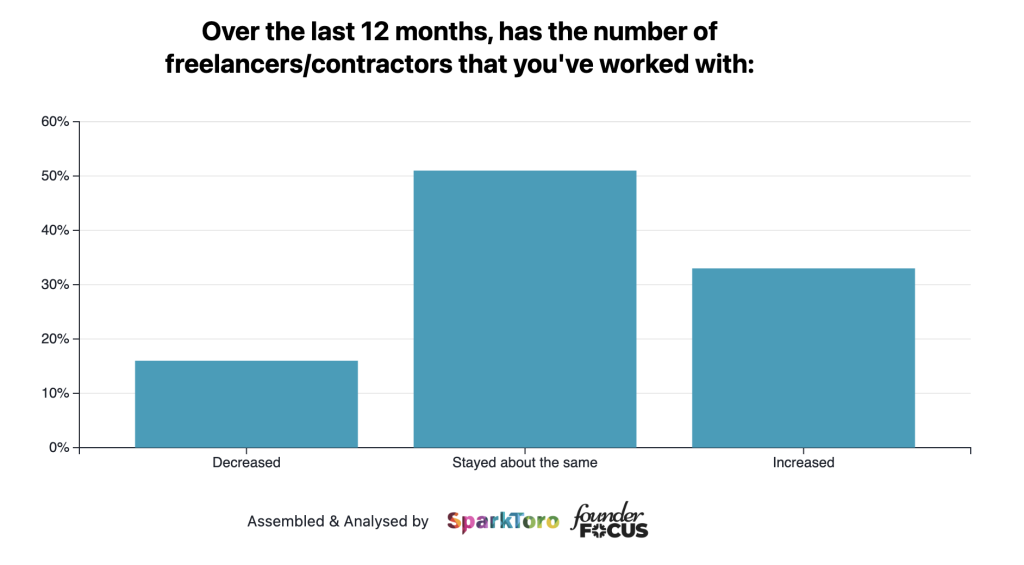

Agencies are working with freelancers more often than a year ago

Speaking of contractors and freelancers, a new question that we asked for 2025 was whether agencies have increased the number that they work with. With some uncertainty constantly surrounding agencies, we wanted to know if they’re choosing to offset some risk by working with freelancers more.

It turns out – yes, they are.

Whilst half said that the number of freelancers they work with has remained the same, nearly a third said they had actually increased how many they worked with.

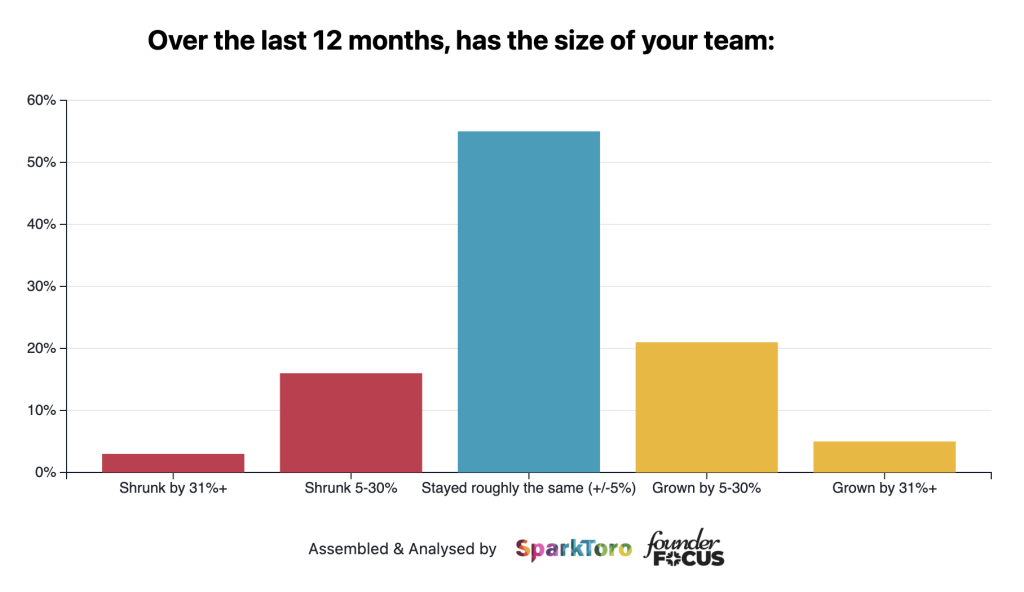

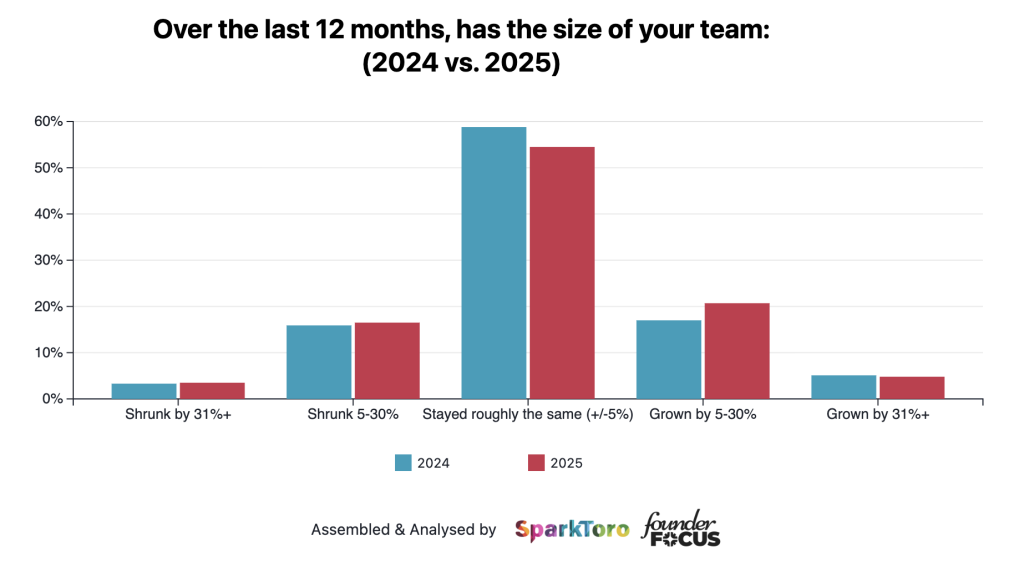

Over half of agencies said that the size of their team has remained the same as a year ago (but things are getting slowly better compared to 2024)

When it comes to headcount, 55% of agencies said that team headcount had stayed roughly the same.

21% said they’d grown by up to 30%, whilst 16% said they’d shrunk by up to 30%.

Only a small number reported sizable headcount changes overall.

This does appear to be another area where things have gotten slightly better for agencies compared to what they reported in 2024.

Last year, 22% of agencies reported that headcount had grown. Whilst this year, we saw a very slight increase with 26% saying that headcount had grown.

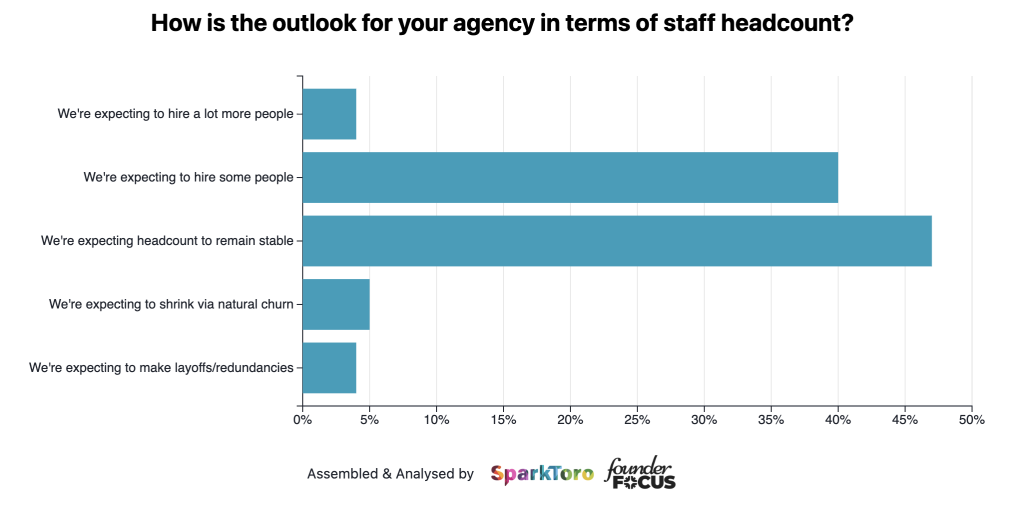

Very few agencies expect headcount to reduce over the next year

Thankfully, only a small proportion of respondents expect headcount to reduce over the next 12 months. Just 4% expect to do layoffs and 5% expect some natural churn that may lead to a smaller headcount overall.

On the more optimistic side, 40% expect to hire more people whereas nearly half (47%) expect headcount to remain stable again.

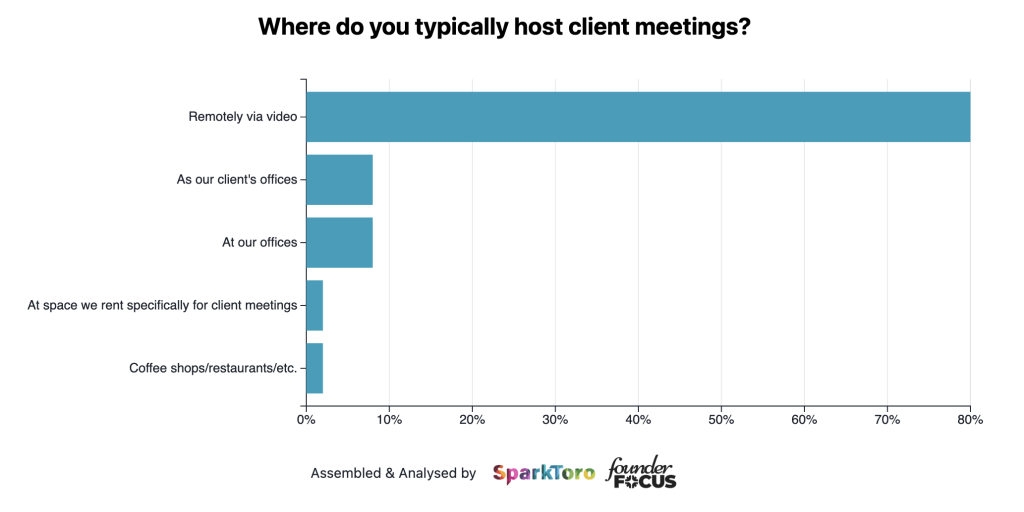

Even more client meetings are taking place over video calls compared to 2024

80% of agencies said that they run client meetings remotely via video call, a slight increase on the same question last year where 77% replied with the same answer.

Less than 10% said that they hosted meetings in person at their own offices, with a similar number hosting them at client offices.

This shouldn’t be too much of a surprise, it seems commonplace now for agencies to work with clients who they rarely meet in real life. Whilst a natural consequence of remote working, I do wonder how many agencies have leaned into this enough to ensure that relationships are as strong as they can be, despite potentially never meeting a client face to face.

Finally, some data on who took the survey.

Who took the survey?

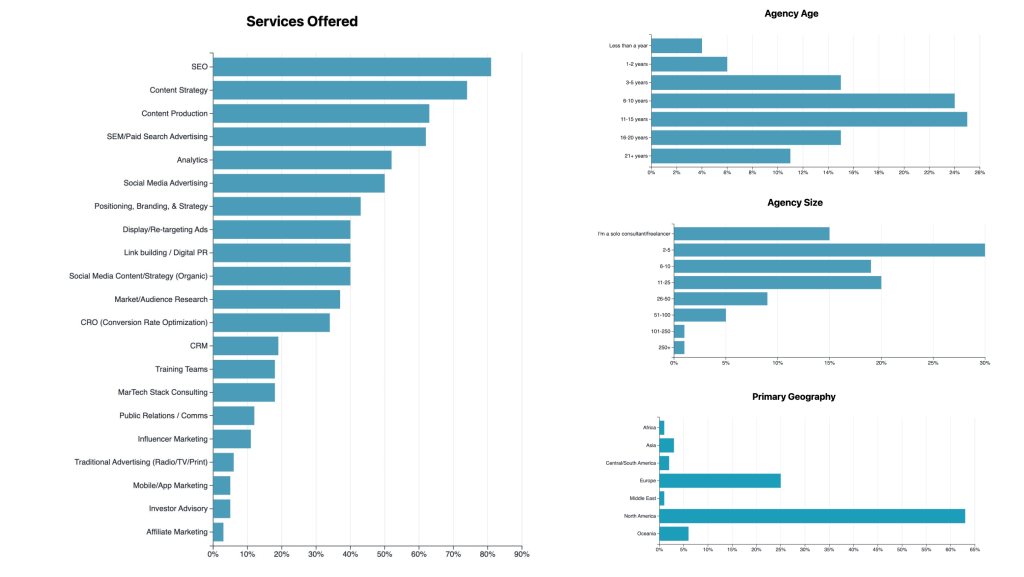

Here are some top line demographics of those who responded to this year’s survey.

The survey includes agencies from a wide range of sizes, geographies, and services offered, but there’s definitely concentration in small to medium sized (1-50 person agencies), North America and Europe, $100K-$5M revenue businesses, and SEO, SEM, Content, and Analytics. In the sections below, we’ll break out responses from specific slices of these groups to illustrate key differentiators and illuminate useful patterns.