For years, two questions have dominated both marketers’ interest and the media’s coverage of Google Search:

- Are AI Tools taking market share away from Google?

- Is Google search growing, flatlining, or declining?

I’ve seen wild speculation that Google’s market share is down 5-10% since ChatGPT’s launch, and heard anecdotes across my feeds from people claiming that they never use Google and have entirely switched to AI tools. But, there’s been no comprehensive, well-structured analysis to show the AI tools’ share of search, nor any data to back up the claims of Google’s supposed search decline.

Today, thanks to our partners at Datos (a Semrush company) and this latest research we’ve done together, I believe we can put these questions to rest.

In order, here’s how we’ll do it:

- Illuminate Google’s search true growth rate from 2023 to 2024

- Determine the size and composition of the AI tools challenging Google in search

- Uncover the metrics necessary to make a solid comparison between Google and their leading competitor(s)

- Directly compare searches on Google vs. the leading AI Tool(s)

Google Search’s Growth Rate

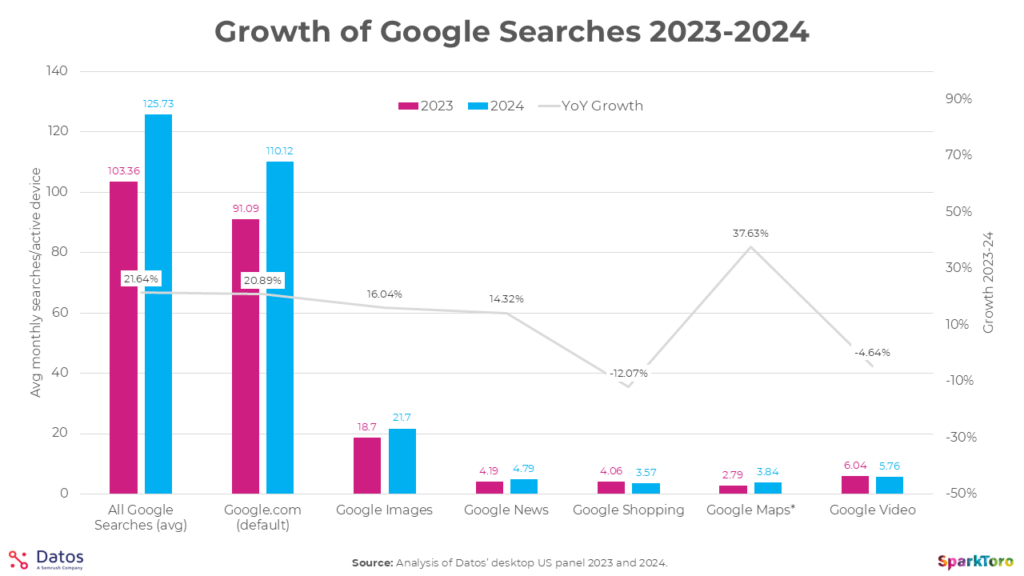

Using the same methodology we covered in last week’s research (Datos’ US panel of active desktop devices that visited Google at least once in a month in 2023 vs. 2024), we compared the average number of searches per searcher between the two years for all of Google (the first set of columns) and for each of the major, individual verticals (Images, News, Shopping, etc.).

In a single year and for a mature product 21.64% growth in searches across Google is remarkable. It also fits with what their CEO said publicly about the introduction of AI Overviews in 2024:

“Based on our testing, we are encouraged that we are seeing an increase in search usage among people who use the new AI overviews as well as increased user satisfaction with the results.”

Sure as heck looks like it did! So much for the fear that AI answers in Google would reduce the number of searches people performed; in fact the exact opposite appears to be true. Unfortunately, AI answers do seem to kill clickthrough rates: Seer Interactive’s study showed that organic results suffered a 70% drop in CTR and paid dropped 12%. Another study from AWR shows a similarly precipitous drop.

Who Are the Major AI Tool Challengers?

Most everyone has heard of ChatGPT, but Datos released research in January identifying the other major AI tool vendors of 2024: Perplexity, Claude, Copilot, and Gemini. The usage of these AI tools is graphed over time below:

My two big takeaways:

- It’s particularly impressive that Google’s Gemini is now in second place after a late start in the AI tools space

- If we want to compare the volume of searches against Google, we need only consider ChatGPT.

The others are so small (and Gemini is part of Google) that their numbers on any visualization would appear as insignificant slivers, so far. Perhaps as the space evolves, if one or several grow many times their current sizes, it will make sense to include them.

That settled, let’s look at searches on Google vs. ChatGPT.

What Metrics Do We Need to Directly Compare Google vs. ChatGPT in Search?

To make a fair comparison, we need to know:

- A) How many searches are run in Google each day/month/year

- B) How many prompts are entered into ChatGPT each day/month/year

- C) What percent of ChatGPT’s prompts have search-like behavior (and are comparable to what we think of as a traditional search in a search engine)

The first one (A) was answered last week by two independent sources. Google themselves released a public statement that they saw “more than 5 trillion searches in 2024.” SparkToro and Datos’ research confirmed this estimate by looking at Datos’ panel and calculating the average number of searches per active panelist and % of panelists visiting Google.

The next (B) was answered in December by OpenAI’s Sam Altman at the Dealbook conference, where he announced the AI tool received “1 billion messages per day.” Unfortunately, messages aren’t the same as prompts, and unlike a search in Google or Bing, a user may go back and forth many times with conversational AI before landing on an answer. But, don’t worry, we’ve got a solution.

Thanks to Semrush’s 2024 research into ChatGPT, we know how many messages the average prompt session entails:

“According to Semrush analysis, the median number of messages in a ChatGPT conversation is three, meaning that more than half (59%) of users had conversations involving three messages or less. However, when looking at the average number of messages in a conversation, this number increased to eight—indicating the presence of longer interactions, especially in cases where users ask for further clarification or examples about the same topic.“

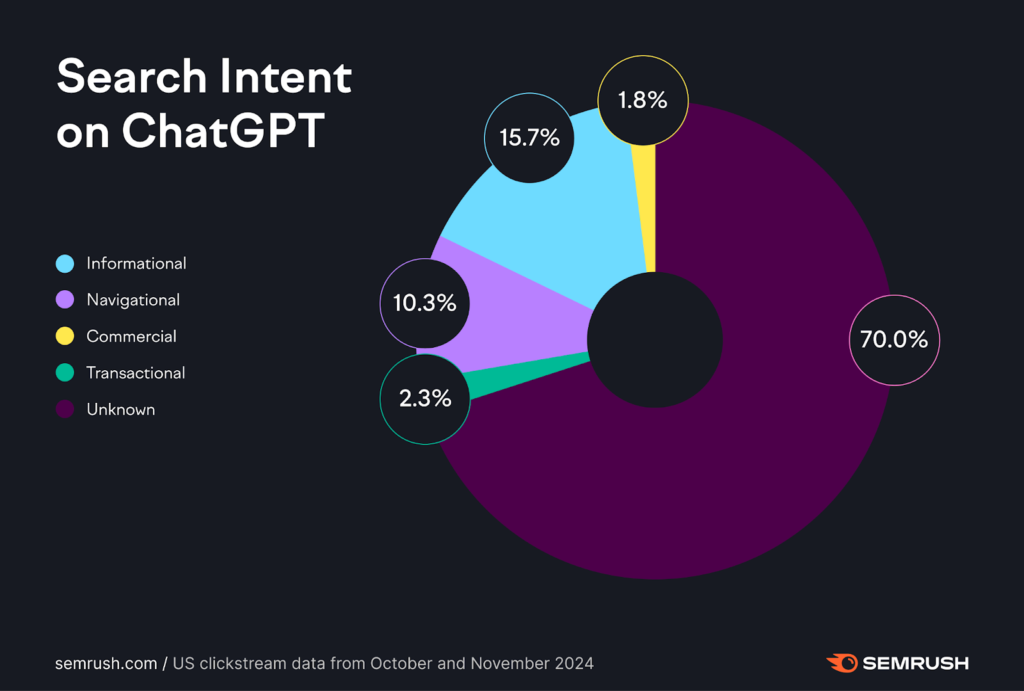

The last (C) is harder to answer, but thanks to recent research from SEMRush’s analysis of 80 million clickstream prompts, we know that 70% of prompts are for non-search-like functions: creating images, summarizing text, writing code, doing math homework that Timmy really should have done himself, etc.

The ChatGPT prompts we care about are those that overlap with how people use search engines: to get information, to navigate somewhere, to compare options/assist in a buying or selection process, or to specifically transact. That makes up 30% of ChatGPT’s use. The 70% isn’t truly “unknown,” in fact, we’ve got research showing exactly what folks are doing with ChatGPT here (and Semrush’s analysis included more details on that, too).

This is the last piece we need in order to build an equation that can directly compare searches in ChatGPT to those in Google:

Of course, this math is even simpler with Google:

Rarely do we get so clear and clean a set of numbers from multiple independent sources, and rarely do I feel as confident giving a definitive comparison. In 2024:

- Google had more than 14 billion searches/day

- ChatGPT had (at the very most) 37.5M searches/day

In 2024 Google received ~373 times as many searches as ChatGPT. The AI tool’s search volume is on a scale similar to Pinterest (~20M/day) and ~one third the size of the ~108M searches/day on DuckDuckGo, though ChatGPT is growing at a faster rate.

These numbers let us build some high veracity market share comparison charts:

And for those who still love pie charts:

Let’s show the math on all of these numbers so there’s no confusion:

- Google – numbers are both public record from the company (SearchEngineLand) and confirmed by our research with Datos released the same day.

- Bing – I used Statcounter’s global search engine market share numbers, which put Bing at 3.95% (this included Yandex, Baidu, and other search engines which I didn’t include in the market share pie chart above, hence the discrepancy), to calculate their 613.5M searches/day (vs. Google’s 14B). There are a number of poorly cited websites claiming the number is 900M/day, but I could find no original, high-quality reference to this figure, and thus discarded it.

- Yahoo! – Same as above.

- ChatGPT – We’ve used their CEO’s public statement from December of “1 billion messages per day” and then applied the average conversation length (8 messages) and percent of ChatGPT conversations that have search-like intent (30%).

- DuckDuckGo – Searches reached a high of 106M/day in 2022, before DDG took down their public traffic page. But, we can use Statcounter’s market share again to estimate: at ~0.7% global market share (considerably lower than their ~2% US share), they’d be ~108M searches/day.

I don’t want to come across as a denier of the power of AI tools, nor a skeptic of their ability to cross the chasm and reach a much larger search audience in the years ahead. But, I’m also a marketer who cares about putting effort into being present where people actually pay attention, regardless of any media hype cycles. Numbers like these may not be 100% precise, but they match public statements, are (in most cases) verifiable through multiple data sources, and show the clearest picture to date of traditional search market share captured by ChatGPT and Google.

Even if one were to assume 100% of ChatGPT’s 125 million prompts/day overlapped with the types of queries people perform on Google, the market share number is still <1%. Combined with every prompt on Perplexity, Claude, Copilot, and Gemini (assuming the ~8 messages/prompt avg is similar), the combination of all AI tools would remain <2% of the search market.

If you’re encouraging your marketing team or agency to get you into the AI tools as a way to future-proof your efforts (and because you know it overlaps with doing good PR work that likely influences many more of the right people), don’t let these numbers sway you. But if you’re recklessly investing in AI tool visibility because of media hype, you might use this report as an opportunity to reconsider whether your budget and effort matches where your customers pay attention.

P.S. Don’t forget that what really matters isn’t where everyone goes, but where your audience goes, something SparkToro’s new Search & AI Tools feature might be a perfect match to answer 😉

The data displayed in this report has been provided by Datos, A Semrush Company. The analysis is based on Datos’s US panel, representing a diverse and statistically significant sample of users, and covers the time frame of (01/23-01/25). For further information please visit Datos’s website and its Privacy Policy.