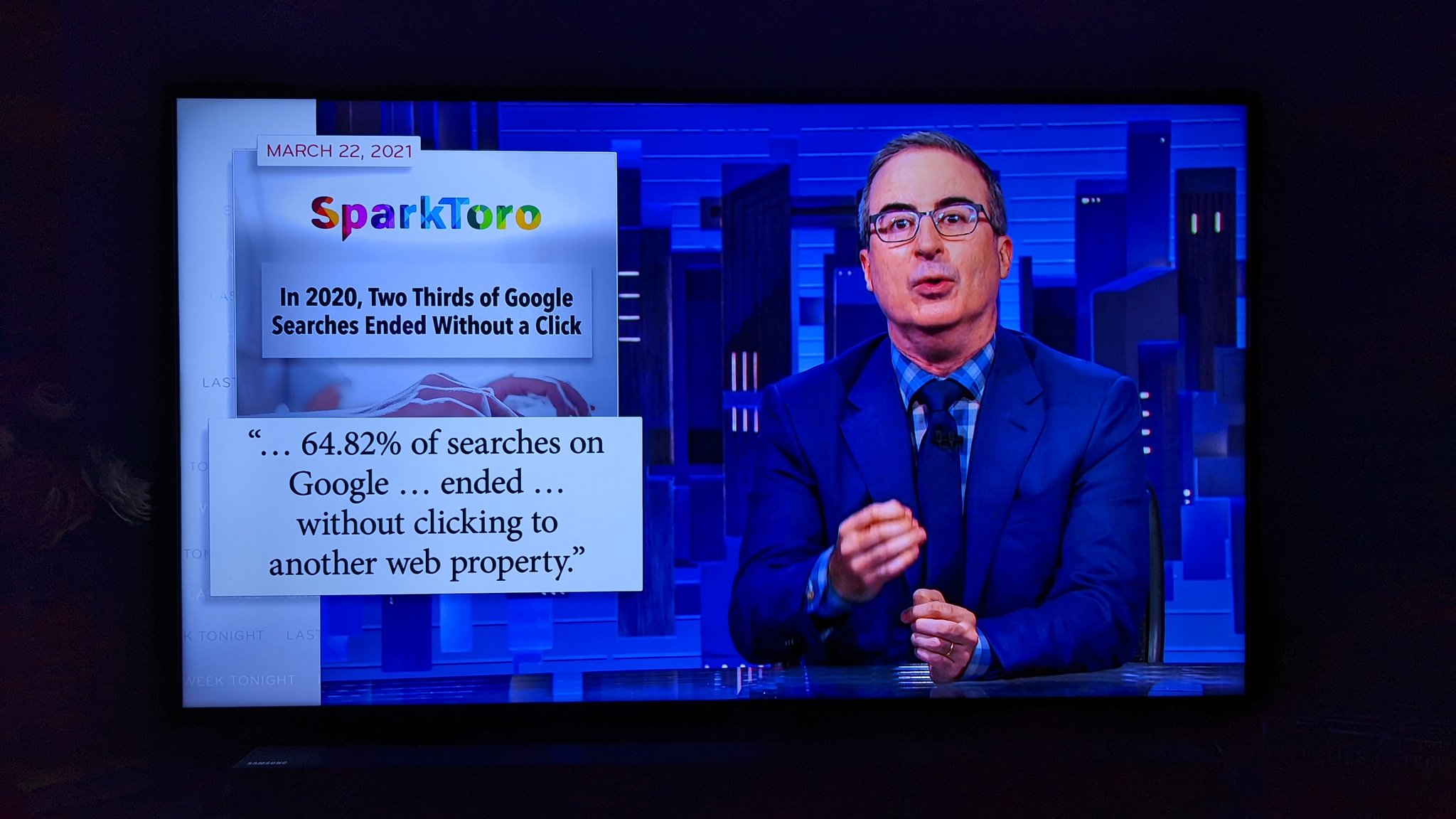

The SparkToro team got an exciting surprise on Sunday evening: a mention of our research on Last Week Tonight by John Oliver. The full episode, Big Tech Monopolies, is available on YouTube. It covers an issue I’ve railed against before, but with a heightened sense of urgency: there is actually a bipartisan bill in Congress that might fix this.

Thankfully, the comedian didn’t make fun of our name, for which we’re eternally grateful

Like any congressional bill, it’s not perfect. Critics can quibble with details. But, in all honesty, I haven’t seen a critique of this legislation that overcomes its strengths. This is as good a law as congress has produced in the last couple decades. It’s also exactly what government should be doing—stopping monopolies who would pervert fairness and inhibit innovation from doing it quite as easily.

What’s weird to me is how transformative this bill is compared to how little marketers have talked about it. The marketing sources I follow have barely covered the legislative process or the bill’s content. I would surmise that most marketers (nevermind entrepreneurs) have little to no knowledge of just how much this might re-invigorate competition and opportunity in Google’s search results, Amazon’s marketplace, or Apple app store.

If you’re feeling behind the curve, Axios has a simple breakdown, and the full text is online: American Choice and Innovation Online Act (for once, a Congressional bill whose name isn’t a direct contradiction of what it does!; I expected the usual No-More-Clubbing of Baby Seals Act, leading to a 5,000% increase in clubbed baby seals).

Above: excerpt from Axios

Full disclosure: the industry team behind this bill (including support from folks from DuckDuckGo, MoveOn, Repair.org, Brave browser, Automattic/Wordpress, the Electronic Frontier Foundation, Fight for the Future, and dozens more) reached out last year and asked if we would be co-signers to support the bill, and we agreed. I was also invited to share recorded testimony in one of the meetings, offering my experiences as someone who’s seen the harm Google’s monopoly (in particular) can do.

I think I owe it to my fellow marketers and readers of this blog to explain why I believe this bill fits with SparkToro’s values and why I think anyone not planning to spend their professional life as a Google, Amazon, or Apple executive should support it. At the end, we’ll dive into the potential implications for marketers.

Let’s start with the story of Hipmunk, a now-defunct travel search engine that took the agony out of finding the right flight. It let you balance features like trip length, price, seating, upgrade availability, mileage plan benefits, all that. Basically, if you were designing a dream-come-true flight search system as a consumer, Hipmunk would be it.

What happened? Google Flights. (Cue ominous music and a few Wilhelm screams.)

Normally, the idea of Google trying to defend this featured widget as “ranked organically by the same algorithm that ranks all the other results” should be hilarious in a Mr. Snrub sort of way. But the problem is that they’ve successfully used this defense for decades to unfairly benefit from monopoly power in search.

- Should YouTube dominate 95% of all video results in Google?

- Should Google Maps be at the top of every single local search?

- Should Google Finance always be at the top of every stock lookup?

- How about Google’s movie/TV widget outranking every other result in that sector?

- Or Google’s Color Picker, Speed Test, Dictionary Definitions, or Animal Sounds widget at the top of 100% of their respective searches?

Here’s the shitty truth: In some of these cases, Google’s widget/property is, today, the arguably *best* result. The dictionary results suck, and their speed test might not be as full-featured or accurate as SpeedTest’s, but the animal sounds feature is pretty good, and Google Flights (despite it’s monopolistic abuse) is, too. We all satisfice with these good-enough results because we’ve been trained to want fast results > the best results, and the familiarity of Google’s UI > the unfamiliarity of some potentially-overrun-with-ads website (nevermind the irony that Google’s ad products are often to blame).

This isn’t new. Google’s been doing it for literally 20 years.

If you don’t believe me, maybe you’ll believe Google employee and Search Liason, Danny Sullivan, who wrote about this problem as it related to Google+ (the search giant’s troubled attempt at a social network) before Google convinced him to shut up about it:

2012 Danny understood a crucial reality that 2022 Danny has been well-paid to forget: when Google unfairly favors its own properties in search results, it drowns out not just competition, but any incentive for innovation.

Side note: it’s a cosmic eyerolling joke that Danny used YouTube as an example of what Google couldn’t dominate all video results with, given that a few years later, they did exactly that.

Imagine you’re a venture capitalist, sitting in your calf hide leather chair, sipping on the delicate blood of fired startup employees whose unexercised shares bought your second mansion, deciding whether to invest in the latest pitch. The founder has an amazing new marketplace that matches parents with childcare facilities, a multi-billion dollar industry that almost no one in tech has touched (probably in no small part because the young, coastal, white dudes you allow to come in for pitches don’t think much about childcare). But there in the back of your skull is a troubling feeling. It can’t be your conscience. (You sold that years ago to pay for your vacation island.)

“What’s to prevent Google from building their own childcare marketplace widget?” you ask.

“Uh… Google?”

“Yes, Google. If you get traction, Google will see that in their data, and pre-emptively build a clone that removes any market opportunity?”

“But that’s not their business.”

“Neither was flights, or hotels, or stock charts, or mortgage calculators, or song lyrics, or checking people’s download speeds, or hosting video, but look how those sectors turned out.”

“Oh… I see.”

“Yeah, you should give up. Please help yourself to some proletariat blood on the way out.”

As an investor, and a founder who talks to many other founders, I can promise you that perturbingly similar discussions take place in the startup investment world every day. Investors are scared to back businesses in sectors Google might choose to enter, those that rely on search traffic for discovery, or those that are easily replicated by someone who already dominates 92% of worldwide web search. Hell, entrepreneurs themselves are scared to start businesses in those fields, knowing that Google could one day come in and make them disappear. (Insert image of a chipmunk smoking and whispering, “Hipmunk? I haven’t heard that name in a long time.”)

That’s the point John Oliver eloquently made in his critique, and extended to Apple’s dominance in the App Store (over app developers) and Amazon’s in e-commerce (over would-be sellers). Monopoly power is problematic, but by itself, doesn’t stifle innovation or prevent competition. It’s when those monopolies extend their power into other sectors, using their dominance in one field to block anyone from entering another, that capitalism turns from an engine of opportunity to an engine that stifles the free market, destroying all of capitalism’s promises.

Today, would you even think of starting Hipmunk? Or Yelp? TripAdvisor? Expedia? Bankrate? Speedtest? Vimeo? Genius.com? Merriam-Webster?

Almost no one does. The rare attempts (say, the search engine Yep or the browser, Brave) are often backed by other motivations, nontraditional entities, and noble intentions > market incentives. That’s not to cast aspersions against any of them; I admire these folks even more for their tenacity.

But there are vanishingly few of these outliers. They’re all Davids against one huge Goliath. And the last 20 years haven’t gone well for the little guys.

The web deserves more competition. It deserves more innovation. It deserves to have lawsuits and legal actions taken against the most powerful companies in the world when they block the highways they’ve overtaken from delivering anyone else’s products and ideas.

That’s where the Klobuchar/Grassley bill comes in. It says (basically):

- Google cannot favor its own products and properties above results from third parties

- Apple cannot force app developers to use its payment systems only (and take an oppressive share of the profits)

- Amazon cannot favor its own products above/over results from sellers on the platform

- Future Googles, Amazons, Apples, and their ilk better be similarly cautious about building a marketplace monopoly, then favoring their own products over others.

No matter whether you’re in B2C, B2B, D2C, or any other field, you’re almost certainly losing out to these tech giants. Google is putting their widgets, content, and properties above yours. They’re removing your ability to get video snippets or maps listings or marketplaces ranked above theirs. For every one business they acquire and give favored placement to, a hundred no longer get even a chance at visibility.

Google favoring their own lyrics over anyone else’s (even though they probably stole ’em)

Amazon is, similarly, pitting their products against yours. They’re learning which of your products have the highest margins and the most demand, then they’re making their own (usually cheaper and worse) versions, and placing them above yours in Amazon’s marketplace. Worse, they’re labeling them like they’re more trusted and authentic by using the Amazon’s Choice labels (which is often code for “the most profitable product for Amazon;” they’ve got 45+ wholly-owned lines!).

ProPublica authored some exceptional research showing the extent to which Amazon features their own product lines over other sellers, but, as The Atlantic reported a couple years ago, these charges are very tough to prove.

Unlike Google, it’s not blindingly obvious when Amazon is unfairly biasing based on these inputs, and obviously they claim not to be doing it at all. The NYT noted that grocery stores have done this forever, and to Amazon and their defenders (and honestly, whoever those people defending Amazon are: stop it. Support indie creators, buy local, and eat the rich.), it feels unfair. This brings up a point that detractors of anti-trust enforcement regularly employ: “why are these companies getting singled out?!”

The answer is market power.

When a single company controls a massive share of a market (40-80%+ depending on the field), they exert monopoly power in that sector of the economy. This isn’t, in itself, in violation of antitrust law. It’s not illegal to be a monopoly. Natural monopolies do exist and in some situations, they’re not even particularly problematic (WordPress, for example, has a near monopoly in blog CMS with 96% of the market). The antitrust-violation exists when these monopolies use their power in one sector to unfairly compete in another.

Say you created a new blog CMS, launched it, and WordPress used their historically cozy relationship with Google to prevent the search engine from showing your website in their results. You’d cry tortious interference (well, at least you would if you were an unusually legal-savvy founder).

How about if WordPress prevented you from creating a WordPress plugin? Or prevented that plugin from showing up well in their plugin directory? It’s their website, right? Shouldn’t they get to decide who gets listed?

This argument is regularly trotted out by defenders of big tech monopolies. And it’s a fine defense in competitive markets. T-Mobile doesn’t have to promote or even list Verizon’s phone plans. Kroger has no obligation to put Lucky Charms cereal at eye-level while their chalky, imitation brand Leprechaun Curses sits on the hurts-your-knees-to-bend-down shelf.

That’s because those markets have healthy competition! There’s no singularly dominant entity in mobile phone providers or grocery purveyors. If there were… things would be different. If Amazon’s Whole Foods suddenly had 70% of the grocery market share, and chose to place Amazon’s Miniature Irish Superstition Talismans in prime locations while hiding Lucky Charms out of reach, General Mills would have every right to not only be pissed, but to expect action from the US Dept. of Justice.

Einar’s right, there are anti-monopoly laws (or rather, anti-abusing-your-monopoly-power laws). So why can’t the United States just use those?

Look, this blog post is already pretty long. Most of your less savvy peers stopped reading paragraphs ago. Even the best of you might have paused for a quick snack break, and to enjoy a delicious bowl of Gaelic Witchcraft Tokens, now with more marshmallows. So, I’ll be brief.

The TL;DR: In the early 1980’s Ronald Reagan made Robert Bork’s philosophy of consumer welfare the standard for how the US DOJ could apply antitrust law, cutting off a path for longstanding antitrust laws to be applied to tech firms like FAANG. They knowingly built abusive monopolies around this standard, arguing that despite their unfair practices, they weren’t hurting consumer prices (and the DOJ wasn’t allowed to consider anything else). If you want a more thorough download, you’ll find a very readable piece from Crosscut here.

In summary:

- When big tech monopolies bias to their own products in their results, they remove opportunities for competition and innovation

- When entrepreneurs and investors consider companies to start and fund, they shy away from sectors where tech monopolies might abuse their mighty power and destroy them

- When big tech cos acquire firms and give them pre-eminent placement (like Google did with YouTube), they end the potential innovation and wealth creation of hundreds of other startups

- Current antitrust laws, because of the “consumer harm standard” can’t do much to hold Google, Amazon, and Apple (in particular) accountable. New laws are needed.

I believe the law proposed by Klobuchar and Grassley is not only “not bad,” it’s surprisingly good. It will probably harm big tech companies, and it may even make some consumer conveniences we take for granted a little less convenient, but these are small prices to pay to protect the macroeconomic necessities of competition and innovation.

Look, a lot of capitalism bites. Especially these last ~25 years or so, where all the gains are going to the top of the wealth brackets. But, capitalism (in my opinion) has two beautiful features:

- The freedom (for many, at least) to choose how to invest your labor. If you want to quit a part-time gig at the gas station and go work for the butcher instead, you can. If you want to start a side-gig making Disco Elysium fan art on Etsy, you can. If that fan art is so popular you can sell it full-time (and want to), congrats, you’re an artist now. Your labor is your own.

- Capitalism creates incentives that organizations, both public and private, can use to motivate outcomes. Want to reward a behavior? Pay for it. Want to punish one? Charge.

Right now, capitalism isn’t working so well for a lot of folks. I think a big part of that is that we (citizenry and elected officials alike) haven’t had the political will to stand up to the wealthy individuals and corporations who fund campaigns and have been getting what they want for too many decades.

This bill is a small step, but it is a step in the right direction. Monopolists hate it. As John Oliver showed, they’re trying to stop the Senate from even voting on it. Some wealthy owners of capital do, too. They’re putting millions into campaigns to stop it. They’re funding think tanks and producing opposition research and trying to convince members of congress that it will kill economic growth. Don’t fall for it.

Want to help support this bill? Join SparkToro, and hundreds of other organizations and businesses in the Call for Antitrust.

How Does This Affect Marketers?

You’ve patiently stuck with all my impassioned rants, so I’ll keep this section very simple. If this bill passes as it is today, there will almost certainly be:

- Changes to what Google can show at the top of its results

- Changes to how Amazon can prioritize of feature the 45+ brands they own

- Changes to how Apple can charge developers

Innovation opportunities will open up in all those sectors:

- Billions of search clicks that have been lost to Google’s widgets will be available to both advertisers and organic search marketers. Everyone is gonna have to redo their keyword research analyses.

- Huge search sectors like video, maps, stocks, flights, hotels, weather, lyrics, definitions, and more will re-open as avenues for traffic-seeking websites.

- Folks who’ve been particularly aggrieved by Google’s entry into their market (Genius.com, Merriam-Webster, Wistia, Yelp, and hundreds more) may have specific cases they can bring to force Google’s hand and open up fair competition in the SERPs

- Retailers on Amazon (and those competing with Amazon in Google search, too) may find a big boost in searches, clicks, and purchases

- In some product spaces where Amazon’s private labels have quietly dominated (Amazon Fresh and Whole Foods come to mind), there may be significant new opportunities that e-tailers never knew were being withheld

- The App Store is going to have a lot of new investment, competition, and monetization opportunities, though Apple may try to implement new charges to make up for the lost revenue from their payment platform as the only option (or they might just make it cheaper for developers in order to compete!).

Until this bill actually passes, it’s hard to know how far and wide these changes will be seen. It could affect advertising markets as well (there’s talk of Google having to offer third party ad options in YouTube already thanks to European regulatory action).

These are big changes. Probably bigger than any in the tech world since Internet Explorer was forced to unbundle from Windows in the 1990s (which many argue paved the way for Google, Facebook, YouTube). Get ready, friends.