The media hype may be overblown, but the data doesn’t lie: over 20% of Americans are now heavy users of AI Tools (employing them 10X or more each month), and nearly 40% use one AI tools 1X+/month. Despite this massive growth, traditional search engines aren’t going anywhere: 95% of Americans continue to use them each month, and 86% are heavy users.

Thanks to our clickstream partners at Datos (a Semrush company), whose multi-million device panel helps power SparkToro’s audience research software, we’ve been able to assemble fascinating new statistics about the growth, shrinkage, and stagnation of AI tools and traditional search engines in the United States. The following visualizations reveal a nuanced story of how these two types of tools intersect.

For this report, we asked Datos to analyze the combined panelist visits to two groups of tools:

- The major traditional search engines in the US: Google, Bing, Yahoo, and DuckDuckGo

- The largest AI tool providers: ChatGPT, Claude, Copilot, Gemini, Perplexity, and Deepseek

We’ve aggregated these to see how adoption and usage rates have changed in the last 2 years.

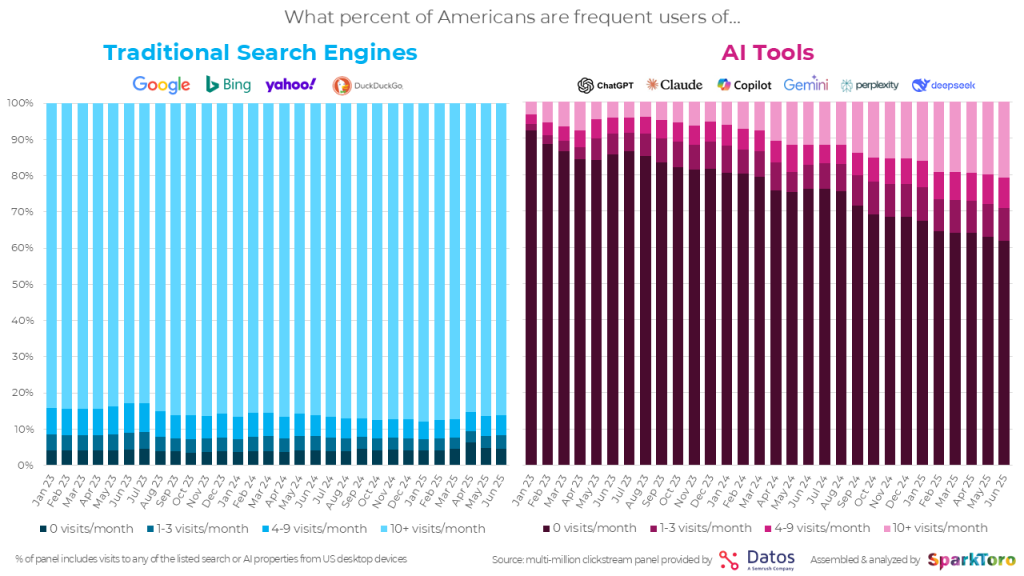

What Percent of Americans Frequently Use Traditional Search Engines vs. AI Tools?

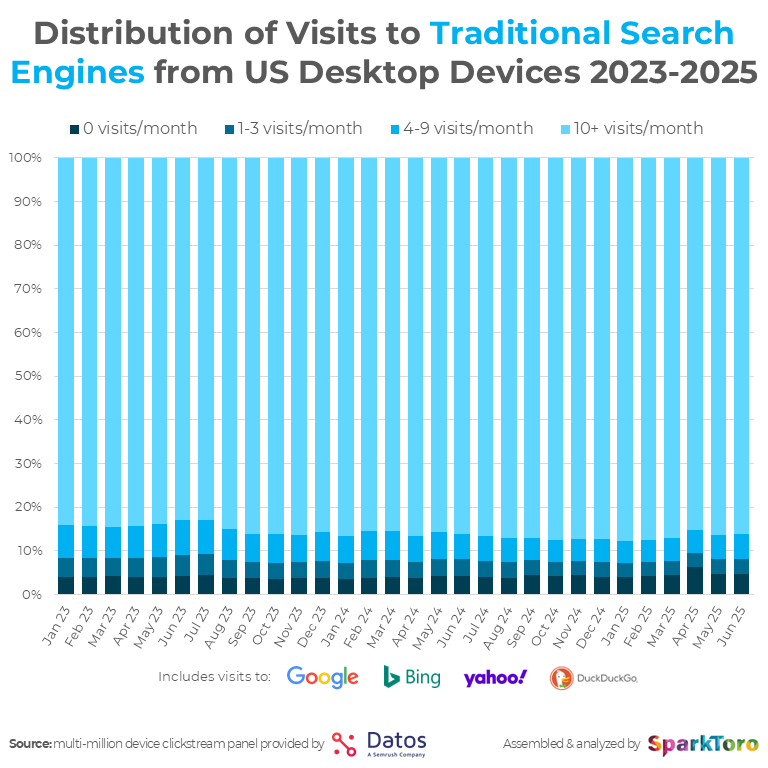

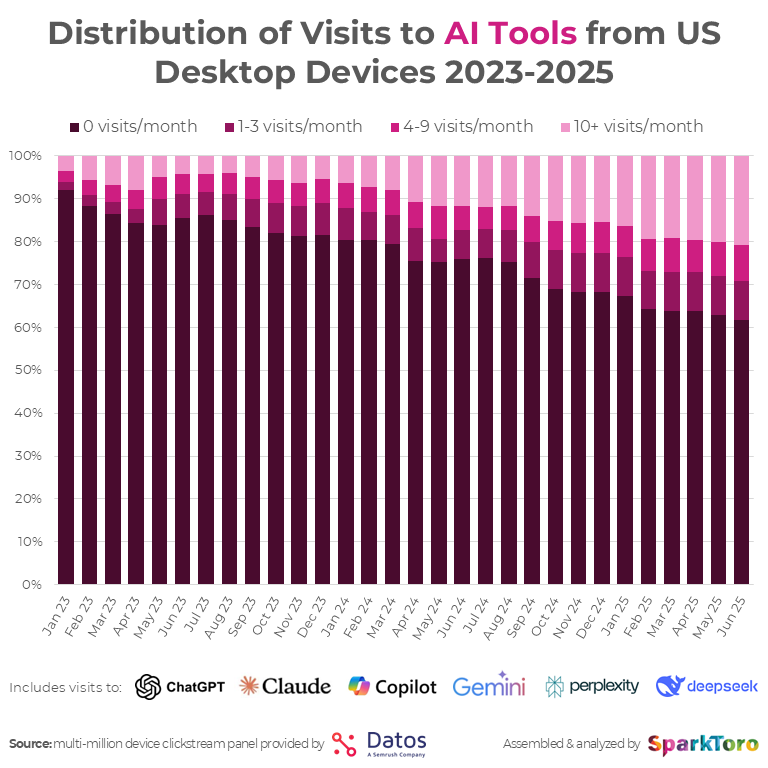

First up: the stagnant, but impenetrable domination of traditional search among Americans vs. the rapid, but slightly slowing adoption of AI.

On the left, in blue, the graph shows the distribution of high-frequency vs. low-frequency traditional searchers (and the rare non-search users). And on the right, in purple, we see the growing share of Americans using AI tools with varying degrees of frequency.

My takeaway is that traditional search isn’t going anywhere, even for the heavy adopters of AI. The more data we gather, the more I’m convinced the “AI vs. Search” narrative is largely made-up by media and influencers seeking attention, rather than an accurate reflection of reality. As Semrush (who partners with Datos for their clickstream panel) recently pointed out, when new users adopt ChatGPT, their quantity of Google searches spikes, and remains higher-than-before even months later.

Via Semrush: ChatGPT is not replacing Google–It’s Expanding Search

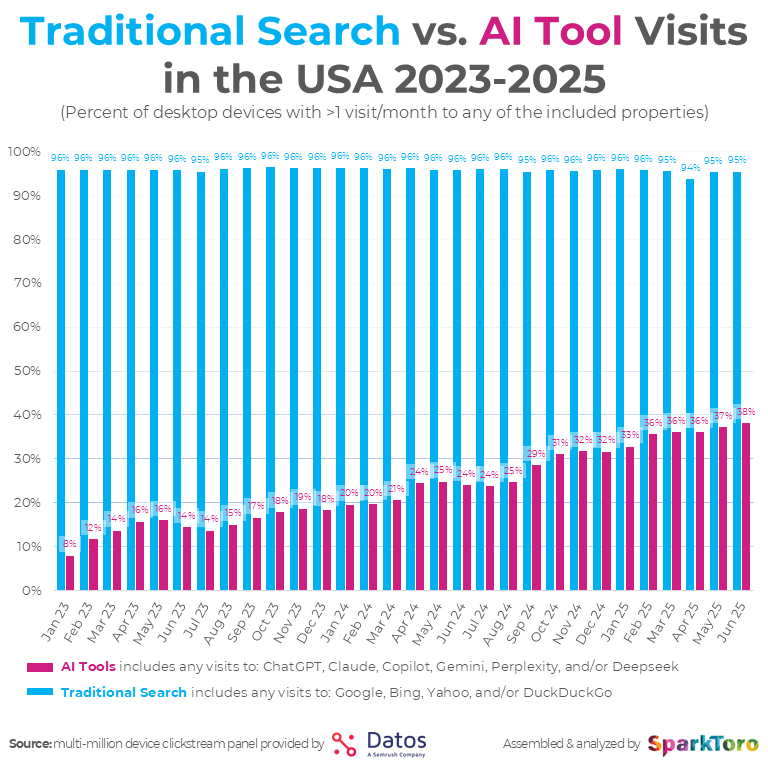

That data comports with our findings on the percent of Americans visiting the major search engines vs. the big AI tools:

Across millions of US devices, 95%+ remain regular users of traditional search engines. That’s down by a negligible <1% over the past 2.5 years, even as AI tool use has nearly quintupled (from 8% to 38% over the same period).

That dude in your LinkedIn feed shouting about how AI will destroy Google has been conspicuously lacking in data for years. This new report will make his job even harder (though I have high confidence it won’t slow him down one bit 🙄).

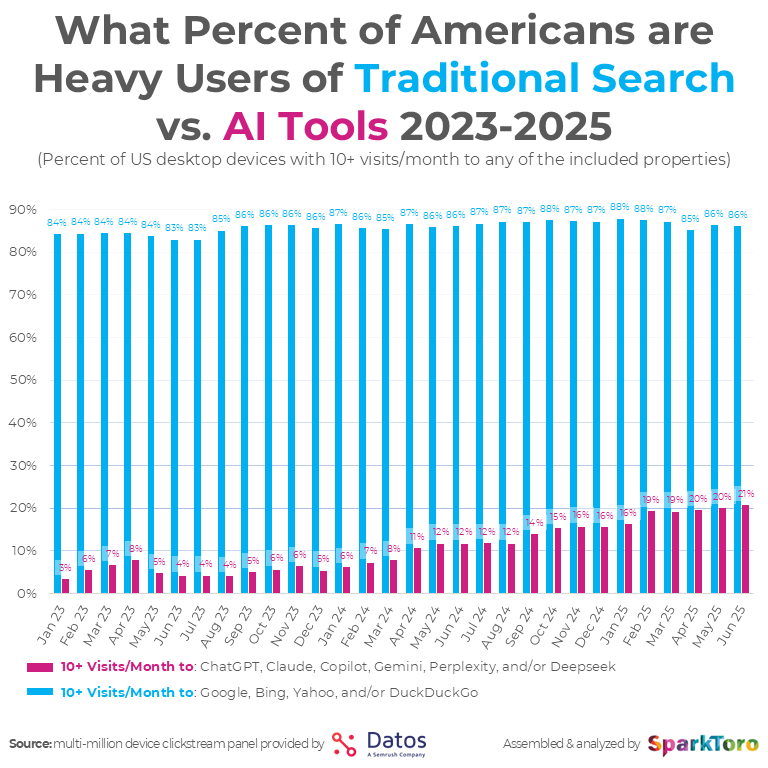

What Percent of Americans Are Heavy Users of AI Tools vs. Traditional Search Engines?

Another nail in that coffin? The change over time in heavy users of traditional search vs. AI tools.

Here we can see that both traditional search engines and AI tools have grown their share of heavy users (those who visit 10X+ each month). In Q1 of 2023, 84% of US desktop devices were heavy Googlers. In Q1 of 2025, that number rose to 87% – a remarkable feat for a mature, quarter-century old protocol.

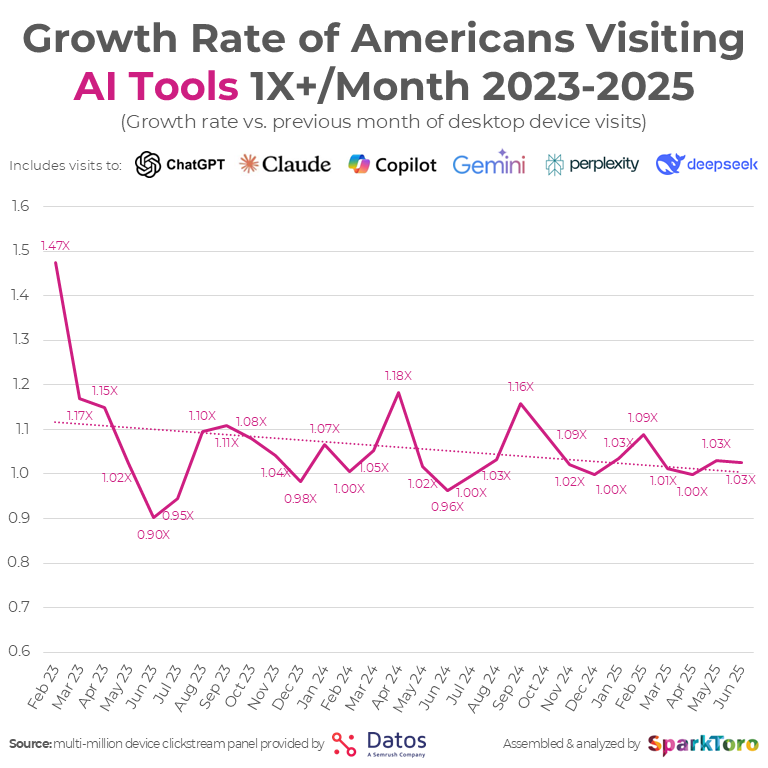

Heavy use of AI tools are, naturally, starting from a much smaller share (3% in January of 2023), and growing much faster (to 21% in June of 2025). But, the rate of growth seems to be slowing, as we can see in the graph below.

Growth/adoption appears to be shrinking over time, as the combined set of AI tools we analyzed (ChatGPT, Claude, CoPilot, Gemini, Perplexity, and Deepseek) hasn’t had a 1.1X+ growth month since September of 2024. That’s not to say AI tools aren’t continuing to get more users, but rather, that the growth trajectory is slowing, suggesting we may reach a steady plateau in the next 12-24 months unless the AI players can convince a wider swath of Americans to get on board.

Those expecting social media-like adoption rates (now ~75% in the US) may be slightly disappointed by what the trendline suggests.

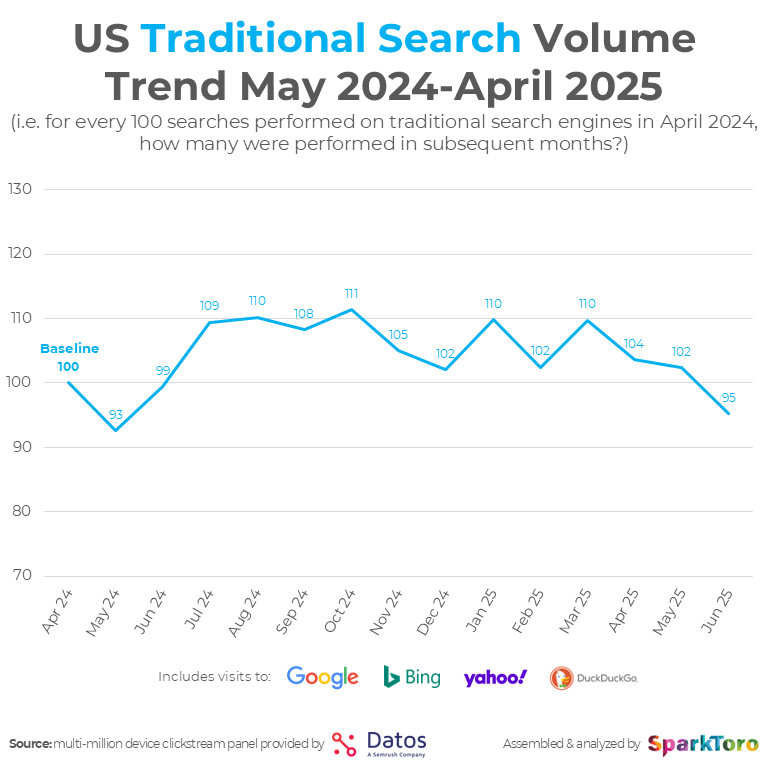

How Many Searches Do Traditional Search Engines Receive?

Meanwhile, over in the traditional search world, we wanted to confirm that volume of visits and percent of heavy users remained correlated with the overall number of searches and searches/searcher.

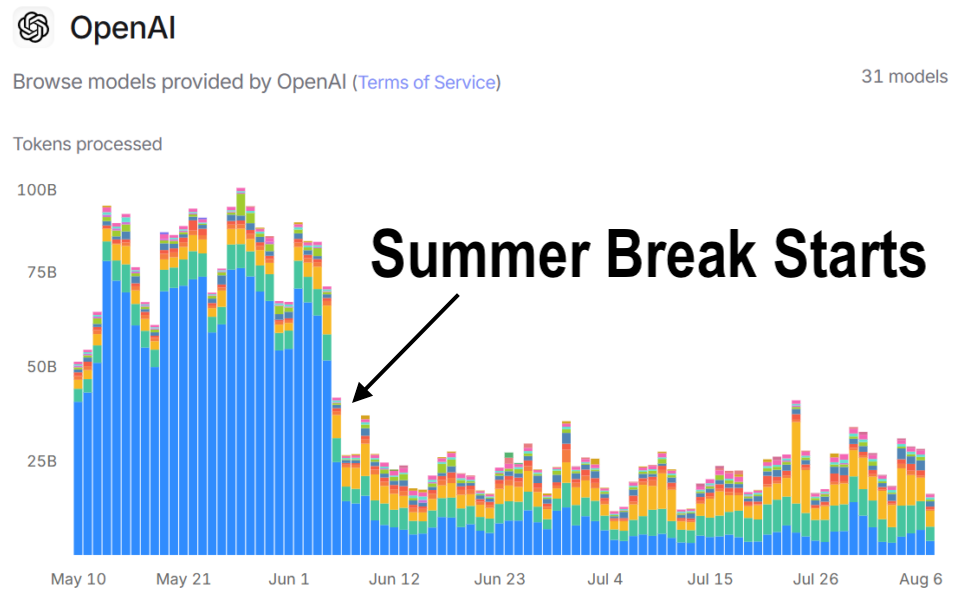

With the exception of June 2025, it appears that Google, Bing, Yahoo, and DuckDuckGo have actually grown the average number of searches performed vs. years past. We’ll be watching the trendline carefully, but traditional search engines aren’t alone in seeing a summer slump. OpenAI recently published numbers around their token-use, showing a precipitous drop on the very day US summer break began:

Via Safe AI Journal

It’s safe to assume that, at least in the US, a considerable amount of AI tool usage (and a smaller, but healthy amount of traditional search) is tied to educational use cases. That matches our findings from 2023 that nearly a quarter of all ChatGPT prompts appeared to be tied to school projects.

To wrap up, I’ve broken out the charts of visit distribution to AI Tools and traditional search engines into separate graphs to help make those trends as clear as possible:

The vast majority of traditional search users are heavy users, with 10+ visits/month and minimal fluctuation. This stagnation should be no surprise–traditional Internet search has been around for nearly 30 years, and every web user in the country is familiar with these products. Apart from tiny blips in usage (May and June 2023?), there’s virtually no trend to be seen.

AI tool adoption is the complete opposite: a clear, obvious, continuing trend of growth that’s starting to slow in 2025, but is still likely to get plenty more penetration before reaching a plateau.

My hope is that this exceptional data, gathered from millions of devices in Datos’ clickstream panel, helps marketers, journalists, investors, and company leaders of all stripes gain a better understanding of the search and AI landscape (and make smarter investment decisions as a result). I’d also provide this somewhat self-serving bit of advice: overall US adoption is interesting, and useful for long-term strategic thinking, but what you really care about is your audience’s adoption (or lack of adoption) of AI tool usage.

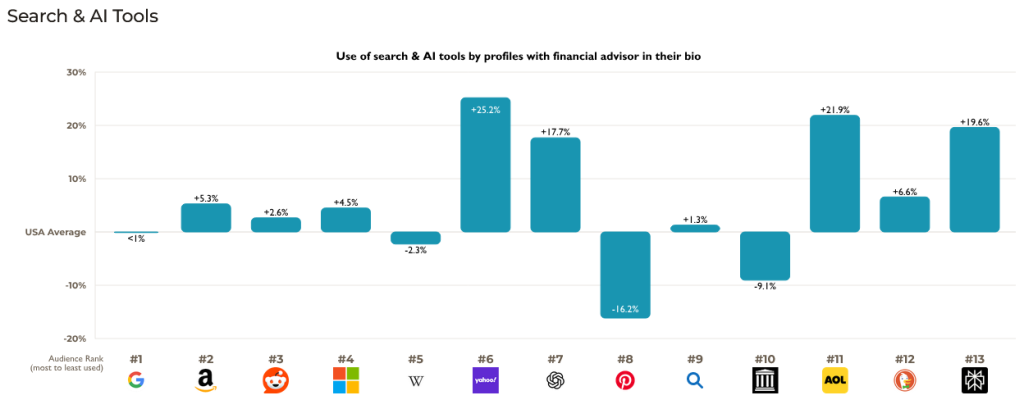

E.G. If you serve financial advisors, you should be analyzing *their* behavior, not just watching the broad adoption reports for all Americans.

Above: SparkToro chart of search vs. AI tool usage, showing that adoption of AI tools like ChatGPT and Perplexity are slightly above average, but still smaller than most traditional search engines.

Are your customers switching to AI tools (and how much)? is a good place to start.

Report FAQs:

- Does this data include mobile apps and mobile browser usage?

- No. Unfortunately, we don’t have access to mobile app usage, and although we can see mobile clickstream data in browsers, chose not to include it for this study as it unfairly biases against AI tools (because adoption/use is so much greater for these products on desktop devices).

- What about EU/UK data?

- We have data from these regions as well and hope to publish that report soon. The TL;DR is that trends are similar, but AI adoption in the EU/UK is ~10% higher than in the US (more on that in the Q2 State of Search report).

- Why would AI tool use be slowing when it’s so hot and gets so much media attention?

- This data doesn’t say why adoption does/doesn’t happen, only what the numbers are. My (Rand’s) best guess is that AI adoption is slowing because we’re reaching saturation among the group most likely to use and need AI for their jobs (i.e. knowledge workers in tech-enabled positions).

- Why trust clickstream data over surveys?

- Human beings are historically terrible at estimating their adoption and use of Internet tools. Directly observable data from clickstream panels can’t be faked or mistaken, and thus, is the most accurate indicator of true usage available. It’s similar to asking people how much of each grocery product they purchased in the last two years vs. looking at actual grocery sales. People aren’t lying or misleading intentionally; we’re just not good at recollection with that level of precision.

- Why doesn’t the clickstream data match AI tool providers’ (like ChatGPT’s) published growth rates?

- Clickstream panel data measures what individual devices run by real humans visit on the web. ChatGPT publishes data about the number of tokens, API calls, prompts, and accounts in its systems. If Boeing or Goldman Sachs build a new internal tool that makes millions of extra ChatGPT calls each day, OpenAI’s growth numbers will skyrocket, even though it’s only one additional “user.” Similarly, if those companies require their employees to use ChatGPT for work, the number of new accounts will spike, even if the employees were already visiting ChatGPT for personal use.

- If Google search is stable, why is everyone’s Google traffic dropping?

- Zero-click answers, i.e. Google delivering results that don’t require users to click. They’ve been doing this for a long time, but the past year has seen notable acceleration (see: AI Overviews linked to 25% drop in publisher traffic, Will Google’s AI Overviews kill news sites as we know them?, Google Search traffic decline is inevitable, execs say, Why Do We Need Zero Click Marketing?, and Zero Clicks Does Not Mean Zero Sales).

- Can I use these graphs/data on my website/in my presentations?

- Absolutely! Just provide a link or citation back to this report 😎

Next steps: Join us for Datos & SparkToro’s joint State of Search webinar September 3 at 11am Pacific / 2pm Eastern. We’ll cover the big trends from across the search, AI, e-commerce, and content platform space, including data in the above report.

P.S. If you haven’t already, we also strongly suggest downloading Datos & SparkToro’s joint Q2 State of Search report where you’ll find even more detailed information about search, e-commerce, content platforms, and AI tool usage.

The data displayed in this report has been provided by Datos, A Semrush Company. The analysis is based on Datos’s US panel, representing a diverse and statistically significant sample of users, and covers the time frame of (01/23-01/25). For further information please visit Datos’s website and its Privacy Policy.