Customer acquisition costs (CAC) have increased significantly over the past decade. This is true for both B2B and B2C companies, with CAC across both industries being up about 70%, according to subscription software company ProfitWell.

In other words, it’s becoming a lot more expensive to acquire customers.

What to do? At our recent SparkToro Office Hours, Asia Orangio, Founder & CEO of DemandMaven, says at least one answer is clear. Figure out who and what influences your customers.

First, shift your thinking on what an “influencer” is. It’s not just the aspirational lifestyle guru on Instagram who suggests meal prepping an entire week’s worth of food for a family of four in just two hours.

Think bigger.

Your audience’s sources of influence include:

- Conferences and webinars

- Podcasts and YouTube shows

- Niche subject matter experts who write newsletters

- all the platforms, channel and people you can’t really track

…and more. In fact, there’s an entire nebulous channel you can’t track at all. One that you’re probably underestimating: Word of Mouth (WOM).

Marketers like to attribute brand discovery to digital ads, social media and streaming services. They give very little weight to WOM — yet nearly one-third of consumers say WOM is how they prefer to learn about new brands, products or services.

So one of the best ways to effectively sustain growth is to fuel WOM. How to do this:

Do customer research.

Our friend Katelyn Bourgoin, Founder of Customer Camp, likes to say, “Customer research is the ultimate growth hack — but it’s not considered ‘sexy’.”

Well… it should be. Customer research sees a 54% greater return on marketing investment and an 18x faster average sales cycle, according to Aberdeen.

Ideally, your customer research program would look like this:

- Plan to interview 10 customers.

- Prepare Jobs To Be Done (JTBD) questions. These are questions that seek to understand what “job” a customer has “hired” a purchase to do. (Example: You’d buy an automated coffee maker to do the job of morning barista for you shortly after you wake up.)

- Record your interviews.

Here are some examples of magical JTBD questions — which unlock key answers to our acquisition mysteries:

- How did you find <insert your company name here>?

- What was going on in your world that led you to look for it?

- What were you using or doing before?

- How did you find out about that platform?

- What are some places you hang out online?

- When you want to learn more about your industry or role, where do you go?

If you can’t do 10 customer interviews, see if you can do at least three. And if you really can’t do those, or if you want to augment your customer research efforts, you have several fall-back plans:

- Use UserInterviews to talk to your audience. Requires some budget, but not a ton.

- Add just one extra question to forms for lead magnets — such as “How did you hear about us?” to gauge attribution, or “What are some places you hang out online?” for marketing ideas (or, ahem, suggestions for SparkToro searches).

- Include a question in your automated email follow-ups. You can ask how someone a customer heard about you.

- Analyze reviews of competitors on review sites. You’ll see firsthand how customers describe their pain points, as well as learn what “jobs” they “hired” your competitors’ products to do for them.

- Position your research as a case study. In a thorough case study, you’ll need to ask what pain point your customer had that led them to you, as well as what made them choose your solution.

- Join demos/customer support meetings. This isn’t always easy to do, and may depend on your company’s culture. But try asking your Sales or Business Development Representative or a Customer Success Associate if you can join one of their demos or meetings. You might be able to sneak in a question or two if appropriate.

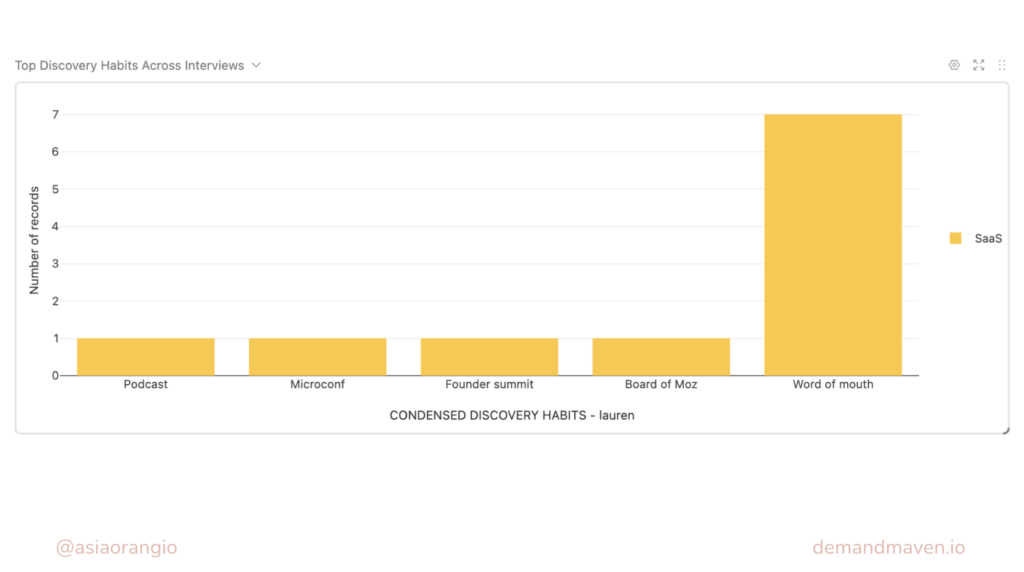

Take copious notes during these interviews. Play back the recordings if you need to. Then organize the insights into key themes in a spreadsheet or Airtable. For instance, makes notes of their discovery habits, distill these habits into themes, and note their desired outcomes. You might be able to come up with a chart like this:

The power of Word of Mouth. We love to see it.

Depending on how thorough your interviews were (and hopefully they were!) you’ll also identify top marketing channels (e.g. LinkedIn advertising and trade shows, for instance) so you can see where your might want your marketing dollars to go.

Do audience research.

After you’ve sourced some intel directly from your customers, do some more research to understand how their characteristics or interests can be broadly applicable to your whole audience.

Let’s say you make a meal-planning app geared towards dietitians and nutritionists. You’ve done a few customer interviews, and you learn that a major influence for them is renowned author and food/nutrition subject matter expert Michael Pollan. You could run a SparkToro query for the audience that follows Pollan on social media. Here’s an overview:

Top hashtags used among this audience include #organic, #climatecrisis and #nutrition. Clearly, an audience that cares about organic food, whole foods, and the environment. From here, you’ll notice this audience listens to a Bon Appetit podcast, and they frequent the /Environment Subreddit.

This gives you a solid sense of what people who follow Michael Pollan are also influenced by.

But maybe you want this to be specific to your audience of nutritionists. So you run a Custom Search that combines both queries of people who follow Michael Pollan and who self-identify publicly online as a nutritionist.

Here’s our audience to a tee!

This audience also follows Marion Nestle and they stay up to date through Harvard Health. They also listen to Mark Hyman’s podcast and participate in the /Antiwork Subreddit. That’s just to name a few stand-out interests.

You could also dig deeper and uncover a bunch of hidden gem social accounts they follow, pull a list of the top 300 websites they frequent, or see what topics they’ve been discussing publicly online over the past few months:

Now this is precisely what classic keyword research can’t tell you. Keyword research can only tell you what the high-volume search terms are. Audience research tells you who’s searching for these keywords and why. You’ll see that this nutritionist audience of Pollan enthusiasts has also been talking about intermittent fasting, gut bacteria, and mediterranean diet, to name a few topics. This would be a great opportunity to create some relevant, top-of-mind content for them.

(Free SparkToro data alert: By the way, if you want audience research on nutritionists or want a taste of the full power of SparkToro, dig deeper in this free, full query on nutritionists.)

Leveraging SparkToro isn’t the only type of audience research you can do. You can also:

- Ask your customers what their favorite social accounts are and follow them yourself to see what they’re seeing.

- Ask them about their favorite podcasts, listen to them, and potentially learn of some new-to-you experts who might be able to guest on one of your webinars.

- Join their most relevant Subreddits and see their discussions unfold in real-time. It’s a great way to learn their jargon and practice talking the way they talk.

When you combine the power of customer research and audience research (oh, and Asia’s strategy and organization skills), you’ll uncover new growth opportunities.

Take it from Asia herself as she shows the outcomes with one of DemandMaven’s clients, vacation listing site Uplisting (at the 56:27 mark):

After conducting hours of customer interviews, DemandMaven learned that Uplisting’s customers thought their competitors (Airbnb, Vrbo, Booking, etc) had slicker branding. They also saw that customers churned from those competitors fairly quickly, as Uplisting became their second or third choice after poor experiences with those competitors.

So Uplisting had a branding and positioning problem. DemandMaven helped them with their brand overhaul, ensuring Uplisting would distinctly stand out among their competitors, improved their onboarding, and updated their positioning and messaging.

The results? A 20% increase in activation rate. 3x lift in new signups. And 10x lift in monthly recurring revenue (MRR).

It wasn’t cheap or easy. But the changes all led to sustainable growth for Uplisting.

And maybe, they’ve even been able to boost their Word of Mouth.

—

This blog post is derived from a recent episode of SparkToro Office Hours. Special thank you to Asia Orangio for lending her time and expertise. You can keep up with Asia’s work by following her on LinkedIn and Twitter. Learn more about her agency DemandMaven.